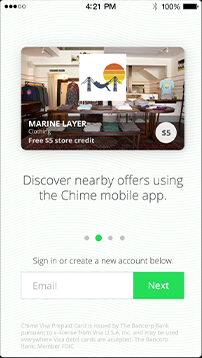

Rewards card Chime just took $8 million in new funding and announced the roll-out of its debit rewards card at the Money 20/20 conference today.

The company is partnered with FDIC banks to create a banking experience that allows users to automatically collect rewards, like discounts and cash back, from participating merchants. Users find offers via Chime’s location-based mobile app from sellers like Balm Cosmetics and Dunkin Donuts.

Chime brands itself as a banking for millennials, but the app seems a little out of touch with the current payments space. With most new payment methods focused entirely on creating a seamless digital experience, Chime is offering a magnetic stripe debit card with rewards — not unlike what American Express and other credit cards already do innately. Google Wallet and Apple’s Passbook both provide for loyalty cards, though it seems Chime wants to offer a more automated experience. Rather than having users add loyalty cards individually, Chime allows users to collect rewards at the register automatically.

Plenty of payment apps are experimenting with offering more loyalty programs to customers, but Chime wants you to switch banks in order to collect better rewards. With digital wallets integrating with loyalty programs, it seems like it might be a lot easier to choose a wallet with an acceptable rewards program than to open a new bank account, or switch over entirely.

Crosslink Capital led this most recent round. Contributors include Homebrew Ventures, Forerunner Ventures, and PivotNorth Capital.

*This article has been updated to better reflect Chime’s banking utility.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More