You can’t monetize in China, right? Wrong, apparently.

According to a report that research firm Superdata released yesterday, Chinese gamers are on track to spend $3 billion this year on mobile games. And they’re spending at a rate that will surpass the U.S. next year.

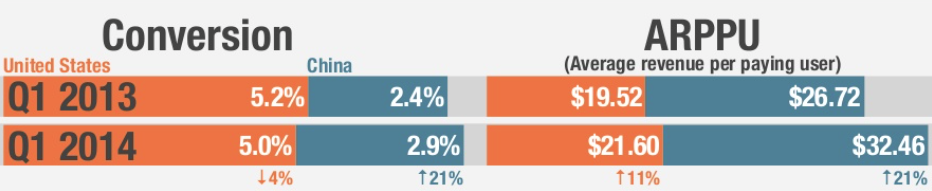

“The U.S. mobile game market is showing signs of saturation,” Superdata says, adding that “China’s average revenue per paying user (ARPPU) and conversion rate both grew more than 20 percent since last year.”

We recently released the VB Mobile Games Monetization report.

As a result, companies like Microsoft have announced their entry into the Chinese market with the Xbox One home console, and gaming-specific companies such as King have inked deals with Tencent to release the popular Candy Crush Saga in China.

Data on the Chinese market is notoriously difficult to acquire.

Superdata typically derives its data directly from participating games, not unlike a Flurry or App Annie. However, for this report the company combined its resources with a partner, Talking Data, which focuses on the China market.

Talking Data says its gathers its information from 20,000-plus apps and 400 million mobile users, while Superdata focuses on 450 big apps, with millions of users.

Worldwide, the app stores and chat networks account for just shy of 1.5 billion mobile games, the report says. The U.S. has 242 million players spending about $3.2 billion a year, while China has 266 million (and presumably growing) who are spending $3 billion a year at current revenue run rates. But growth in U.S. monthly average users has slowed as the market has saturated, Superdata claims.

Tellingly, while average revenue per paying user in the U.S. edged up 11 percent to $21.60 in the first quarter of 2014, ARPPU in China jumped 21 percent to an astounding $32.46.

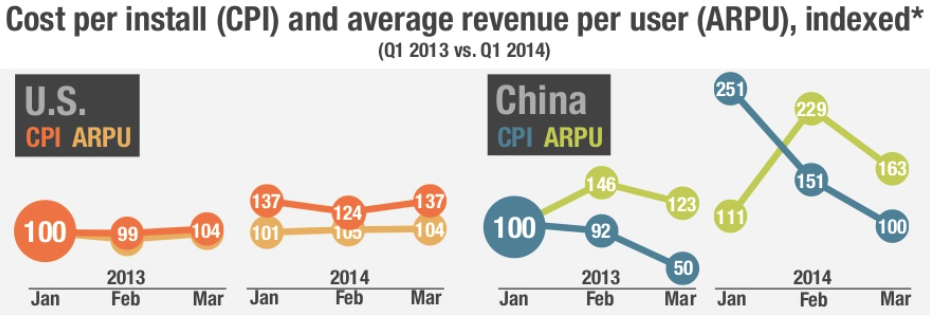

The most painful number for American game developers, however, has to be cost per install.

In the U.S., this number has jumped 37 percent in the past year, according to Superdata. But spending hasn’t changed anywhere near that amount, resulting in lower profitability. Meanwhile in China, cost per install — which more than doubled in January — has settled back down to more reasonable levels. Importantly, it’s well below average revenue per user, meaning game developers have an easier time making money and generating profits.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More