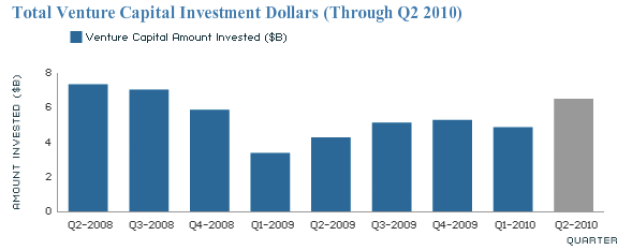

Venture capital funds may be struggling to raise money lately, but their investments in other companies actually increased during the second quarter — a positive sign after one of the bleakest periods for the venture capital industry in years.

VC funds invested $6.5 billion across 906 deals during Q2, and $11.4 billion across 1,646 deals in the first half of 2010, according to the MoneyTree Report released today by PricewaterhouseCoopers and the National Venture Capital Association.

The data, provided by Thomson Reuters, shows a 34 percent increase in the amount invested between Q2 2009 and Q2 2010, and a 22 percent uptick in the number of deals. The half-year dollar amount jumped 49 percent, and the number of deals went up 23 percent compared to last year.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

But this doesn’t mean that venture capital has made a full recovery from the economic downturn. Its results for the quarter are strong, but not as good as they were in 2006, 2007 and 2008, when the investment totals exceeded $7 billion and included more deals.

Their report made several other key observations about investment activity this quarter:

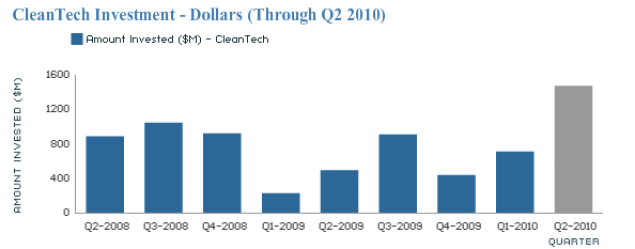

– Dollars sunk into the clean technology sector doubled during Q2, up from Q1, setting a new record for quarterly investment in the area at $1.5 billion. Interestingly, the number of deals in green remained flat between the two quarters, but included seven of the top deals of the quarter, as well as the fourth largest deal in any sector in the past 15 years (the $350 million invested in Better Place, a company that wants to build battery-switching stations for electric vehicles).

– Investment in biotechnology bumped up 52 percent in dollars to $2.1 billion across 234 deals. Pricewaterhouse attributes the boost to the large number of companies filing to go public in the sector. Medical device investing, in particular, went up 40 percent to $755 million across 95 deals.

– The software industry saw the highest number of deals: 229 — a 43 percent increase from the first quarter. But the sector still came in third place in terms of dollars, receiving only $1 billion. Clearly, software remains the most capital-efficient category for firms.

– Seed and early-stage investments are on the rise, increasing 54 percent to $2.3 billion in the second quarter. The number of deals in this category increased 32 percent to 429 just from Q1, and accounted for 47 percent of the total number of deals made during the quarter. Seed deals are also growing in size, from an average of $5.1 million in Q1 to $7.1 million in Q2.

– Mid-stage — also knows as expansion stage — investments increased 48 percent over the second quarter, with $2.7 billion handed out in 277 deals.

– Late-stage investment remained flat at $1.5 billion, although the number of deals increased 14 percent from Q1 to 200. Later-stage rounds are actually shrinking, with averages falling from $8.9 million in Q1 to $7.7 million in Q2. This highlights a convergence between seed and angel investors and large late-stage venture firms, noted earlier this week at the VentureBeat’s MobileBeat conference.

– Other top deals in Q2 included $150 million for solar-thermal company BrightSource Energy, $90 million for analysis software maker Palantir Technologies, $70 million for photovoltaic manufacturer Stion, $62 million for advanced battery maker Boston Power, $55 million for solar panel financing firm SunRun, and $50 million for DNA sequencing provider Pacific Biosciences.

Earlier reports breaking down venture capital performance in the second quarter were not nearly as sunny as today’s. Earlier this week, the NVCA released two other reports, one showing a seven-year low in the dollars raised by funds from limited and institutional partners, and one detailing results of a survey showing that most venture capitalists see their industry shrinking in the U.S. and Europe and growing in emerging markets like Asia.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More