Are venture capitalists really shunning biotechnology, as I wrote a few days ago? A deeper look at the data suggests the answer is still yes, although not exactly for the reasons I first suspected.

Are venture capitalists really shunning biotechnology, as I wrote a few days ago? A deeper look at the data suggests the answer is still yes, although not exactly for the reasons I first suspected.

First off, the most striking data point I noted in my earlier post — that VC funding accounted for just 62 percent, or $872 million, of the $1.4 billion invested in biotech startups during the third quarter — did indeed turn out to be a statistical anomaly. According to Jessica Canning, director of global research at VentureOne, a single private-equity deal accounts for most of the difference: Blackstone Group’s $500 million investment (PDF) in Stiefel Laboratories, a maker of skin-care products.

Although I didn’t know this until recently, VentureOne counts private-equity startup investments as “venture capital” so long as the investment doesn’t amount to a buyout and at least one traditional VC firm is involved. As a result, VentureOne’s VC-funding numbers don’t actually differentiate between VCs and private equity, as I had mistakenly assumed. Since the Stiefel deal didn’t involve traditional VC, however, VentureOne classified it as a non-VC equity investment, thereby skewing the top-line “equity-finance” numbers. “Skewing,” by the way, is my term, not Canning’s — I find it kind of hard to believe that any investment in a 150-year-old company like Stiefel (it was founded in 1847) should be included in what is ostensibly a measure of startup funding, but Canning said a VentureOne client had specifically requested that the deal be included in the data. Since it was apparently a minority investment, in it went.

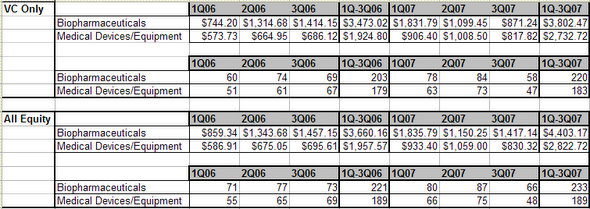

Canning also argued that VC backing for biotech remains strong, and sent along the following data to underscore that aggregate biotech funding over the first three quarters of this year remains up compared to last year (click on the image for a larger and more legible version):

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

I’m not wholly reassured. Those aggregate numbers obscure the fact that biotech funding went gonzo in the first quarter — jumping to a record $1.8 billion that exceeded the previous high by almost 30 percent — but then fell sharply for the subsequent two quarters. Biotech backing in Q3 was lower than any quarter since the first quarter of 2006, and if you want to discount possible seasonal effects, it was also the worst third quarter since the dark, post-bubble days of 2002. In fact, when measured against the prior-year quarter, Q3 marked the first time biotech funding has fallen in two-and-a-half years. The number of deals also dropped to a level not seen since early 2005.

That said, one quarter of data doesn’t make a trend, as a commenter kindly pointed out earlier. Still, I suspect the relatively horribleness of this quarter might have gotten a bit more attention without the confounding effects of the Blackstone/Stiefel deal on the top-line numbers. We’ll be keeping a close eye on this going forward.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More