Facebook was either an amazing driver of purchases and traffic over the holiday shopping weekend or a complete non-factor. So which is it?

The truth is likely somewhere in the middle, despite data sets that point us toward completely opposite ends of the spectrum.

On one end, we have analysis from third-party, holiday-weekend trackers such as IBM and Adobe, each of which looked at data sets from their clients. The lazy headline from their findings would be this: Facebook, and Twitter in particular, had little to no impact on direct traffic or online sales.

But Facebook’s own findings indicate it drove a substantial amount of referral traffic to retailers’ websites yesterday.

And then there’s Fab, a Facebook partner with the brightest outlook of all. The startup claims that a massive chunk, or about one-fourth, of its holiday weekend sales can be traced back to social sites.

So who should we believe? Everyone. I’ll tell you why, but first let’s go over the data sets.

The data

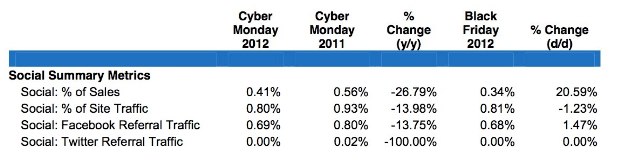

In IBM’s Digital Analytics Benchmark report, the company shared a few findings about the correlation, or lack there of, between social networks and Cyber Monday online sales:

- Out of all online sales, .41 percent can be attributed to referrals from social sites. Read as: less than half of a percent of Cyber Monday online sales for the day can be tracked back to people who directly clicked over from Facebook, Twitter, LinkedIn, or YouTube.

- Out of all online sessions, .8 percent can be attributed to social referrals. Read as: less than a percent of total Cyber Monday online sessions were from people who clicked through from Facebook, Twitter, LinkedIn, or YouTube.

- Facebook was responsible for referring .69 percent of all online sessions on Cyber Monday. Twitter was responsible for zero percent. Yes, I said zero.

- Cyber Monday online sales from people who clicked through from social networks were down 26 percent from 2011.

Above: Social sales and referrals

Adobe’s Digital Index came up with some similarly bleak-looking numbers around social and shopping on Cyber Monday. Keep in mind that the Adobe analytics team pegged online sales at $1.98 billion for the day, which is up 17 percent year-over-year.

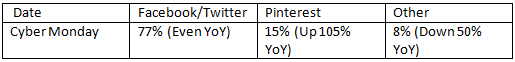

- Social networks, including Facebook, Twitter, and Pinterest drove 2 percent of total visits on Cyber Monday.

- Social referrals were up 100 percent year-over-year.

- 77 percent of social referrals were from Facebook and Twitter combined, though Twitter was largely inconsequential.

- 15 percent of social referrals originated from Pinterest.

Above: Table: Social Referral Share on Cyber Monday

Facebook, meanwhile, said that the top Internet retailers using the social network noticed an aggregate 240 percent increase in referral traffic on Cyber Monday compared to average referral traffic from the last several Mondays. Harry & David saw the highest jump in referral traffic. The basket-maker noticed an 11,425 percent uptick in referral traffic on Cyber Monday over the previous Mondays.

I requested the raw numbers associated with these leaps in referral traffic, but the company said it was unable to provide the data because it belongs to the advertisers.

Facebook did tell me, however, that the sites receiving the most referral traffic from the social network on Cyber Monday showed an average increase of 18 percent versus Cyber Monday 2011 referral traffic.

E-commerce site Fab was also more than happy to provide evidence that Facebook helped it bring in record-breaking sales on over the shopping weekend, even though said data was lacking actual revenue figures. Boo. Here’s what the startup shared:

- About 25 percent of sales over the long weekend can be linked back to social sources.

- Roughly 20 percent of Fab’s revenue from Friday through Monday came from users who originally joined the site via Facebook. Consider this indirect socially generated revenue.

- 65 percent of social traffic between Friday and Monday came from Facebook, 20 percent came from Pinterest, and 5 percent came from Twitter.

What it means

How doe you reconcile these disparate data sets? Honestly, you don’t, except to conclude that the story of how Facebook, Twitter, or Pinterest contributed to Cyber Monday is complex.

“You can do anything with numbers,” Altimeter Group digital advertising and media analyst Rebecca Lieb told me. She believes that Fab’s data is likely the most telling of what actually happened on Cyber Monday, though she cautioned me and everyone else to wait until all the ballots have been counted, so to speak. “All the data aren’t in yet.”

Also consider that the data sets are looking at multiple types of behaviors. IBM and Adobe go for the direct approach, attempting to tie sales and traffic to click-throughs. Facebook, meanwhile, skips the conversion and return-on-investment metrics to show its ability to exponentially increase a retailer’s visibility.

“In all probability, Facebook did contribute to sales. I’m very sure they generated an enormous amount of traffic to retailers,” Lieb concluded.

Fab chose to look at the holiday weekend sales from people who, at any previous juncture, joined the service through Facebook, which means they sliced and diced revenue figures in terms of who was buying and not where people came from at the exact time of sale.

Even Adobe admits that its numbers don’t capture the complete story of what happened on social networks to drive or influence sales and traffic.

“Our data is based on last click, but we also know that social plays a much bigger role at the beginning of a conversation,” Tamara Gaffney, senior marketing manager at Adobe, told me.

“We really took a look at year-over-year growth in general, and we saw that the 2 percent of traffic was up 100 percent over last year. So, even though these are small numbers, they did grow dramatically since last year. We have another report that we’ve done that shows that one of the first places that people go when they turn on their computer is to their social network. Then, they do a few other things. Then, they do their shopping.”

Adobe, said Gaffney, is also working to better unravel the social-to-purchase flow for Black Friday and Cyber Monday.

If there was any one major discrepancy to note, it would be that Adobe found social referrals to retailers on Cyber Monday were up 100 percent year-over-year, while IBM said sales from social referrals were down 26 percent year-over-year. Either social is getting better or worse at driving people to online retailers, not both.

Gaffney said the disparity has to do with the companies measuring different customers and that Adobe’s data pool was more representative than IBM’s. Adobe looked at more than 800 million visits on Monday and considered more than 50 percent of the Internet Retailer 500 list.

Oh, and by the way, I did ask Gaffney why Adobe lumped Facebook and Twitter into the same bucket, together representing 77 percent of all social referrals. It turns out that Twitter referrals were statistically insignificant and Facebook made up the bulk of that 77 percent. That means IBM and Adobe did agree on at least one thing: Twitter was irrelevant in generating click-throughs.

Still, the one absolute truth here is that the real story of social’s influence on holiday sales is unfinished business.

“We’re digging in to see if we can tell a broader story about social by looking at how many ‘likes,’ how many clicks, how many shares there are on Facebook during the holiday-Cyber Monday time period. This is another way that really shows the impact of social much earlier in the conversation,” Gaffney said.

Or as Lieb put it, “The way you model attribution is everything.”

Photo credit: Яick Harris/Flickr

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More