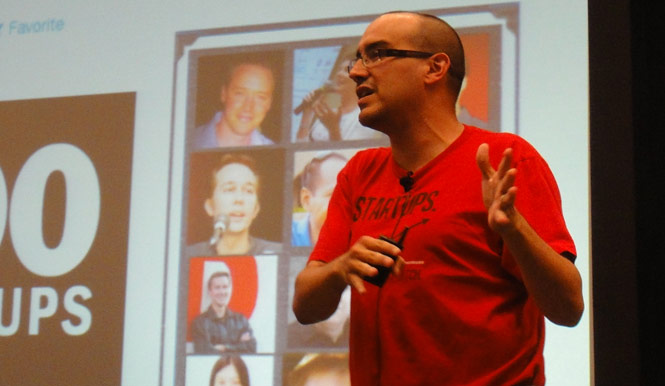

VANCOUVER, British Columbia — Dave McClure is one of the most prominent angel investors in Silicon Valley — and possibly the world. His accelerator, 500 Startups, will fund its 500th company sometime this year. And no, in answer to “all the stupid questions,” 500 Startups will not shut its doors after reaching that number.

VANCOUVER, British Columbia — Dave McClure is one of the most prominent angel investors in Silicon Valley — and possibly the world. His accelerator, 500 Startups, will fund its 500th company sometime this year. And no, in answer to “all the stupid questions,” 500 Startups will not shut its doors after reaching that number.

He may also take the prize for most F-bombs per sentence of any investor.

I caught up with McClure at the GROW 2012 conference in Vancouver yesterday and spent a few minutes asking him whatever popped into my head. Here’s the interview.

VentureBeat: What’s your favorite startup right now?

Dave McClure: Favorite startup right now that I’m not an investor in … if AngelList is considered a startup, that would be my favorite.

VentureBeat: Gotcha — I know you’ve got a passion for AngelList. I heard that today.

Dave McClure: Totally! Actually, full disclosure, I’m an advisor.

Favorite startup in our portfolio — all my children are beautiful [Laughs] — right now, recent favorite I would say probably Refer.ly. Danielle Morrill — I’m really psyched about what she’s doing. Some older ones that I love: MindSnacks, AppStack, Dulio, SendGrid.

VentureBeat: What’s the hottest space to invest in right now?

Dave McClure: [Laughs] That’s such a lame-ass fucking question.

VentureBeat: Yes, it is! [Laughs] But I’m still asking it.

Dave McClure: Hottest space that I think is interesting would be education, particularly like ages 3-10.

VentureBeat: Most clueless founder question you ever got?

Dave McClure: Oh, that’s like … that could be its own show!

Hmm … most clueless founder question … I don’t want to be too harsh, but understanding basic shit that’s on Venture Hacks or AngelList or something like that. There’s a lot of available information online … basic term sheet stuff or valuation.

VentureBeat: What are the three most important things for startups to get right?

Dave McClure: Customers, problem, and don’t spend too much time on it.

VentureBeat: Best investment ever?

Dave McClure: I think right now that looks like Wildfire, an investment I made when I was at Facebook Fund, and it looks like a 40-times or 50-times return … $350 million exit.

VentureBeat: The biggest cause of startup failure?

Dave McClure: Taking too long to ship or not listening to customers.

VentureBeat: What’s the startup you thought was stupid but ended up rocking?

Dave McClure: Boy, there’s a long list of fuck-ups I’ve made in not investing … stupid is kinda harsh … probably AirBnB, because they had the cereal box thing, and I’m just, like, I’m not getting it.

VentureBeat: You’re in Vancouver quite often. What’s the best thing about Vancouver?

Dave McClure: This view is fucking amazing … we’re looking out at Vancouver harbor right now, which is gorgeous, astonishing.

VentureBeat: What’s the thing that pisses you off most about the recent Twitter API changes?

Dave McClure: Ahh … haven’t been following it too closely and I don’t think it’s necessarily irrational … it’s just like they decided to make some relatively hardcore decisions on how their developer community operates, which is quite different from how it used to operate.

Understandably, I know a lot of people are pissed off, but understandably, I think they need to figure the business model also. Maybe not my choice, but … I get it.

VentureBeat: What’s the most important thing you learned when you were at PayPal?

Dave McClure: Offline anything is expensive. Online is much cheaper usually to do almost anything.

VentureBeat: What’s the one thing you want a do-over on?

Dave McClure: Last 20 years? [Laughs].

Ahh … probably the opportunity to invest in Fab, Uber, LivingSocial, AirBnb … all those I had very significant opportunities with the founders — at least most of those I know personally — and totally fucked that up. [Laughs]

Image credit: John Koetsier

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More