Mortgage brokers, bankers and real estate agents marred their reputations in the past few years by recommending mortgages that many now-broke homeowners couldn’t afford. Now Home-Account is unveiling a consumer service that recommends a mortgage solution that takes consumer interests to heart.

Mortgage brokers, bankers and real estate agents marred their reputations in the past few years by recommending mortgages that many now-broke homeowners couldn’t afford. Now Home-Account is unveiling a consumer service that recommends a mortgage solution that takes consumer interests to heart.

The company will take the stage today at the DEMO 2009 conference in a segment dubbed “Stimulating the Economy.” As the name suggests, this company takes the credit crisis into account and offers advice to consumers who have been hit hard. Since it refused to take any money from the $11 trillion mortgage industry, the San Francisco company claims to offer unbiased advice that fits homeowners’ needs. If this kind of Consumer Reports-style institution was around five years ago, we might not have had this mortgage mess.

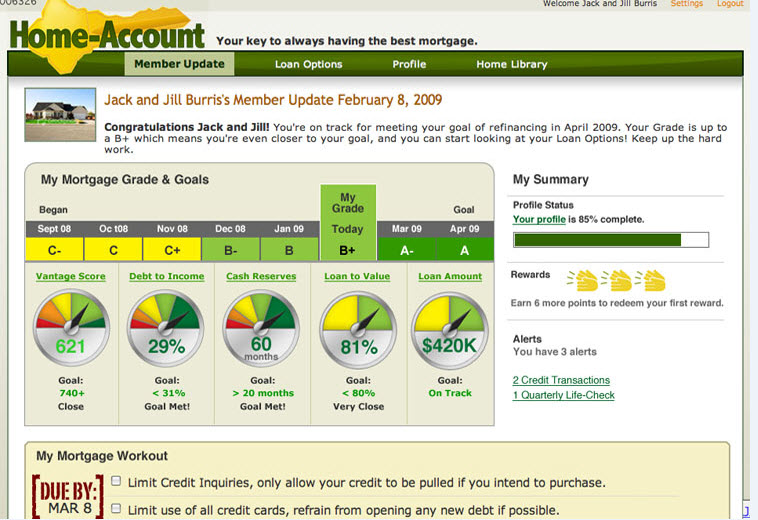

The company grades and analyzes the homeowner and his or her mortgage, presents scenarios to improve the financial picture, and then pinpoints the best mortgage options the consumer is qualified for. The consumer can then choose what works best for them. The system is transparent from beginning to end.

This is probably the kind of service the government should subsidize to avoid future bankruptcies and bailouts. But there’s no reason why entrepreneurs shouldn’t try it as well. The company is giving away its Mortgage-Evaluator for free. But it will try to upsell consumers to a $9.95 a month subscription fee for a personalized recommendation and ongoing advice.

The goal is to demystify the mortgage process, said Mark Goldstein, chief executive of Home-Account. The idea is good, but the business model needs more work. It may be hard to convince consumers that they should keep the subscription for more than a month. The logical course of action is to take the advice, get a loan, and be done with it.

Goldstein is currently chairman of Loyalty Lab, a marketing system provider for banks and brands, and is the former chief executive of Bluelight.com, acquired by Sears. The team also includes five former executives from Washington Mutual, now a part of JP Morgan Chase.

Goldstein is currently chairman of Loyalty Lab, a marketing system provider for banks and brands, and is the former chief executive of Bluelight.com, acquired by Sears. The team also includes five former executives from Washington Mutual, now a part of JP Morgan Chase.

[Update: Goldstein said that the company has to charge a subscription because ad-supported finance sites just aren’t generating enough money to justify the business. At some point, he believes people will add a la carte financial subscriptions as part of a larger suite. In addition, Goldstein says $9.95 a month is a small price to pay relative to how much a refinancing recommendation — at the right time, before the market window disappears — is worth if made in a timely manner. With its launch today, Home-Account says the site is already processing three mortgage evaluations per second.]

The company was founded in 2008 and has ten employees. It is backed by Charles River Ventures and several prominent Silicon Valley angel investors. Competitors include retail bankers and real estate web sites like Quicken Loans, Zillow.com and LowerMyBills.

The company was founded in 2008 and has ten employees. It is backed by Charles River Ventures and several prominent Silicon Valley angel investors. Competitors include retail bankers and real estate web sites like Quicken Loans, Zillow.com and LowerMyBills.

http://services.brightcove.com/services/viewer/federated_f8/980795693