It’s tax season in the United States, and financial service startup Digit has launched a feature designed to automate savings from tax refunds. Working with the Duke University nonprofit CommonCents Lab, the company leverages behavioral economics and technology to help you automatically put away a predetermined amount of your tax return.

According to the Internal Revenue Service (IRS), nearly 80 percent of all U.S. tax filers will receive a federal tax refund. The total amount is estimated to be $125 billion nationwide. Digit said that over 50 percent of people have less than $1,000 in savings and believes a tax refund is a good place to start saving.

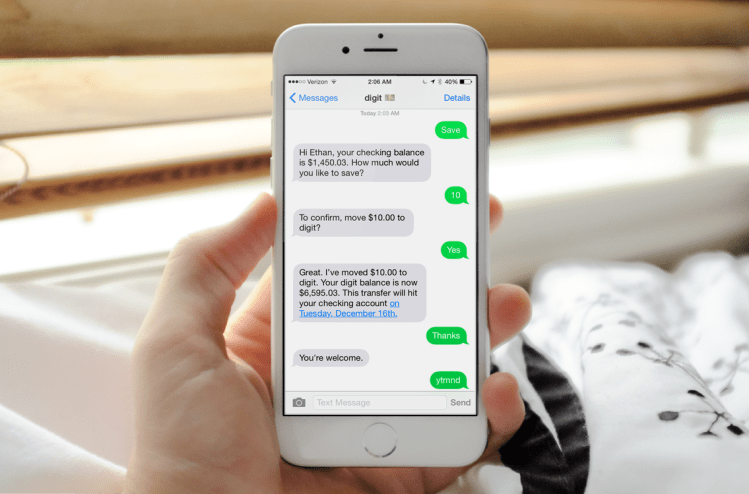

By partnering with CommonCents Lab, Digit is utilizing the organization’s research into how “automatization technology” affects the way we save money. When you participate in this program, you can tell the service what percentage of your federal tax return you want to save. When the return gets deposited into your checking account, Digit will transfer the portion earmarked for savings into an account on its service. If you prefer, you can always route it to another account.

By partnering with CommonCents Lab, Digit is utilizing the organization’s research into how “automatization technology” affects the way we save money. When you participate in this program, you can tell the service what percentage of your federal tax return you want to save. When the return gets deposited into your checking account, Digit will transfer the portion earmarked for savings into an account on its service. If you prefer, you can always route it to another account.

“The average tax return is $2,800 per household, making it the biggest windfall of cash most people receive annually,” said company CEO Ethan Bloch in a statement. “This is the most significant savings moment of the entire year. By automating the process, Digit makes it incredibly easy for people to set aside a huge chunk of cash without spending a single mental synapse on making that decision.”

The automated tax refund feature will be rolled out throughout the tax season.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More