[Disclosure: Sohail Prasad is a prior investor in Zenefits, which is a recipient of a write-down. No non-public information is disclosed in this article, nor are we receiving compensation for writing this article.]

Over the last few days, nearly every financial and tech publication has reported that Fidelity and Blackrock have written down their holdings in various late-stage startups. For many who have been predicting doom in the startup valuation bubble, this seems like a tipping point.

These institutions made their investments after conducting extensive due diligence on the enterprise, business model, and forecasts of each company. If they believe the investment is worth significantly less now, shouldn’t that be a red flag that those startups are overvalued? Isn’t Fidelity — a multinational financial institution that has $2 trillion under management and direct insider visibility into the company’s performance — qualified to judge the economic outlook better than anyone else?

It’s easy to think of Fidelity and Blackrock as monoliths, crunching reams of data to arrive at highly analytical conclusions. But in the end, there are individual people, teams, and divisions making these decisions. People miscommunicate and misunderstand. Though the mutual fund companies have not disclosed their methodologies, the numbers indicate that the teams responsible for the write-downs may have conducted an incomplete analysis that does not sufficiently consider the fundamentals of venture financing.

The importance of liquidation preference

Venture investors receive preferred stock in exchange for their investment. This almost always carries an economic right known as a liquidation preference, which means that they get their money back first. Only after the venture investors are paid back do other shareholders (such as founders or employees) get anything.

If a firm invests $100 million in a company at a $400 million valuation, the company is said to be worth $500 million on paper, and the investor owns 20 percent of the company. With today’s typical investing terms:

- If the company doubles its valuation to exit (going public, or being sold) for $1 billion, the investing firm gets $200 million, and the other shareholders get $800 million, the proportionate outcome one would expect.

- If the company loses half its valuation and exits at $250 million, the investing firm gets its $100 million back, and the other shareholders share the remaining $150 million. Though the ownership upon investment was 80% / 20%, the exit proceeds are divided 60% / 40%, because of the benevolence that is liquidation preference.

- If the company exits at $50 million, the investing firm gets $50 million back, and the other shareholders receive nothing.

In most cases — a slight decrease, parity, or an increase in enterprise value — the economic outcome of common and preferred is similar or identical. But in an extreme downside scenario, the company has to exit below the total invested capital to date for the investors to lose anything.

Indeed, liquidation preferences may matter less in an IPO because, at that point, preferred shares get converted into common. But preferred shareholders often have other protections in a “down-round IPO”: ratchets or other favorable conversion ratios. They also often have veto power over IPOs.

Many people smarter than us have pointed out that liquidation preferences inflate paper valuations. That’s a discussion for another time. In this case, investors in Dropbox, Zenefits, Blue Bottle, and Dataminr have all received this protection, based on our research. Without seeing Fidelity and Blackrock’s specific investment documents, there is every reason to expect that – like the other investors in the rounds – they received these near-universal preferences in these venture investments.

Specifics of the write-downs

Fidelity and Blackrock have written down their holdings by 30 – 50 percent for each company. The press has interpreted this to mean that the value of Dropbox has declined to $7 billion and that of Zenefits has declined to $2.3 billion. But Fidelity and Blackrock have not actually made any public statement about their estimated valuation of these companies. So let’s consider: What would the enterprise value of these companies have to be for Fidelity and Blackrock to justify their write-downs?

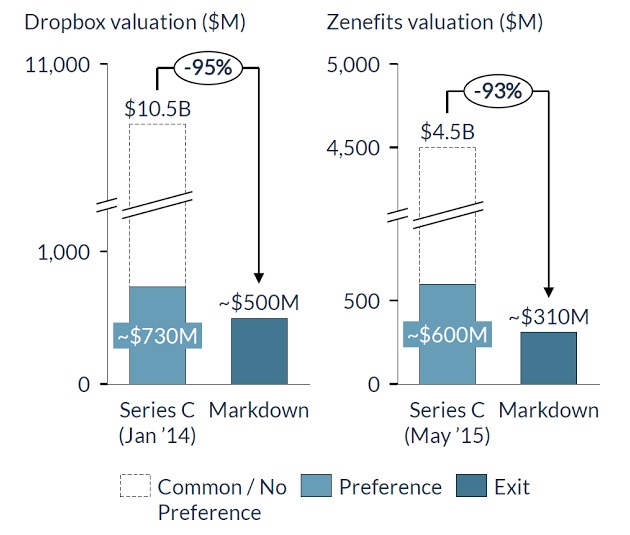

Dropbox has issued shares with a total of ~$730 million in preference. A 32 percent write-down would only be met at a $500 million exit, a 95 percent drop from its $10.5 billion valuation.

Dropbox has issued shares with a total of ~$730 million in preference. A 32 percent write-down would only be met at a $500 million exit, a 95 percent drop from its $10.5 billion valuation.

Zenefits has issued shares with a total of ~$600 million in preference. A 48 percent write-down would be met at a $310 million exit, a 93 percent drop from the its $4.5 billion valuation.

The write-downs for Blue Bottle and Dataminr would require an 86 percent and 87 percent drop in enterprise value, respectively.

We don’t provide subjective opinions or buy/sell recommendations for customers on our platform, and we do not have access to the detailed insider information Fidelity and Blackrock might have when making valuations. At Equidate we provide publicly known facts and insight when facilitating access to the startup equity market. Here is what is generally known, reported, or estimated:

- Zenefits had annual recurring revenue (ARR) of $20 million in January 2015 and projected revenues of $100 million in the next fiscal year, targeting an ambitious 400 percent growth year on year. It was later reported that revenue had “only” grown by 300 percent year on year instead, as of October 2015.

- Dropbox’s 2014 revenue was reported to be around $400 million, with meaningful growth upon that figure this year.

Public market SaaS companies are typically valued on the basis of a revenue multiple until they hit steady state profitability, and these multiples are often correlated with growth rates. For example, Workday is valued at 20x revenue with ~70 percent growth, and Salesforce is valued at 10x revenue with ~30 percent growth.

Fidelity’s write-downs, as calculated above, would imply a revenue multiple of ~1x for Dropbox, and ~4x for Zenefits. We’re not asserting what the correct multiple should be for these companies, but however you look at it, these multiples are an order of magnitude lower than those seen in public markets.

So what’s happening here?

There are a few likely possibilities:

1. Fidelity and Blackrock could indeed be trying to estimate that these companies are worth 85 – 95 percent less than their previous valuations, in many cases just six months after the investment. This seems very unlikely.

2. The teams assessing these holdings did not consider the economics of liquidation preference, which means they simply did not undertake a robust enough analysis of their venture investments. And this incomplete model, probably adopted for accounting reasons, should not determine the valuation and perception of dozens of companies, nor somehow translate to the overall late-stage startup and venture capital world. This is quite likely.

3. Given that Fidelity is used to public investments, it’s also possible that it’s just valuing these holdings as it would public companies. This assumes that Dropbox, Zenefits, Dataminr, and Blue Bottle will definitely go public, without any further IPO-related protections, or “down round” until IPO. This would be an over-simplified model. The worse a company’s status (to the point of justifying a write-down), the less likely an IPO becomes, and the more likely a distressed acquisition becomes. This scenario increases the importance of liquidation preference all over again. With reasonable assumptions around probability of IPO versus acquisition, the multiples are still fairly hard to justify.

Any way you look at it, the decision by the mutual fund companies to write down their holdings by 30 – 50 percent suggests a fundamental problem in valuation methodology. In fact, it’s most likely that these holdings were written down purely for accounting reasons, with no indication that Fidelity would even consider them to be “fair” market values.

The news of these write-downs should not be treated as a conclusive estimate of these companies’ valuations; in fact, we see no reason to sound the alarm. It’s better to consider – just as in every equity and debt market – that some investments are undervalued and some are overvalued. At Equidate, we believe that the market for startup equity still presents plenty of opportunities.

An adage among statisticians and analysts seems particularly relevant here: “All models are wrong … but only some are useful.”

Sohail Prasad is the founder and CEO of Equidate, and Hari Raghavan is its VP of Operations. Equidate is a marketplace for secondary investments in late-stage startups. Sohail can be reached at sohail@equidateinc.com, and Hari can be reached at hari@equidateinc.com.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More