—

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":337809,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"C"}']Software is eating the world, storied venture capitalist Marc Andreessen recently wrote — and from his perspective, it certainly looks like it. But that’s only part of the picture.

It’s true that the fastest-growing companies in a variety of markets are driven by their deep understanding of software. Andreessen cites Amazon, Netflix, Skype, Pandora and Zynga as examples.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

And like Andreessen, Salesforce CEO Marc Benioff lauded HP for getting out of the PC business to focus on software-based “cloud” products and services.

It’s true that if you’re an investor looking for a good multiple, software startups offer an unparalleled opportunity to create value with relatively small investments. And yet, if you’re concerned about the long-term shape of technology, software is only one dimension of many. Arguably, hardware makers and service providers exert far more control over the future direction of technology.

When I look at the companies that will make a difference to my future (and my children’s), I’m more concerned about the latter. Apple’s iPad, Amazon’s Kindle Fire, Nike’s Nike+ system, sensors built into cities and computer chips printed on paper: These are the kinds of things that will change the world over time. The data-usage and app policies of wireless and wireline carriers: These are the kinds of things that can enable revolutionary change, or kill it in its cradle.

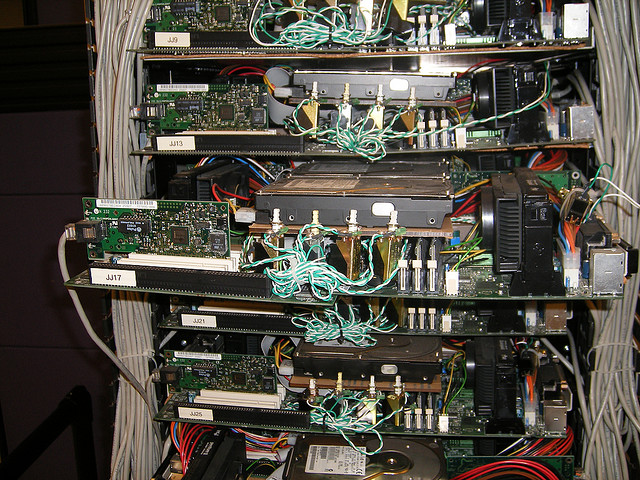

And the truth is, all of this software couldn’t exist without hardware to drive it. A massive infrastructure had to be built before software could “eat the world,” including hundreds of thousands of miles of fiber-optic cable, millions of servers and billions of handsets.

For every 600 smartphones sold, a carrier has to deploy one server, according to sources at Intel. You think that’s not a business opportunity? Talk to AT&T, which has struggled — or perhaps dragged its heels — to install enough back-end hardware and cell towers to support all the iPhones it sold, and to Verizon, whose infrastructure let it capitalize on AT&T’s weakness. Even Google owes an often-overlooked debt to the genius of its hardware engineers, which let the company make the most of its clever search and ad-sales algorithms.

If you think that all the companies that built that infrastructure are just going to step aside while software startups extract value from it, you’re mistaken.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":337809,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"C"}']

Just look at the carriers’ enormous resistance to net neutrality, which they pay lip service to but panic whenever it threatens to become legislation. Google’s decision to purchase Motorola so it would have some leverage against the whims of every other handset manufacturer. Apple’s tenacious defense of the hardware, software and services complex it has created around iTunes, iOS and apps.

Even Netflix’s failure to renew its contract with Starz, an old-school cable TV company, shows that, at the end of the day, software is at the mercy of hardware. Starz is a cable TV content provider, but it’s dependent on customers paying monthly fees for access to the wires installed and provisioned by the likes of Comcast and Time Warner. Netflix was desperate enough for that content that it was willing to pay $300 million for it. $300 MILLION. And Starz turned it down, because it knew Netflix was a threat to its basic business and that of every other cable company.

The fact that Netflix is a threat gives me some hope, because a business model based on fear won’t last long. Sooner or later, Netflix — or some other company — is going to find a way to distribute video without going through the cable companies’ current subscription model, where you have to subscribe to the premium package before you can get the movies you want.

But guess what? Even when that happens, you’ll still be paying the cable companies for access to the Internet. You’ll still be paying Apple, Dell or the former PC division of HP for your computer. You’ll pay Apple, RIM or Nokia for your phone. You’ll still be paying Intel for the chips, and Intel will still be paying Applied Materials for the million-dollar machines that make those chips.

[aditude-amp id="medium2" targeting='{"env":"staging","page_type":"article","post_id":337809,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"C"}']

Software is not eating the world. It’s merely riding on the back of an infrastructure leviathan, like a monkey on an elephant.

Photo: An early Google server rack. Photo by Steve Parker/Flickr.

Here are a few other recent stories from VentureBeat that I think you’ll enjoy.

- Can a single game reach a billion players?

- Amazon has Palm in its shopping cart — will it click Buy? (exclusive)

- Box.net founder Aaron Levie is poised on the edge of startup stardom

- 29 electric car makers ready to rule the streets

- Amazon unveils Kindle Fire tablet for $199, coming Nov. 15

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More