Dynamics, a startup that’s developing a bunch of multi-purpose credit cards under the name Card 2.0, announced that it’s working with Citi Cards on a new product that will make it easier to redeem the credit card company’s reward points.

Dynamics, a startup that’s developing a bunch of multi-purpose credit cards under the name Card 2.0, announced that it’s working with Citi Cards on a new product that will make it easier to redeem the credit card company’s reward points.

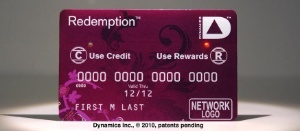

Once a card user has earned reward points from Citi, they can use the new Redemption card to apply those points to a payment at a store. You just press a button on the card to select whether you’re paying using the credit card or the points. That’s more convenient than many other ways of cashing in your points, like choosing from an online catalog of products or ordering a gift card.

Again, this is built on top of Dynamics’ Card 2.0 technology, which embeds new technology into the card while leaving it readable for old-fashioned magnetic stripe readers — when you press a button, the card rewrites its magnetic stripe.

Dynamics launched Card 2.0 at the DEMO conference last month co-produced by VentureBeat, where it won the $1 million DEMOgod award and was also selected as the favorite among VentureBeat’s writers. At the conference, Dynamics demonstrated its first two card types, MultiAccount (for accessing multiple credit card accounts on a single card) and Hidden (where users have to enter a security code before the card will work).

Still, I heard from multiple DEMO attendees that Card 2.0 sounded awesome — as long as Dynamics could actually make it work. The fact that it’s partnering with a major credit card company on a pilot program should help quell any remaining doubts. This announcement should also make it clear that Dynamics isn’t stopping with just two card types.

The company is based in Pittsburgh and has raised $5.7 million from Adams Capital management.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More