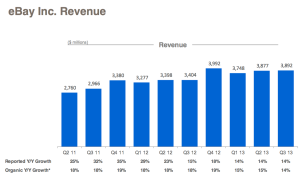

EBay hit exactly the number analysts expected today as it released its Q3 earnings report, with revenues of $3.9 billion, GAAP earnings of $689 million, and 21 percent growth in its “enabled commerce volume” to $51 billion.

But its guidance for the next quarter is at the low end of investor expectations.

“In the past 12 months we have enabled $200 billion of commerce volume, a 20 percent increase in a fairly lackluster macro environment,” John Donahoe, the president and CEO, said in a statement. “That growth demonstrates the strength of our core businesses and our power as a partner, not a competitor, to merchants, brands and retailers.”

Some highlights from the company’s earnings presentation:

Mobile continues to be a strength and source of growth for eBay, with mobile enabled commerce volume jumping 75 percent. Twenty-two percent of the company’s sales are via mobile, as eBay added 3.2 million new mobile users across its entire suite of apps. Nine thousand restaurants now support PayPal payments, Donahoe said on the company’s earnings call, and PayPal continues to grow, with five million new active users joining for a new total of 137 million active PayPal buyers.

That’s a 17 percent increase in a single quarter — impressive — and a full 32 percent of eBay’s new users are coming in via mobile, Donahoe said, adding that they are “the users of the future.” In addition, although mobile users tend to buy less, they also tend to sign in more frequently, he added, making them valuable customers.

Much of the increase is probably due to a new localized service in Russia.

“In the first two weeks of PayPal launching in Russia, 2,000 merchants applied for accounts,” Donahoe said on the call. “And 1 million Russian consumers registered for consumer accounts.”

The company’s revenues resulted in free cash flow of just over $1 billion for the quarter, and payments revenue increased 19 percent year-over-year to $1.493 billion, over half of which is international. That coin was earned on a new high of 729.4 million individual payments.

The company’s revenues resulted in free cash flow of just over $1 billion for the quarter, and payments revenue increased 19 percent year-over-year to $1.493 billion, over half of which is international. That coin was earned on a new high of 729.4 million individual payments.

EBay Marketplaces hit a huge 500 million listings in the past quarter, and gained 3.9 million new active users, ending the quarter with 124 million. That’s up 14 percent, but this segment of eBay is not growing nearing as fast as PayPal and payments.

Another downside is that much of eBay’s earnings growth came from the sale of company investments in RueLaLa and ShopRunner. Alibaba recently invested in ShopRunner, buying eBay’s stake. EBay realized $485 million from those divestitures, plus repayment of a receivable note, which it will use to partially fund its recent $800 million acquisition of Braintree, an e-commerce payments processor.

And the company’s take rate — how much of its sales volume it takes in as revenue — dipped to 7.6 percent, continuing a downward trend from as far back as last year, when it was over eight percent.

But eBay has lots of cash on hand — over $13 billion, CFO John Swan said on the earnings call. And its acquisition of Braintree, largely for its developer-friendly tools and its client list of companies in the “new economy or sharing economy,” as Donahoe said, demonstrates that the company is willing and able to move on new investment opportunities to diversify and improve its competitive positioning.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More