EEDAR made its name as a console and PC game number-crunching research company. But the firm is now releasing a 120-page report on mobile and tablet games today to show companies how they can succeed in the overcrowded and rapidly expanding North American mobile gaming market.

The report is relevant to most of the big and small players in games, as 194.8 million consumers in North America own or have access to a smartphone and tablet. About 73 percent, or 141.9 million people, play mobile games, according to EEDAR. The report shows that if you win these players over, you can win really big in the $4.6 billion North American market. But it also shows a lot of ways to lose in this difficult and sometimes unpredictable field.

“We are finding a lot of the people playing on mobile are already playing core games on consoles,” said Patrick Walker, the head of insights at EEDAR in Carlsbad, Calif., in an interview with GamesBeat. “We see huge growth, but only a small number of game publishers are profiting from a small percentage of mobile gamers who pay. Mobile is more and more saturated. The big winners are winning big.”

EEDAR, which was founded in 2006, has a database of 80 million researched data points from 50,000 game products. It is giving away 41 pages of the report for free (and charging for the rest). It’s so large because there are a lot of details to executing well, with many different segments that are worth understanding.

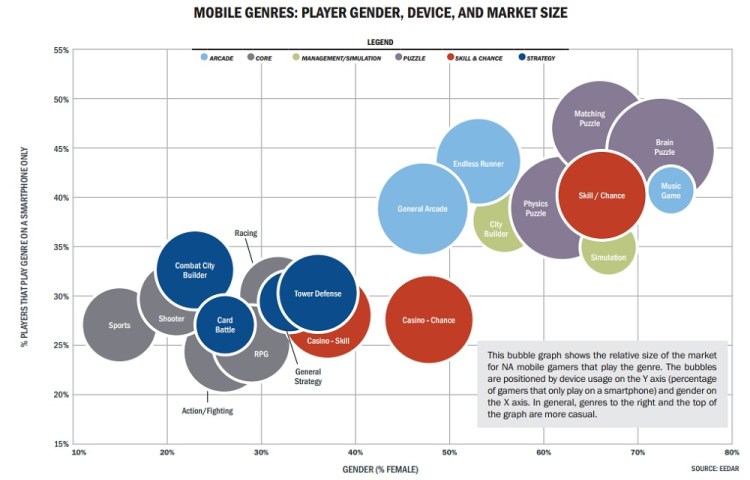

Walker said that it is more important than ever to come up with a good strategy, starting with segmenting the market into its different genres and audiences. Mobile is the most diverse gaming market, ranging from young kids to seniors. Walker says you can break mobile and tablet experience into five parts: discovery, engagement, virality, monetization, and churn.

The report breaks down the mobile funnel, or moving from the largest number of possible users via user-acquisition campaigns to the smaller number of people who will pay for something in a game. It goes into what sorts of brands work well in the different segments. About 50 percent of revenues come from 6 percent of players, known as whales. And 77 percent of whales use both a phone and a tablet.

EEDAR found that combat city builder games like Clash of Clans generated $335.5 million in the third quarter on iOS, far above the $218.9 million generated in the No. 2 category, matching puzzle games like Candy Crush Saga. Casino chance games were third at $179.5 million, and city builder games came in at No. 4 at $99.8 million.

If you launch a mobile game these days, you have to run it as a service, rather than a one-time purchase. That means you have to constantly add new content before players will consider spending money in it. Many people may not realize that Clash of Clans has stayed on top of the top-grossing list through constant updates, such as the launch of its Clan Wars feature.

One of the critical things that companies should do, once they have more than one hit, is a portfolio analysis. Supercell, for instance, had to analyze whether its new game, Boom Beach, would expand its market or cannibalize Clash of Clans. King, meanwhile, has to figure out exactly how many Saga games — like Candy Crush Saga or Farm Heroes Saga — its customers will embrace. Will the multiplayer online battle arena (MOBA) genre explode on mobile as it has in online games with League of Legends and Dota 2, which generate millions upon millions of dollars?

“These are questions that the big companies like EA Mobile, Gree, and Zynga have to ask,” Walker said.

Mobile developer or publisher?

Learn how the most successful developers get better users for less money.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More