(Tech.eu) – There’s no doubt that food delivery has been a hot sector in the European, Israeli, and Turkish tech scenes over the past few years. Regardless of where you live, you’ve probably seen flyers or ads from multiple food delivery startups on the bus, on the metro, and at your doorstep.

Companies from a number of locations have built significant war chests in order to rapidly gain market share in Europe’s largest countries: Delivery Hero in Germany, Deliveroo in the UK, Pizzabo in Italy, La Nevera Roja in Spain, Just Eat across multiple countries, etc. The list goes on.

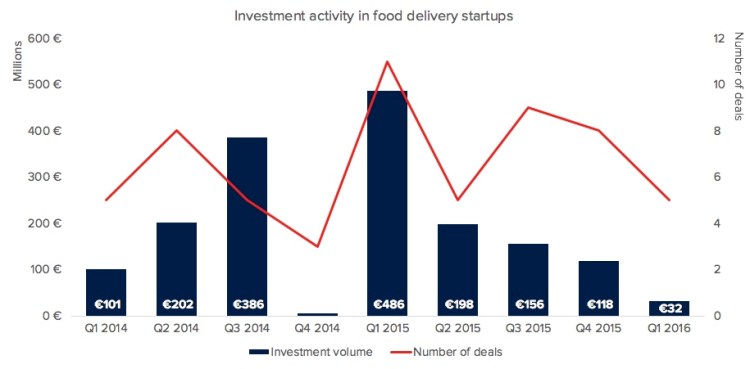

In 2015 alone, food delivery startups raised €1 billion in funding across 33 rounds. That’s 6.9 percent of all capital raised in the same period in Europe, Israel, and Turkey, despite the fact that those 33 rounds accounted for just 1.6 percent of the region’s 1,970 total investments.

Food delivery is a capital-intensive business in which market share, wide availability in high-density urban areas, and low margins have pushed multiple companies to raise large rounds of funding.

According to our data, throughout 2015, there were seven investments in Europe in the food delivery space worth at least €50 million each: Delivery Hero raised €386 million in two separate rounds, HelloFresh €207 million, Deliveroo €176 million, and Foodpanda €128 million. And there were other notable investments, like ShopWings, Take Eat Easy, and EatFirst.

At the same time, the inevitable move toward market consolidation started in Europe and Turkey.

Rocket Internet bought a 30 percent stake in Delivery Hero and also acquired Pizzabo and La Nevera Roja, which were sold to Just Eat less than a year a later. Meanwhile, GeoPost acquired Resto-In in France, Delivery Hero paid €540 million for Turkey-based Yemeksepeti, and Just Eat got its hands on Italian startups Clicca e Mangia and DeliveRex.

In 2015, there were 18 M&A deals involving European and Turkish food delivery startups.

Since then, the market has cooled off. A closer look at food delivery funding data shows that investment in the sector has decreased steadily since early 2015, from a peak of €486 million in Q1 2015 to €32 million (and five investments) in the first three months of this year.

Established players like Just Eat, Delivery Hero, and Takeaway.com now compete with well-funded companies like Deliveroo, Take Eat Easy, Frichti and Wolt, which are trying to bring food delivery to premium restaurants, and thus expand their total addressable market (TAM).

As Deliveroo’s William Shu recently put it: “It’s time to make the economics of the business work and treat every round of funding as if it was our last.”

Given the evolution of the market, each of these rounds could have been the last for many of these food delivery startups.

You can subscribe to Tech.eu’s newsletter here.

This story originally appeared on Tech.eu. Copyright 2016