The company also announced that it has surpassed 1 million submitted receipts, and CEO David Barrett tells me that it has also recently surpassed 300,000 users.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":259028,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"D"}']Clearly, the company is on to something. 300,000 users may not sound like much for a startup that’s been around for a few years, but it’s impressive given that Expensify hasn’t really pushed itself on potential users. Instead, it typically attracts employees who are looking for a way out of expense report hell (and who then go on to get their whole company addicted to the service).

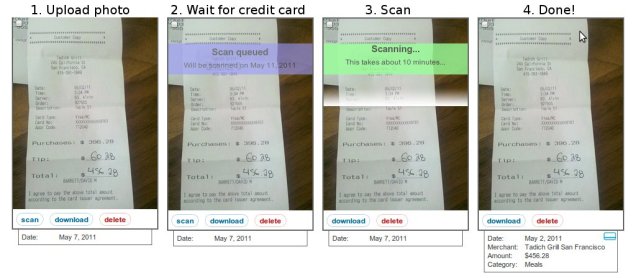

With automatic receipt scanning, Expensify will automatically detect and plug-in the merchant’s name, sales date, and purchase amount into your reports. Combined with Expensify’s existing capability to import your credit card transaction data, the new feature means that you won’t have to lift a finger to populate your expense reports with data.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

The company uses a combination of text recognition and human workers to make this possible. Barrett tells me it was a difficult process for the company to perfect. For example, the company needs to wait for credit card companies to post your transactions — something that may take days — to properly assign transactions with the proper receipt information.

In addition to pulling information from the receipts, the expense is also automatically categorized based on the content of the purchase and your past behavior. You can also create rules that will change the way future transactions are handled.

“There are some services big and small that provide elements of this new feature,” Barrett said in today’s press release. “But only Expensify offers end-to-end expense report automation by combining receipt scanning, credit-card association, and self-tuning categorization.”

Users won’t need to update their mobile apps to take advantage of the new features since all of the work happens on Expensify’s servers. The company is implementing a system of credits to pay for the feature at $0.20 per scanned receipt. Expensify accounts will include some credits to start (existing users will receive some as well), and you can also earn 100 credits by inviting a friend to the service. You can invite friends manually over the web, or by simply scanning their business card into Expensify.

The San Francisco, Calif. company was founded in 2008, launched in 2009 and has thus far raised $6.7 million in funding from Redpoint Ventures, Hillsven Capital, Baseline Capital and Travis Kalanick.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More