Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

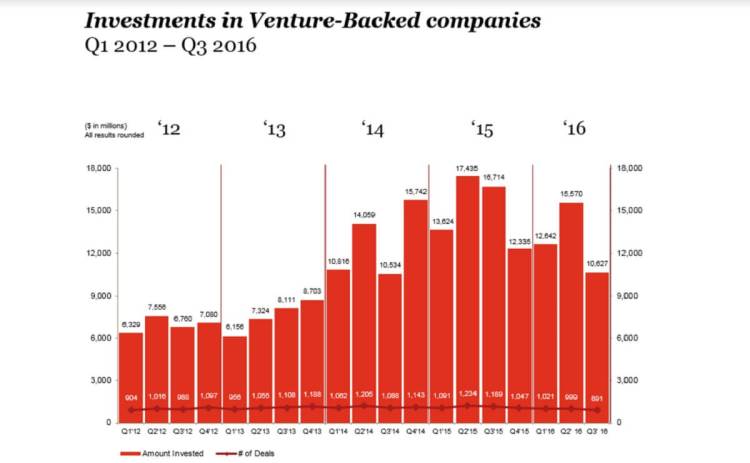

Venture capital investments plummeted 36 percent in the third quarter to $10.6 billion, compared to $16.7 billion a year ago, according to the MoneyTree Report from accounting firm PricewaterhouseCoopers, based on data provided by Thomson Reuters. The number of deals was 891 in the quarter, down 25 percent from 1,189 deals in the third quarter a year earlier.

The deals were also down 32 percent from $15.6 billion in the second quarter, and deals were down 11 percent from 999. The data is consistent with that reported earlier Thursday by CB Insights and KPMG in the Venture Pulse quarterly report.

Still, the report noted that this is the eleventh consecutive quarter of more than $10 billion in venture capital invested in a single quarter, and only the second time deal count has dropped below one thousand since the first quarter of 2013.

“The decline in venture capital activity this quarter is part of the normalization process that is expected after a quarter in which record-breaking investments dominated headlines,” said Tom Ciccolella, US Venture Capital market leader at PwC. “Despite deal count being the lowest since Q3 2010, quality deals continue to receive funding. The broader ecosystem remains healthy, bolstered by a lift in biotechnology within the top deals and overall, strong fundraising, and a continuation of the trend towards investments in non-traditional industries.”

Above: Silicon Valley still rules VC investments.

The top deals were 22 percent of total dollars invested in the third quarter, compared to 38 percent of the total venture capital invested in the second quarter. There were 10 megadeals (investments of $100 million or more) in total, down from 12 in the previous quarter and 27 in Q3 2015.

Software was the largest category, and it was down 58 percent in dollars and 6 percent from the second quarter. Software companies received $3.7 billion across 372 deals in the third quarter.

The biotechnology industry received the second-largest amount of venture capital for the quarter, with $1.8 billion invested into 87 deals, increasing 5 percent in dollars despite a 16 percent decrease in deals, compared to the previous quarter. Three of the top 10 deals were in the biotechnology industry. Investments in the life sciences sector (Biotechnology and Medical Devices combined) during the third quarter accounted for $2.5 billion going into 156 deals, increasing 8 percent in dollars and decreasing 7 percent in deals. Investments in Life Sciences companies accounted for 23 percent of all venture capital deployed to the startup ecosystem in the third quarter.

PwC said consumer products and services companies received the third largest amount of venture capital for the quarter, with $1.3 billion deployed across 52 deals. Notably, the industry sector also received the greatest increase in dollars versus the previous quarter, with a lift of 114 percent. Industrial/energy received the fourth largest amount of venture capital, with $677 million going into 51 deals, followed closely by medical devices and equipment, which received $663 million going into 69 deals.

Above: Q3 top investments by industry.

Ten of the 17 MoneyTree industries saw a decrease in dollars invested in the third quarter, including semiconductors (76 percent decrease) and networking and equipment (66 percent decrease). Venture capitalists invested $2.7 billion into 210 Internet-specific companies during the third quarter of 2016, increasing 4 percent in dollars but decreasing 17 percent in deal count, compared to the second quarter of 2016. “Internet-specific” is a discrete classification assigned to a company with a business model that is fundamentally dependent on the Internet, regardless of the company’s primary industry category.

Dollars invested in seed stage companies declined 23 percent during the third quarter, totaling $388 million in 37 deals and representing just 4 percent of all venture investment dollars and deals for the quarter. Early stage investment declined 12 percent in dollars and 14 percent in deals, with $3.6 billion going into 398 deals. Seed/early stage deals as a percent of the total remained flat versus the previous quarter, accounting for 49 percent of total deal volume, compared to 51 percent in the prior quarter.

The average seed stage deal in the third quarter was $10.5 million, versus $11.1 million in the second quarter. The average early stage deal in the third quarter was $8.9 million, flat versus the $8.8 million average in the prior quarter.

First-time financing (companies receiving venture capital for the first time) dollars decreased 9 percent to $1.5 billion and deals decreased 8 percent to 259 in the third quarter, compared to the previous quarter. First-time financings accounted for 15 percent of all dollars and 29 percent of all deals in the third quarter.