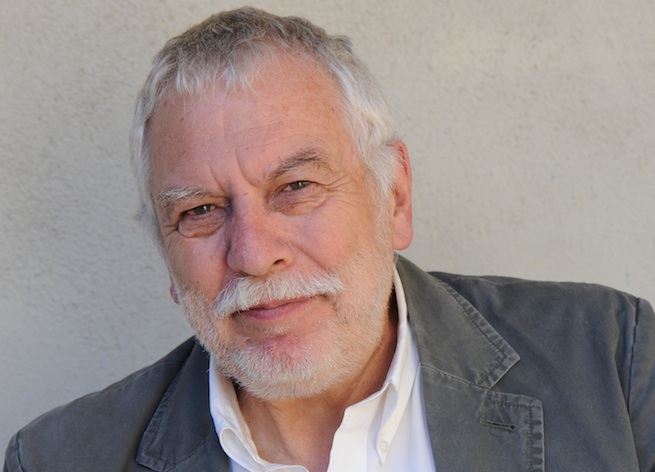

We all have regrets, but they don’t typically involve blowing billions of dollars. Not so for Nolan Bushnell (pictured above), the founder of Chuck E Cheese’s and Atari. Sorry, Nolan: Turning down a chance to own one third of Apple was not your finest moment.

Many view venture capital as an easy route to billions of dollars, but success is often dictated by inventing at the right time. Home run investments in companies like Facebook and Apple what make up for scores of outright failures and disappointing losses. If it weren’t for the meteoric rise of Tandem Computing (acquired by Compaq for $3 billion), one of Silicon Valley’s most prolific venture capital firms, Kleiner Perkins Caulfield Byers, would have been unlikely to raise another fund. This, and other tales of the early days of venture capital, are the subject of the recent documentary Something Ventured.

The stand-out successes are few and far between. According to the National Venture Capital Association (NVCA), about 40 percent of venture backed companies fail, 40 percent return moderate amounts of capital, and only 20 percent or less produce high returns.

Inspired by Bessemer Venture Partners’ anti-portfolio, here is a list of the greatest missed opportunities in the history of Silicon Valley.

(And I’ve got to hand it to Bessemer: They readily volunteer this information, whereas the half-dozen firms I asked about the super-successful startups they didn’t fund weren’t so willing to ‘fess up!)

[vb_gallery id=521176]

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More