As digital commerce has evolved over the past decade to penetrate nearly every element of our lives, one category has largely been left in the dust: furniture. But in the past 12 months disruption has accelerated exponentially – with the industry suddenly under a broad-based assault from all key angles: manufacturing, delivery, assembly, and discovery.

A few months back, I noted that furniture was one of the remaining massive categories still struggling with finding a mass-market consumer fit online. In it, I cited a conversation I’d had with a well known venture capitalist:

Similarly, [the investor] noted at the time, furniture – sofas, mattresses, tables, etc – were one of those categories that hadn’t been cracked by e-commerce. The unit economics made delivery expensive. And, like shoes, consumers wanted to try them on. Is it comfortable? Do the colors match up with your room palette? What if, he proposed at the time, a furniture company offered the following value proposition: We’ll show up at your home, for free, with 10 different sofas of varying feels and colors, let you try them all out for free, and then you just keep the one you want and send all the rest back for free?

Under the legacy model, e-commerce furniture sales were simply a digital extension of traditional product purchasing and sampling. Further, the thinking continued, the legacy retailers were actually capable of avoiding disruption because of the complexity in the supply chain and delivery logistics that made it expensive, if not impossible, for startups to compete.

But this is all changing.

Furniture in a Millenial World

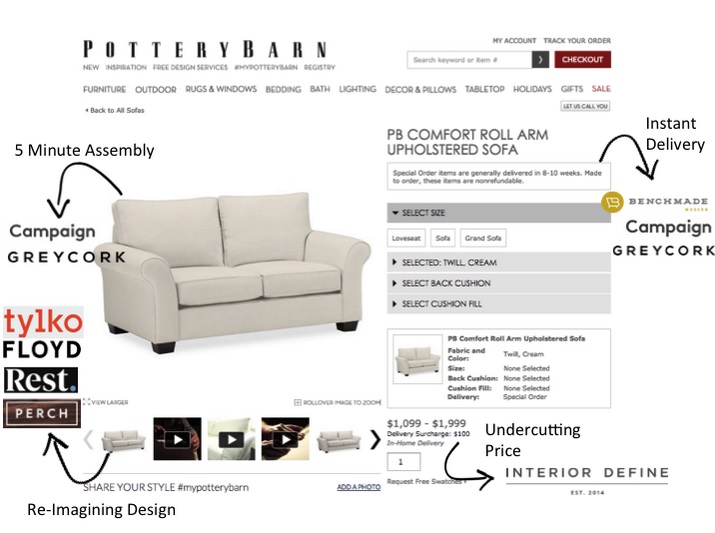

To be fair, it’s still exceedingly early in the disruption cycle – two of the emerging brands, Campaign and Greycork, for example, haven’t even begun shipping their product yet – but taking into account the strength of their pre-sales and the growing traction among other disrupters, its hard to dispute that there is a fundamental shift underway:

At Chicago Ventures, we’ve categorized the disruption from these new, vertically integrated brands into four categories: Delivery, Assembly, Price, and Design.

- Delivery: Arguably the most important angle, as evidenced by Casper’s runaway traction, millennial consumers are looking for experiences that provide for both immediate delivery and frictionless ease of return. Traditional retailers have long lead times on larger pieces (8-12 weeks), and they arrive via a third-party trucking provider (who disappears shortly thereafter), making it extremely inconvenient to return a product. The new disrupters are getting product to a customer’s door in under a week from time of purchase — and sometimes in as little as 24 hours. They are also using novel shipping/packaging methods to enable accessible and low-cost (or free) returns.

- Price: Typically the most important variable for consumers, price is also one of the hardest areas to clearly differentiate in furniture, as every retailer offers differences in quality, style, etc. One thing’s for sure: IKEA is the low-cost provider in the space, and despite the arguably miserable experience it offers, it still moves a lot of product. The new disrupters, by building a direct business-to-consumer brand, are able to discount heavily on price while maintaining similar margins by removing some of the supply chain layers.

- Assembly: The current status quo is either long lead times where items come fully assembled OR shorter windows/in-store pickup (think IKEA) where consumers are responsible for arduous assembly and installation (my wife loves doing IKEA assembly, but she’s gotta be in the 1%). The new disrupters, focused on building an anxiety-free product, offer large items that can be assembled in minutes without tools. A further benefit to the simplicity is that they can also be disassembled in minutes for moving or for easy packaging to return items.

- Design: If you’ve been to the big box retailers – from Pottery Barn to Arhaus to Restoration – you know each has its own unique personality. But the new designers believe those pieces aren’t being imagined with a millennial purchaser in mind. The new disrupters are attacking home, apartment, and workplace furnishings and trying to reimagine product that stays sensitive to personal devices, new work habits, etc.

We view Delivery and Assembly as the two most intriguing and sustainable angles being attacked. Although our internal consumer surveying has shown that price is ultimately the #1 most important variable for buyers, we fear that — given the healthy gross margins in the category (42.9% at Ikea, ~38.3% at Pottery Barn*) and de minimus return rates — incumbent retailers will quickly be able to adapt on price undercutting or free shipping/returns offers.

What appears hardest for legacy retailers to respond to are fundamental reimaginations of the production line, product design, and supply chain.

Discovery

Outside of the millenial manufacturers, there’s an equal amount of momentum in the next generation of retail models. Right now, the process for actually purchasing a piece of furniture online is cluttered, as most product exists in an environment of millions of SKUs with minimal effective filters. And while the companies listed in the Pottery Barn graphic above are trying to reimagine the next generation of vertically integrated brands, that doesn’t solve the wider discovery problem for consumers.

The problem for consumers is that the increase in SKUs across all furniture categories has made shopping on the aggregators an utter nightmare. Comparing from vendor to vendor is also a time-consuming, high-friction experience. These are the reasons that, according to Upfront Ventures’ Greg Bettenlli, the only growth driver at Wayfair is Joss & Main, their ultra-curated flash sales site.

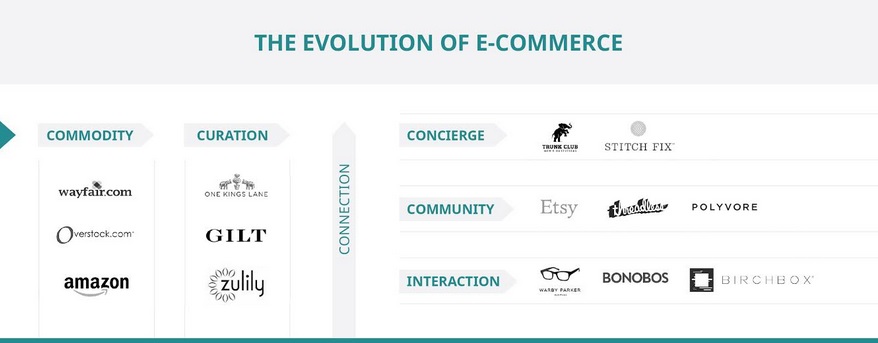

Thus, the furniture category appears to be mirroring the quintessential e-commerce curve that I detailed earlier this year:

Th[e] same catalog of infinite SKUs caused real pain for all but the most specific of product searches. This pain led to the birth of discovery- and push-curation focused platforms. On a macro level, the [present] move towards connection makes a lot of sense. Consumers are overwhelmed by email, social, and retargeted marketing, while at the same time flocking to platforms such as Uber and HotelTonight, whose focus is on constraining choice and cognitive noise.

For example, we’ve witnesses this process play out in the fashion industry – first with discovery-focused platforms (Gilt, Fab, Wish, RueLaLa) and now with personalization experiences (TrunkClub, Stitchfix, Wantable). The following chart illustrates how the same dynamic is now emerging in the furniture world:

And yet in spite of the increasing focus on the sector, only about $20 billion of the $160 billion U.S. market for furniture and home accessories is being transacted online:

Put together, the category represents a tremendous opportunity for venture investors: demonstrable consumer pain points, broken processes and experience, and a market size well over a hundred billion dollars. Few of the companies noted have material traction or brand equity – but it’s the early innings; it’s one of the most exciting categories to watch in consumer Internet and is poised for outsized growth.

At Chicago Ventures, we’re definitely looking for entrepreneurs focused on reimagining the furniture space. If you’re one of them, please reach out!

* This is blended and includes results from Williams-Sonoma and a number of other properties. As PB sales have increased, GM has contracted, implying their GM on their PB business is probably closer to 35% than 40%.

Ezra Galston is a venture capitalist with Chicago Ventures and the former Director of Marketing for CardRunners Gaming. Follow him on Twitter @EzraMoGee and his blog BreakingVC.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More