Game acquisitions set a new record in 2012, with a total transaction value of $4 billion, up 18 percent from $3.4 billion a year earlier. But investments in new companies fell in transaction value by 57 percent to $853 million from a year earlier, according to game-focused investment bank Digi-Capital.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":604393,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,entrepreneur,games,","session":"B"}']The data shows that games have become a dynamic industry on a global stage, but investments in new companies are down for a variety of reasons. Those startups have become the fuel for growth at the larger companies, which are adapting to the new age of digital games through strategic acquisitions.

Zynga’s rapid growth in the past few years drew the attention of big companies, including ones in China, South Korea, and Japan. But Zynga’s fall in the stock market, brought on by weak earnings, crushed the value of all game companies, resulting in smaller transactions. On top of that, Tim Merel, the managing director at Digi-Capital, said that venture capitalists almost abandoned their investments in social-game companies. Social-game investments accounted for 94 percent of the decline in overall investment. Merel warned there could be a “games investment gap” in the medium term.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

Digi-Capital estimates that the total industry could grow to $83 billion by 2016, with 57 percent of that revenue produced by online and mobile games, compared to 49 percent in 2012.

If you add up the returns of the game business by combining acquisitions and initial public offerings, the numbers from 2005 through 2012 add up to a six-fold return. As for acquisitions, the number of deals were down 27 percent to 83 transactions in 2012. But the overall figure rose because the average transaction size rose 60 percent to $49 million. More and more of the buyers are in Asia, as seven of the top 10 deals involved buyers in South Korea, China, and Japan. Digi-Capital believes China could take 32 percent market share in online and mobile games, compared to 21 percent for Europe.

Massively multiplayer online games accounted for 38 percent of the transaction value in acquisitions, followed by 27 percent for mobile, 18 percent for social and casual, 13 percent for middleware (such as gamemaking tools) and gamification (using game-like tactics to increase engagement in nongame applications), 4 percent for console and PC, and 1 percent for advertising. By volume, mobile was 28 percent of transactions, MMOs were 20 percent, social and casual were 19 percent, middleware and gamification were 19 percent, console and PC were 12 percent, and advertising was 1 percent.

For game investments, the average transaction value was down 57 percent, but transactions were up 9 percent to 165. That might be because more mobile-game studios were funded, but the dollars needed for such studios are much smaller. The average size of an investment was $5 million, down 60 percent.

Middleware and gamification were 35 percent of all game investments in terms of transaction value, compared with 31 percent for mobile, 18 percent for MMOs, 7 percent for social and casual, 7 percent for console and PC, and 1 percent for ads. In terms of transaction volume, mobile was 39 percent, middleware and gamification were 29 percent, social and casual games were 10 percent, console and mobile were 10 percent, MMOs were 9 percent, and ads were 2 percent.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":604393,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,entrepreneur,games,","session":"B"}']

Kickstarter, meanwhile, complemented VC investments. The crowdfunding site account for 6 percent of all investment ($49 million, excluding board games). Kickstarter was 63 percent focused on PC games and 23 percent on hardware. About 87 percent of the value was in just 7 percent of the projects, such as Ouya, which raised $8 million for its Android game console.

Merel said that there was significant volatility across individual game sectors. The potential exists for the “mispricing” of both public and private game market assets in 2013.

Free to play continues to grow as a business model. It is expected to be 55 percent of mobile and tablet app revenue in 2016. It is expected to be 93 percent of mobile and app downloads in 2016. Merel said that gamification is attracting significant early stage investment, but a lot has to happen before the market achieves its potential.

In 2013, Merel said the new generation of consoles could reinvigorate the console market this year. Last year, game sales fell dramatically for home systems.

[aditude-amp id="medium2" targeting='{"env":"staging","page_type":"article","post_id":604393,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,entrepreneur,games,","session":"B"}']

As the market shifts toward digital games, Merel believes development will switch from a focus on producing one big hit to investments in multiple, low-cost parallel efforts. Companies will abandon failures quickly and move behind hits fast.

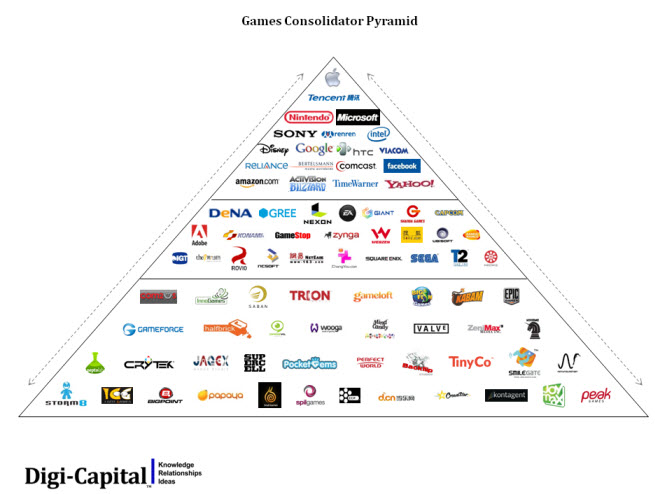

On the highest level (see picture at right), Digi-Capital sees games shifting toward high-value titles in the West, particularly in the U.S., along with the rise of subscription MMOs and console games. Meanwhile, Asia will diverge into a high-volume market, with China leading the development of mobile/tablet games, free-to-play titles, and casual online titles.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More