Following the failure of a number of solar companies, the investing climate has not exactly been sunny for that industry.

It’s a challenge for a Durham, North Carolina-based company that has developed technology it describes as “a game-changer.” But the CEO of Semprius, Joe Carr, told VentureBeat today that the forecast for his company is not as dire as one recent report suggests.

The report, in Thursday’s M.I.T. Technology Review, said “the company needs a new investor soon.” Otherwise, the story contended, “it could go under.”

“We’re not on our death bed,” Carr told us.

The story “says we’re [sounding] our death knell,” he said, when in fact Semprius is in the process of wrapping up a Series D funding round. He added that all four of the current investors — Arch Venture Partners, Intersouth Venture Partners, Morgan Creek Capital Management, and Illinois Ventures — are re-upping.

“We’re obviously a startup, attempting to close what we believe to be our final [investment] round before we’re cash positive,” he told us. The company started in 2005.

Investment funding for solar is difficult to come by, he said, in large part because more than 400 companies worldwide — many of them Chinese — have gone under in the last four years. Additionally, a major Semprius partnership and investment by Siemens was discontinued, which Carr said was because that company’s top management decided to reduce its financial exposure to renewables.

Siemens’ decision, he said, “had nothing to do with us,” adding that Siemens took two more contracts with his company even after the German company decided to exit solar.

“When investors look at that sort of environment,” Carr said, “it makes it difficult to raise funds.”

On the other hand, “we’ve turned away six times more business last year than we actually took,” because the company’s ramp-up cannot yet handle the demand. Carr said the first three rounds of funding — $45 million to date — were sequenced to back technology development, product development, and production, in that order.

Now, the D round-in-progress is focused on developing a large plant capacity. Semprius currently has 16 pilot installations in the U.S., Saudi Arabia, Jordan, Spain, and elsewhere, which are operational demonstrations pumping power to grids. The goal of those projects, Carr told us, is to “get the data” needed to ramp up toward a larger plant.

But “larger plant” doesn’t mean massive utility-level gigawatt generators, at a time when there are signs that the centralized, utility-oriented electrical model may be winding down in favor of decentralized generation.

Semprius is part of the decentralized movement, Carr said. A megawatt-producing solar plant using the company’s technology could be built for about $1.5 million, he said, capable of serving 300 to 500 homes — or it could scale up to much larger plants.

And its technology could mean a breakthrough in solar pricing — just under a nickel per kilowatt-hour. By contrast, the U.S. Energy Administration says that natural gas-powered plants generally deliver 6.5 to 13 cents per kilowatt-hour, coal-generated electricity is 9 to 14 cents, wind about 9.5, nuclear about 11, and conventional solar about 15 — although Carr said other solar companies have claimed as low as 7 cents.

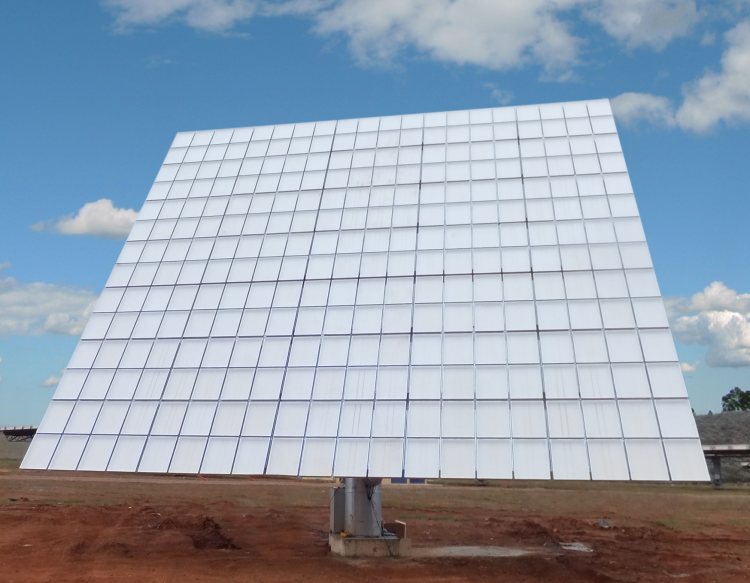

Semprius accomplishes its pricing with concentrated photovoltaics that use lenses over solar cells, in thinner and smaller implementations than previous efforts in order to generate more power from smaller cells. Additionally, Semprius’ solar panels are motorized to track the sun, “so we can provide more kilowatt-hours in a day,” he told us.

Compared to standard silicon-based solar panels — Semprius uses gallium arsenide — Carr said his company offers 30 to 40 percent more energy than a similar-sized plant and two to three times the conversion efficiency — 35.5 percent, the highest in the industry.