Mobile gaming is hitting its renaissance. In both the Google Play and Apple iTunes app stores, the percentage of money spent on games out of the total amount spent on apps is increasing, according to analytics firm App Annie, which released the data this week at the Mobile Gaming USA East event in New York.

The gaming industry and mobile device makers alike are putting their hopes in mobile games as the rocket to vast profits. While smartphone and tablet revenues are a small slice of the overall game market, the growth rates based on data from December are gathering momentum. Evidence collected by App Annie in December suggests that mobile gaming nirvana is not so far away.

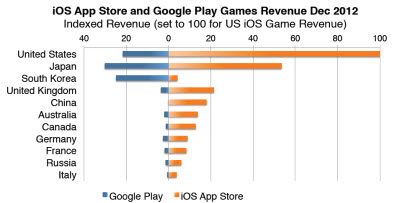

The iOS app store continues to generate five times more revenue from games than Google Play, but Google Play is growing. In fact, in South Korea, the money spent on games is almost entirely on Google Play. In Japan, iOS is significantly bigger than Google Play. Apple generates more game revenue than Google Play in the United Kingdom, China, Australia, Canada, German, France, Russia, and Italy. Still, Google Play earns a higher percentage of its revenue from games compared to the Apple iOS app store.

“What was very telling was that December was the biggest increase we have ever seen for iOS, driven by device sales and promotions,” said Oliver Lo, vice president of marketing at App Annie, in an interview with GamesBeat.

Google Play gaming grows

Google Play gaming grows

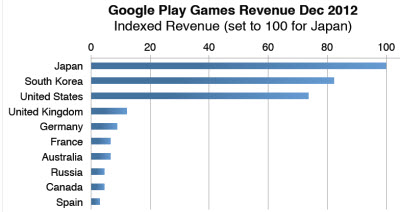

For games, the top three countries generating revenue in the Google Play store are Japan, South Korea, and the U.S. Together, they drove about three-fourths of the Google Play games revenue in December, said Lo.

These three countries also spend a higher percentage of app money on games than any other country. In data from the month of December, South Korea’s Google Play app revenues are 95 percent based on games. Japan’s Google Play app revenues are about 88 percent based on games, and the figure for the U.S. is 76 percent.

With Google Play, the percentage app downloads from games ranges from mid-20 percent to low-40 percent figures. Arcade, action, and casual games make up close to two-thirds of game revenue. Other popular categories in descending order are brain and puzzle games, cards and casino, sports, and racing. South Korea and Japan skew toward brain, puzzle, and casual games. In the U.S. and Australia, the more popular categories are card and casino games.

Japanese gamers are big spenders. With Google Play, Japan has the highest games revenue-to-download ratio by far. As a category, cards and casino games have a high revenue-to-download ratio.

On Google Play, the top app publishers in December in terms of downloads were Facebook, NHN, Rovio, Google, and GO Launcher. Japanese and South Korean game publishers dominate the revenue rankings for Google Play. The top revenue producers worldwide were NHN, DeNA, GungHo Online, Gree, and Colopl.

For games, the top revenue generators on Google Play in December were GungHo Online’s Puzzle & Dragons, DragonFlight for Kakao by NextFloor, NHN’s Line Pope, Anipang for Kakao by Sundaytoz, and a casual title from Patistudio. Of these top five, all were from Japan and South Korea.

“We’re seeing reverse globalization, where Japanese and Korean companies are dominating the store,” Lo said.

In the U.S., the top revenue generators among games on Google Play were DeNA’s Rage of Bahamut, DeNA’s Blood Brothers, Ateam’s Dark Summoner, Playtika’s Slotomania, and Dragonplay’s Slot City.

iOS app store gaming stats

iOS app store gaming stats

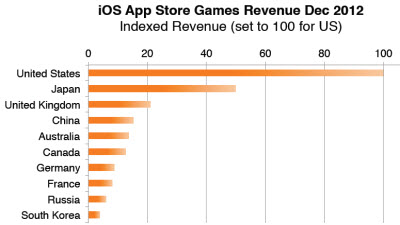

App Annie found that the U.S. and Japan contributed over half of the total revenue for the iOS app store in December. Asian countries lead the way in percent of revenue coming from games on the iOS app store. China has more than 80 percent of its iOS app store revenue coming from games. It is followed by Japan, Macau, Singapore, and Canada.

Japan has the highest games revenue-to-download ratio on the iOS app store, followed by Switzerland, Australia, and Singapore. As a category, card games have the highest revenue-to-download ratio in the iOS app store, followed by role-playing games, casino games, and strategy games.

Apple’s store is still the cream of the crop, earning 350 percent more revenue than Google Play, and growing more in absolute dollar figures than the upstart Android store.

On iOS, Apple and Google are the top app store publishers in downloads during December. They were followed by EA, which had 958 apps, Rovio, which had 28 apps, and Disney, with 199 apps. But in revenue, EA was No. 1 in December, followed by Supercell, the Finnish publisher of Clash of Clans. It was followed by Gameloft, Gree, and GungHo Online. The rest of the top ten included Zynga, Kabam, NHN, Square Enix, and Rovio.

When it comes to games alone, Clash of Clans was the top worldwide revenue producer on iOS for each month in the fourth quarter. It remained No. 1 in December, followed by EA’s The Simpsons: Tapped Out, Puzzle & Dragons by Japan’s GungHo Online, Supercell’s Hay Day, and King.com’s Candy Crush Saga.

And in the U.S., the top revenue generators among games in the iOS app store were Supercell’s Clash of Titans, EA’s The Simpsons: Tapped Out, Supercell’s Hay Day, Backflip Studios’ DragonVale, and Kabam’s Kingdoms of Camelot: Battle for the North.

And in the U.S., the top revenue generators among games in the iOS app store were Supercell’s Clash of Titans, EA’s The Simpsons: Tapped Out, Supercell’s Hay Day, Backflip Studios’ DragonVale, and Kabam’s Kingdoms of Camelot: Battle for the North.

Putting mobile gaming in perspective

The amount of money associated with mobile apps is still relatively small. Electronic Arts reported $1.2 billion in revenues in the last three months of the year. But mobile games accounted for only $100 million of that amount. That was up 18 percent from a year ago. And EA said that EA said that The Simpsons: Tapped Out was a top-grossing game on iOS in the quarter, generating $23 million in digital revenue. By comparison, a top hit on the consoles can generate hundreds of millions of dollars in sales.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More