The PC market’s decline still seems to have no end in sight after continuing for up to eight quarters in a row, according to at least one research firm. For Q3 2016, both Gartner and IDC found PC shipments were down globally.

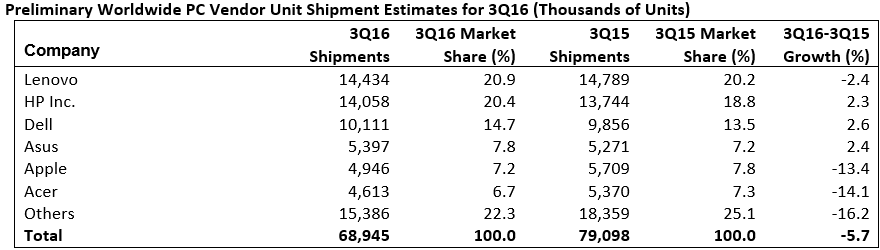

Gartner estimates worldwide PC shipments fell 5.7 percent to 68.9 million units in Q3 2016, marking the eighth quarter of PC shipment declines. According to the firm’s numbers, this is “the longest duration of decline in the history of the PC industry.”

The top six vendors were Lenovo, HP, Dell, Asus, Apple, and Acer. As you can see in the chart below, Gartner found that Lenovo, Apple, and Acer experienced a decrease in PC shipments. HP, Dell, and Asus were each up slightly. The rest of the market, however, was down 16.2 percent.

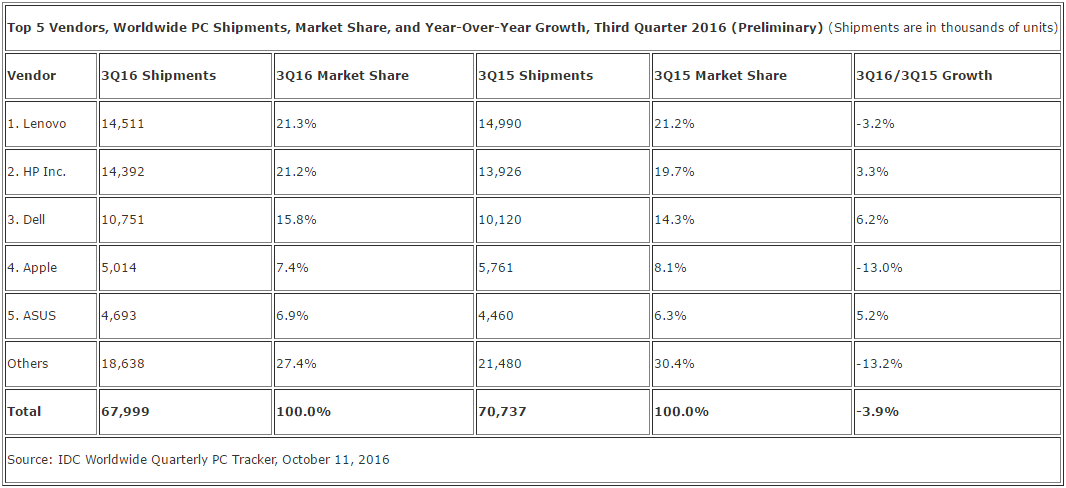

IDC, meanwhile, estimates worldwide PC shipments dropped 3.9 percent to 68 million units in the third quarter. The top five vendors in IDC’s results were Lenovo, HP, Dell, Apple, and Asus.

IDC agrees with Gartner that Lenovo and Apple were down and that the remaining smaller companies suffered a double-digit drop. The exact numbers, for your perusal:

Gartner and IDC analysts have stopped blaming Brexit and are now once again saying the PC simply isn’t in demand as it once was. Gartner, in particular, emphasized this year’s weak back-to-school demand.

“There are two fundamental issues that have impacted PC market results: the extension of the lifetime of the PC caused by the excess of consumer devices, and weak PC consumer demand in emerging markets,” Gartner principal analyst Mikako Kitagawa said in a statement.

According to our 2016 personal technology survey, the majority of consumers own, and use, at least three different types of devices in mature markets. Among these devices, the PC is not a high priority device for the majority of consumers, so they do not feel the need to upgrade their PCs as often as they used to. Some may never decide to upgrade to a PC again. In emerging markets, PC penetration is low, but consumers are not keen to own PCs. Consumers in emerging markets primarily use smartphones or phablets for their computing needs, and they don’t find the need to use a PC as much as consumers in mature markets.

IDC, meanwhile, found this quarter’s results to be better than expected. The firm’s outlook is rosier, pointing to PC vendors rebuilding inventory for the second half of the year and being more willing to compete aggressively.

“We are very pleased to see some improvement in the market,” IDC analyst Loren Loverde said in a statement. “Industry efforts to update products to leverage new processors and operating systems; to deliver a better computing experience encompassing more mobile, secure, and faster systems; and to accelerate PC replacements have been critical. These improvements are accumulating, and set the stage for a stronger market going forward.”

Neither firm mentioned Windows 10, which has been unable to reverse the PC decline and in many ways has only furthered it. Microsoft is holding an event for its latest and greatest operating system later this month in New York, where various new PCs are expected to be shown off.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More