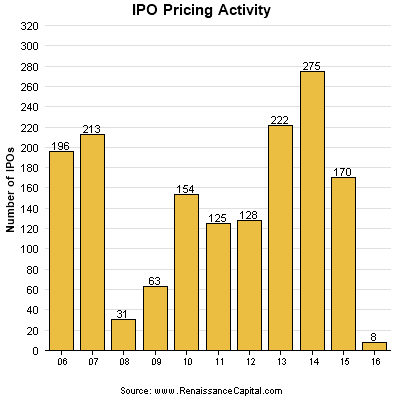

The first quarter of 2016 is about to go into the books as the worst three months for global IPOs since 2009.

The disappearance of initial public offerings of stock is a remarkable turn of events, considering that, in the U.S. at least, stock markets have been stable over the past year (if unspectacular), the overall economy is growing, and unemployment is falling.

There are certainly weaknesses in the U.S. economy and global concerns in various regions, including China. But it’s safe to say that the global economy today is nothing like the economy of 2009, when it seemed for a while that the world could be headed toward a catastrophic collapse.

And yet, in the U.S., there have been just 8 IPOs this year, compared to 34 for the same period last year. In 2009, there was just one IPO in the first three months, according to data from Renaissance Capital.

The problem cuts across nearly all markets and industries. The total amount raised by IPOs is $700 million, down 86.7 percent from last year. The health care sector accounts for all 8 U.S. IPOs so far in 2016.

And the forecast for the rest of the year is not strong: So far, there have been 24 IPOs publicly filed — down 45.5 percent from last year — according to Renaissance.

As noted, this slowing is not just in the U.S. According to Renaissance, the 29 global IPOs in 2016 is down from 75 a year ago. And they raised only $9.6 billion, a drop of 73 percent from a year ago. It’s the worst total since Q2 2009, when IPOs raised $10 billion.

And that meager total includes only two tech IPOs.

Even Renaissance was at pains to explain the reasons behind the IPO implosion.

“While factors such as low oil prices and fears of a global recession continue to weigh on investor sentiment, decent performance from IPOs year-to-date and lower market volatility exiting the quarter should encourage more companies to step forward,” says the Renaissance report.

It will likely be a few more weeks before we get M&A figures for Q1 2016. But if all exit options continue to close, we can probably expect to see more and more overvalued startups start to shed workers and pare back spending.

And venture capitalists are eventually going to face difficult decisions about how long to privately fund money-losing startups, even growing ones, if the chances for return continue to recede further and further over the horizon.