Google may dominate online advertising, but it’s been slow to innovate in mobile.

Today at the Google I/O conference in San Francisco, the search giant took its first big step toward changing that paradigm. The company revealed two big plays: cross-platform campaigns for mobile developers and mobile ad conversion metrics for app-install ads.

The updates are big for Google, which is losing a sizable hunk of the mobile advertising market to small innovative advertising startups and Facebook. Mobile analytics firm Flurry estimated that $6 billion was spent on mobile app install ads in 2014. However, today’s updates won’t win Google the same stranglehold in mobile that it enjoys online.

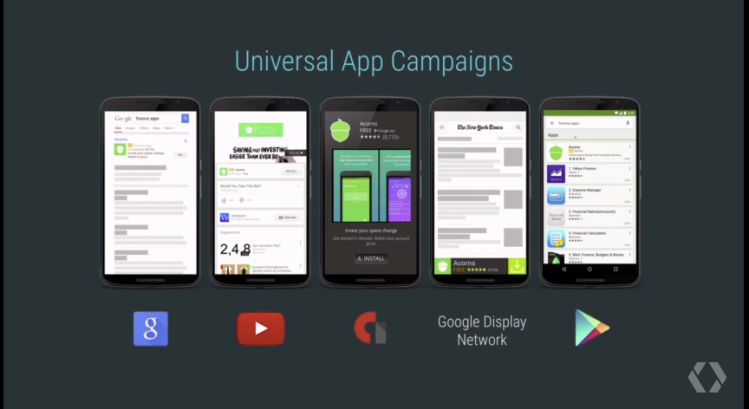

Google’s AdWords teams unveiled Universal App Campaigns, which will allow mobile developers to more simply run campaigns across Google Search, the AdMob network, the Google Display Network, YouTube, and Google Play. This will (finally) give mobile developers the opportunity to access Google’s massive audience. For advertisers looking to spend, this (potentially) means more bang for their buck.

But audience reach is nothing without metrics to prove that Google is turning those millions of eyes into buying customers.

The second key announcement was Mobile App Install Campaign Attribution. Google is integrating with a few third-party partners like Adjust, Appsflyer, Apsalar, Kochava, and Tune to help measure and track ads that turn into sales. Developers will also be able to “postback” ad conversions.

“Google still controls the operating system that runs 80 to 90 percent of the smartphones on the planet, so they have an incredible amount of data. They have incredible reach, and they have incredible opportunity to connect products and services for developers, publishers, as well as advertisers,” said John Koetsier, VP of VB Insight, VentureBeat’s research arm.

He said that if Google bundles its services more tightly together, creating an integrated network, it has the opportunity to grow its market share substantially. Think of Twitter’s ad ecosystem. Twitter attempts to give advertisers and developers all the tools they need in one place through its Fabric network as an incentive to advertise through its platform. Google could easily replicate that model to great success.

It will have to do so carefully, though. Increasingly, government officials are concerned with Google’s size and potential for infringing on antitrust laws. The European Union is already investigating whether Google is unfairly affecting competition through bias in its search results. Tying its services more tightly together could draw the attention of legislators or be considered an unfair competitive advantage, said Koetsier.

However Google moves forward with its ad network, one thing is sure: It has to beat Facebook at its own game.

“I think the next thing they need to figure out is how to find the most valuable consumers and crack the targeting nut that Facebook has done so well with,” said Peter Hamilton, CEO of Tune, one of the third-party tools Google now integrates with.

Facebook has accumulated a lot of personal data through its large, active user base. That data translates into highly targeted advertisements. Google also has large swathes of user data, but it hasn’t been able to use it to the same effect that Facebook has on mobile.

In order to ensure it can secure a big share of the mobile ad market, Google is going to have to better understand the way its users behave and why they make the choices they do. That kind of data most easily comes from social settings — an area where Google has so far failed to excel.

That means its upcoming plans for Google+ could be hugely important to its advertising strategy.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More