This past Thursday Amazon issued a press release announcing a record-setting holiday season for the company, leading with statistic that “more than one million customers become new Prime members in the third week of December” (emphasis added).

New subscriptions were so popular, according to Amazon, that it had to limit new membership signups so that service wouldn’t be disrupted by current Prime members.

Amazon is known for bragging about vague sales growth data. But in spite of complaining about it, the tech press continues to report these numbers every time. That the tech press continues parrot Amazon’s vague numbers is baffling on its own, but the fact is, they don’t even dig deeper into the concrete numbers provided by Amazon. Case in point, the Amazon Prime numbers for the third week of December. You can look at Geekwire, AllThingsD, NYTimes Bits, Bloomberg Businessweek, Ars Technica, GigaOm, and many others only to realize that the writers simply copy-paste the figures without providing any sort of context that would help us better understand what these numbers mean for the company.

So what could’ve caused the impressive spike in Amazon Prime subscriptions? And will these new users stick around — i.e. did Amazon lock-in another $79 million this holiday season due to growth in Prime?

According to National Retail Federation, approximately 10 percent of shoppers wait until Christmas Eve to finish their shopping. Based on data from two years ago, this figure represented a total of 24 million Americans. The situation was exacerbated this year which saw the shortest shopping season in 11 years (26 days, down from 32 days last year) and a record 32 million Americans hadn’t even started shopping by December 9th. Moreover, a record 50 percent of these shoppers said they would do their last-minute shopping online (highest figure in 11 years), according to the National Retail Federation. Their reason for this was to take advantage of same-day delivery offered by companies like Amazon, according to Mark Moran, SVP of marketing for Ebates.

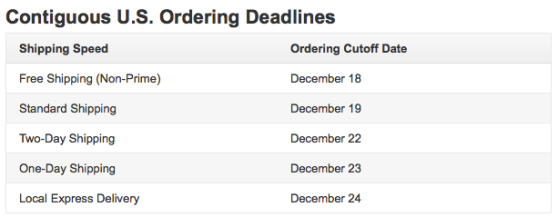

Within this context, Amazon’s announcement begins to make more sense. American shoppers are not only procrastinators, but were under added pressure thanks to the shorter holiday shopping season. They turned to Amazon (and Amazon Prime in particular) to take advantage of its free trials (1 month free trial for first time users, 6 month free trial for students or anyone with valid .edu email address, and 3 month free trial for Amazon Moms subscribers) and the two-day, one-day, and local express delivery that comes with it. The fact that Amazon recently raised its requirement for free shipping to $35 per order from $25 probably also played a role. The chart below shows Amazon’s Christmas ordering deadlines from this year and why Amazon Prime can be vital for last-minute shoppers.

Finally, both Amazon and UPS in their apologies admitted that that delays in shipments this year were primarily caused by “a flood of last-minute online shoppers.”

In light of all this it should be obvious that while while Amazon may have registered 1 million new Amazon Prime members, many of them are probably using it to expedite shipping on last minute purchases and are likely to cancel after. Many others are probably taking advantage of months-long free Prime access for students and moms. In both cases, they will not be paying the annual fee of $79, so those signups won’t translate into revenue for Amazon.

Muhammad Saleem is a tech industry observer and digital marketing strategist based in Toronto. You can follow him at @msaleem and contact him at MuhammadSaleem.com.

Muhammad Saleem is a tech industry observer and digital marketing strategist based in Toronto. You can follow him at @msaleem and contact him at MuhammadSaleem.com.