Last week, Apple announced two new iPhones that included Near Field Communication (NFC) for wireless payments for the first time. The company’s new Apple Pay service provides a full digital wallet for the iPhone 6 and 6 Plus, which enables consumers to pay by phone using NFC with simplicity. NFC Payments have been around a while, but Apple Pay has the potential to make widespread adoption of digital wallet payments a reality at last.

“Apple Pay will forever change the way we buy,” said Apple Chief Executive Tim Cook at the launch event in Cupertino, Calif. That’s a bold claim given the spotty adoption that NFC has had by US retailers and consumers. But while much of the focus has been on in-store payments, Apple Pay will have a potentially very significant impact online as well.

Let’s start with in-store payments: One thing that Apple is very good at is the ability to combine existing technologies in an innovative and compelling way that can transform a category. It looks set to do the same for mobile payments.

In this case it is the intersection of four key Apple capabilities, combined with a very slick customer experience that makes this a game changer:

- Touch ID – Fingerprint Authentication was first built into the iPhone 5s and will be featured in the iPhone 6 and 6 Plus. With more than 10 million iPhone 5s devices sold and over four million pre-orders for the iPhone 6 and 6 Plus, Touch ID technology is now on at least 14 million smartphones around the world.

- Passbook – The digital wallet app is deployed on 200 million iPhones.

- iTunes – There are well over 800 million iTunes accounts with stored credit card information.

- NFC – A method of connecting to a point of sale terminal when in close proximity, NFC technology is already embedded into 395 million smartphones.

It’s been speculated for some time that the combination of Touch ID and NFC payments could potentially overcome consumer resistance to paying with a phone. Consumers remain wary about credit card security, and Apple has listened to these concerns intently. While a fingerprint may not actually be all that secure (there are plenty of fingerprints on a touch screen phone that could be lifted), it gives the perception of security for consumers, which is all too important.

Touch ID, first rolled out on the iPhone 5s, works reasonably well, and the majority of iPhone 5s customers use it in place of a screen lock password. That’s an important step because 200 million consumers around the world are already familiar with using their thumb in place of a password. Passwords are always problematic – we forget them all too easily, but our thumbs are firmly attached and never forgotten.

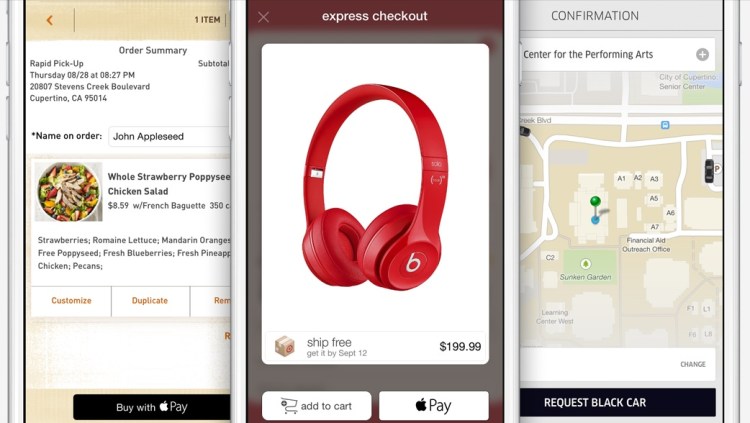

The second key attribute of the Apple Pay story is Passbook, the Apple digital wallet app. This app has primarily been used for storing airline boarding passes, and more recently retailers have begun to use it for storing loyalty cards and digital coupons. Because it is already on every iOS 7 phone, it is very widely deployed even if it is not widely understood. That’s about to change. With Apple Pay, Passbook gets a major upgrade to a real digital wallet for “storing” credit cards, together with all the other things you keep in your wallet – such as loyalty cards, promotional vouchers, boarding passes, etc.

Apple also has hundreds of millions of payment details stored in iTunes, which can be used in Apple Pay with a simple click. Alternatively, all it takes is a photograph to add a new credit card. However, this ability to upload new card details is limited to Amex, Mastercard and Visa currently, and only the major U.S. merchant acquiring banks. While this may sound like a scary proposition, the card data is not “stored” on the phone but on a secure token that generates one-time payment codes. This is more secure than a physical wallet, and if a customer loses their phone, an updated version of ‘Find My iPhone’ can disable NFC payments remotely.

The final piece of the puzzle is NFC. Since NFC is not new, having been supported on some Android phones for years, there are already some retailers with NFC-enabled point of sale terminals. Apple was keen to tout a raft of major retailers supporting Apple Pay, but in reality most of the NFC infrastructure has been in place for a while.

What this means for in-store payments is that Apple finally has a chance to succeed in making a phone a wallet. The user experience is very slick, as many have come to expect with Apple, and this will draw an influential and affluent new segment of consumers into NFC payments. Perhaps for the first time there, is a combination of factors that make this a likely winner. There are still some hurdles, of course: Many more retailers will need to upgrade their POS terminals to accept NFC (which is always painful and a slow process); more merchant acquirers will need to support Apple Pay; and customers will need to upgrade their phones. These aren’t trivial hurdles, but the iPhone 6 will be a success for the loyal and lucrative Apple fan base, and this looks like the beginning of a sea change in the way that we shop.

Charles Nicholls is founder and chief strategy officer of real-time behavioral marketing company SeeWhy. He has worked with many of the world’s top companies on their web and customer analytics programs, including Amazon.com, eBay, Lands End, and MasterCard.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More