Vorhaus: Do you play them online, or do you play them in your living room?

Thompson: I play Hooks and Ladders with my daughter and Risk with my son.

Vorhaus: Tell me about the online poker space. I’ve seen you play poker in real life, and people were telling me last night that sitting at a table with you was one of the scariest things that ever happened to them in the poker world.

Thompson: My wife will tell you that I’m kicking myself for missing the online poker opportunity in the early 2000s. Then it became illegal for U.S. citizens to be in that industry, which was a pretty sad thing. The opportunity came around again when the Justice Department shut down all the offshore sites and said that only companies that have been cleared will be allowed to compete. That created an opportunity to cover that base. Online social gaming is still a huge opportunity.

Vorhaus: What’s your read on real-money online gambling, where we’re headed on that versus the Zynga approach or just people going out to discover a poker game on the web using Google? Apparently, people are spending money, but they can’t take it out.

Thompson: Yeah, it’s called free to play. It’s not gambling. Gambling requires consideration in an element of chance, and consideration out. In free to play, there’s no consideration out. It’s strictly a form of entertainment.

Vorhaus: Do you think the space is overcrowded, or do you think we’ll see a phase two or a phase three of online poker games and online casino games?

Thompson: The legalization hasn’t come to the U.S. and probably won’t happen in 2013, maybe even 2014. I do think it’s inevitable. I do think players in the social space will be part of the online gambling ecosystem as that evolves. That’s a big part of my motivation for getting into the social casino space.

Vorhaus: Where are you headed these days? What else is out there? Do you want to make movies? TV shows?

Thompson: We stick to our knitting. Signia, the fund that I started with Dan Fiden and Ed Cluss, is continuing to do what we do: work with early-stage companies in our founder-investor model in areas we understand. Mobile is a major driver. Through gaming now, we have a pretty good handle on customer acquisition in that ecosystem. That’s leading us into some content companies creating games, but more often, they also have a platform component to it — a platform for others to develop and market games. Some technology and infrastructure. We’re interested in augmented reality. We think Google Glasses is going to be exciting although it’s at least another year out before we’ll see that enter … . The smartphones will start to get displays. In the meantime, enterprise, small business. We’re reworking business processes on mobile. There are hundreds of opportunities. We’re interested in everything from vertical B-to-B utilizing mobile-social networking is still particularly interesting on mobile, what’s going to happen there. The messaging and chat apps where users can connect with their friends, exchange information, and play games on mobile. It’s going to look very different from it has on the web.

Vorhaus: I have here a list of 14 of your investments. I’d buy a personal favorite, which is Iddiction. I’d love for you to tell us a thing or two about Iddiction. Then we’re going to see if you like me as much as you say you do. What’s your favorite on the list?

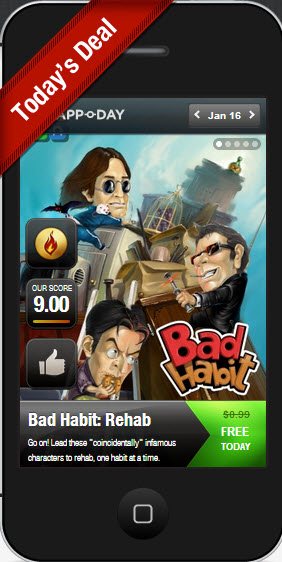

Thompson: Iddiction is a great example of something we’re really proud to be involved in. It’s a company that helps create distribution and discovery for app developers, particularly on iOS. We’re also incorporating Android in the future. It’s a difficult problem that all app developers face. Distribution is hard and can be expensive. Iddiction is one of the few companies I know that has a loyal following of users that look to Iddiction for apps they can get a deal on. Iddiction has a feedback loop with their user base. “What kind of apps are you looking for? What would you like?” Their users call out and say, “Here’s a paid app that costs $2.99. We’d like it for free.”

Iddiction goes to the creator of that app and basically, no charge, offers 40,000 or 50,000 downloads of that app to its user base, which drives usage and helps that app get up higher in the iTunes store. That continues a circle creating an increased number of users. It serves its users well. It helps developers get their apps discovered. Many of those campaigns are done for no charge, but their revenue model also involves working with quality [developers] who pay to get their apps discovered. They sell it at a very competitive rate, so they can choose the apps they want to have developed. What I like about that company is that it’s user-centric, it’s quality-focused, and it’s playing a key role in the ecosystem.

Vorhaus: Tell me what Fun+ is like. What’s it like working with a very rapidly growing Chinese-based social-game developer? Are they in Shanghai or Beijing?

Thompson: Actually, I think it’s both. Fun+ is interesting because Facebook is pretty much blocked in China. Fun+ is a Chinese Facebook game developer. The team there is obviously able to access Facebook directly in order to develop products before it, but their customers are all outside of China, mostly in Europe. They take advantage of lower-cost labor and an understanding of the Facebook ecosystem and develop apps that they localize for a some countries, mostly in Europe and the Middle East.

Vorhaus: You get a lot pitches. You get a lot of people coming into your office looking for a partnership. What do you look for in a pitch?

Thompson: Most every investor would say they look at growing markets, team, and technology, in that order. We very much emphasize a market opportunity, particularly something that’s disruptive. We love new platforms because they’re disruptive and create exactly the sorts of opportunities we’re looking for. As far as teams, we will start with a team, or we’ll start with one person and help build a team. We’re also all operating people inside Signia. We understand technology and the risks and how to go about building it. Those are areas where we can help out. Obviously if the company has all of its elements put together, they may not need us. Things that we look for are a great market opportunity and a seed, a core to build the company around.

Vorhaus: I’m hearing increasingly about a financial reluctance to take series A and B [venture capital] money and give up a lot of your company at an early stage. I’m hearing about a lot of emotional rejection of VCs also. What’s going on here?

Thompson: It’s important to have investors who are aligned with entrepreneurs in terms of outcome. There is a lot of tension, potentially, in that relationship. Part of the important thing for any entrepreneur is to have investors that they want to work with, that they like and that they trust — investors that they can be honest with. There are a lot of entrepreneurs who practice their pitch. They learn all the right answers so they can pass the test and get financing. But I think they’re cheating themselves in many cases.

It really is a dating process. When you’re dating, if you really like video games, is it important to go for walks in the park and hiking and jogging and all these healthy things that you try to advertise when you’re dating? Or would you rather play video games and watch a movie? When you’re in that dating process, either as a funder or as an entrepreneur looking for funding … . You certainly get in with them professionally. You are in a sales mode. But it’s important to be honest. Through all the process and after the transaction closes, it’s really important to be completely honest about the business and the challenges. That’s really the only way that investors can help. I think what happens more often than not with venture investors taking a seat on the board is that entrepreneurs try to carefully manage their board. They manage their investors because they’ll be looking at investors for formal financing. And that VC really can’t help. What we do differently at Signia is we’re part of the creation. We’re part of the early team. We talk to not just the C-level people but to the director and the engineers. We network and help connect them.

Vorhaus: I hear a lot of founder-[chief executive officers] talking about feeling a real reluctance to lose control of the CEO and the business side. How do you feel about those types of deals?

Thompson: I think if Pincus were to give up his supervoting rights, Zynga stock would probably double overnight. I think it’s bad for all other constituents within a company. All other shareholders suffer. Real, true entrepreneurs are glad to share power as well as responsibility and the burden of it. Not all entrepreneurs should be CEO for life.