Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Opinion makers, founders, and funders often develop a consensus of opinions around specific entrepreneurial ideas and evaluate opportunities narrowly within that predefined framework. Traditional and social media can exacerbate the problem by transforming that simple consensus into a dangerously hyped consensus.

Being an original thinker and challenging the status quo are the most exciting dimensions of entrepreneurship for both founders and funders.

It is, of course, possible to be successful founders and funders by following established consensus. Some founders launch companies by analyzing existing ones, copying them, and adding operational excellence and regional expertise. In the same vein, some funders base their investment strategy on joining “party deals” and blindly follow proven investors.

That said, it is important to recognize that extraordinary, game-changing and industry-defining tech companies (i.e. Google, Facebook, Uber, AirBnB, Spotify) were not built by making operational or feature improvements to an existing idea or business. Rather, they were all non-consensus business ideas, applying brand new thinking and approaches to existing and new problems.

When those companies started, founders and a few funders had an idea that the majority of people around them didn’t share. They were clearly in the area of non-consensus. A good read on this topic is by Brian Chesky of AirBnB: 7 Rejections.

Above: Source: InReach Ventures

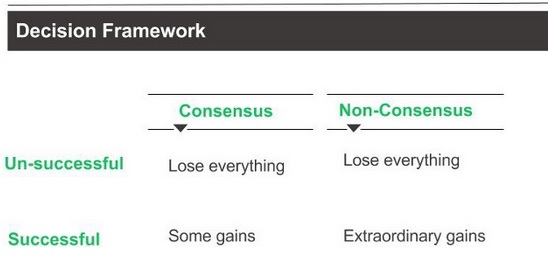

Here is a simple framework for analyzing consensus vs. non-consensus thinking:

In order to unleash entrepreneurship and take it to the next level, both founders and funders need to be able to get out of their comfort zones and push the envelope in the areas of non-consensus business building. If founders and funders rely on consensus and good execution, this may well achieve some gains and in some cases even good gains. However, you can only achieve extraordinary gains based on sustainable huge opportunities by pushing the envelope in the areas of non-consensus.

If you’re a founder or funder pursuing a non-consensus based business idea, here are three key things you need to keep in mind:

1. Accept that you’re going to feel alone

Deciding to work on a non-consensus driven business idea is often the start of a lonely road, which can be very scary and might push both founders and funders to constantly challenge their decision making.

Founders and funders need to accept that non-consensus based decisions imply by definition a sense of isolation. There will likely be a large gap between T0 (time in which the decision is made) and T1 (time in which it is possible to see the results of that decision). In a non-consensus tech venture, the time between T0 and T1 can be extremely challenging.

Tip: Once you’ve made the decision to work on a non-consensus venture, try to protect yourself from the noise of consensus. Try not to be influenced by what others say and think. This is tough because the noise can be high and can come from many directions: friends, press, other founders and funders.

This is usually the best time for founders and funders to stick together and feed off each other’s energy. This is a war against consensus, and the best thing to do is to stay super focused and hide from the hype of consensus.

2 . Challenge your own thinking — you may know too much

Sometimes knowing too much is an obstacle because knowledge aligns itself with the status quo and therefore with consensus. This is why in some cases, young founders can come up with disruptive non-consensus based business ideas. This is also true for funders, who might have previously invested in the space and are not able to recognize a new idea because their brain is influenced by their old experience.

Tip: Founders with strong experience in an industry should always be sure to challenge their own thinking. The most traditional industries can be disrupted if approached from a new angle. Sometimes we observe spectacular failures from serial entrepreneurs who just work within the constraints of what they know, unable to free themselves from the past.

Similarly, some funders should not have the answers before asking the questions. Keeping the brain fresh and unopinionated in front of a non-consensus business idea is often a key component of successful judgement.

3 . Don’t court the cool factor

Sometimes there is a perceived cool factor in developing a non-consensus business idea: “I am working on the next search engine because Google sucks! Therefore, I am building the next Google.” Non-consensus business ideas emerge because founders and funders see something other people do not see, rather than a desire to generate hype around a cool story.

Most founders and funders are not proud of the fact that their venture is a non-consensus one. They actually suffer the non-consensus dimension. It makes their life much more complex.

Tip: There is nothing cool about working on a non-consensus business idea. Avoid seeking publicity until product-market fit is proven and focus on execution. Hype is not validation.

Founders and funders need to realize that in order to build extraordinary large sustainable businesses, they need to get out of their comfort zones, take risks and found and fund non-consensus driven ventures. In Europe, where I am based, this is all the more true: European funders tend to be more focused on protecting the downside rather than helping to unleash potential of the upside, and founders are more focused on developing ventures with an exit in mind rather than focusing on the broad long term objective of maximization of shareholder value.

So, founders and funders, let’s forget the hype, the news, the political posturing and all the rest. Let’s all focus on working hard to unleash the most successful non-consensus based entrepreneurial ventures!

Roberto Bonanzinga is cofounder of InReach Ventures, a software-powered investment firm focused on the early stage European sector and based on a no-management-fee structure. He has more than 20 years of experience building technology companies in Europe and in the US. Prior to cofounding InReach Ventures, he spent eight years as a General Partner at Balderton Capital (formerly Benchmark Europe).