Hewlett-Packard reported a decline in revenue for the first fiscal quarter of 2012, which analysts expected as the company struggles to turn itself around.

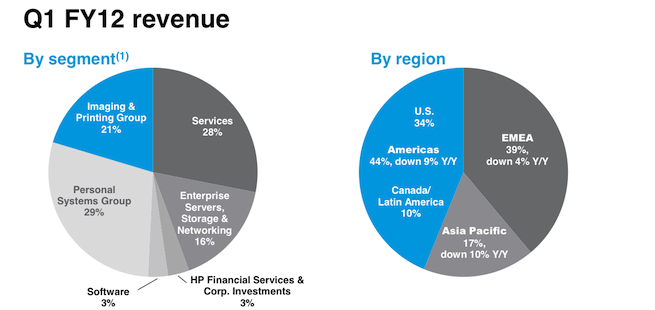

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":394028,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,entrepreneur,","session":"B"}']HP’s revenue was $30 billion for the quarter, down from $32.3 billion during the same period last year, a decline of seven percent. Its GAAP diluted earnings per share (EPS) was $0.73, down 38 percent from the prior-year period, while non-GAAP diluted EPS was $0.92, down 32 percent year-over-year. The company said last year’s hard drive shortages impacted the losses for the quarter, which also affected quarterly earnings for Dell and Intel.

Over the past year, HP has suffered from drastic shifts in both management and business strategy. The company’s board fired former CEO Leo Apotheker after poor communication regarding his intention to sell off the company’s PC division in September (among other reasons). The company also faltered over its TouchPad tablet strategy and other mobile devices running Palm’s WebOS operating system. Apotheker was replaced with former eBay CEO Meg Whitman, who impressed investors by beating analysts’ bleak estimates last quarter.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

“In the first quarter, we delivered on our Q1 outlook and remained focused on the fundamentals to drive long-term sustainable returns,” Whitman stated in the earnings report. “We are taking the necessary steps to improve execution, increase effectiveness and capitalize on emerging opportunities to reassert HP’s technology leadership.”

While revenue from services and software did improve for the quarter, Whitman said it wasn’t enough to compensate for the large losses due to changes in the overall market from consumer behavior. People are buying fewer PCs and using printers less, which is forcing the company to look elsewhere for its revenue growth. During the earnings call, she reaffirmed that HP will focus on three main areas going forward: cloud services, security services, and information management.

A summary of the earnings report follows:

- First quarter non-GAAP diluted earnings per share of $0.92, down 32% from the prior-year period and above previously provided outlook of $0.83 to $0.86 per share.

- First quarter GAAP diluted earnings per share of $0.73, down 38% from the prior-year period and above previously provided outlook of $0.61 to $0.64 per share.

- First quarter net revenue of $30 billion, down 7% from the prior-year period.

- Returned $1 billion in cash to shareholders in the form of dividends and share repurchases.

- Personal Systems Group (PSG) revenue declined 15% year over year with a 5.2% operating margin. Commercial client revenue declined 7%. Consumer client revenue declined 25%. Workstations revenue was flat. Total units were down 18%, with a 19% decline in desktop units and an 18% decline in notebook units.

- Services revenue of $8.6 billion grew 1% year over year with a 10.5% operating margin. Technology Services revenue grew 2%, Application and Business Services revenue was flat and IT Outsourcing revenue grew 2% year over year.

- Imaging and Printing Group (IPG) revenue declined 7% year over year, with a 12.2% operating margin. Commercial hardware revenue was down 5% year over year, with commercial printer units down 10%. Consumer hardware revenue was down 15% year over year, with a 15% decline in printer units.

- Enterprise Servers, Storage and Networking (ESSN) revenue declined 10% year over year, with an 11.2% operating margin. Networking revenue was flat, Industry Standard Servers revenue was down 11%, Business Critical Systems revenue was down 27%, and Storage revenue was down 6% year over year.

- Software revenue grew 30% year over year with a 17.1% operating margin, including the results of Autonomy. Software revenue was driven by 12% license growth, 22% support growth, and 108% growth in services.

- HP Financial Services revenue grew 15% year over year, driven by an 8% increase in net portfolio assets and flat financing volume. The business delivered a 9.6% operating margin.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More