The collapse of talks hammered Sun’s stock price. It dropped 23 percent to around $6.50, or well below the purchase price being talked about — reportedly around $9.50. However, in a sign the market doesn’t believe the talks are over for good, Sun’s shares remain higher than the $4.97 level they were at before news about a possible deal with IBM arose.

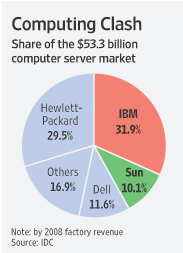

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":105976,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"C"}']Multiple news reports said that the deal foundered Sunday after Sun’s board rejected a formal offer by IBM, saying the deal price was too low — and this led IBM to withdraw its offer. The New York Times said Sun was bothered by IBM’s lowering of its bid to $9.40 a share from an initial $10 to $11 a share. IBM may have bet that Sun really needed the deal — something most observers also believe, given’s Sun’s struggles of late — and that Sun would be forced to take the lower bid or look like a lame duck if IBM walked away. Meanwhile, the Wall Street Journal reported that Sun’s board was split over the prospective sale, with a group led by CEO Jonathan Schwartz allegedly favoring a deal, and a faction led by Chairman and co-founder Scott McNealy opposing it.

Keep in mind that these sorts of politics are typical in any negotiation, and so this doesn’t really mean the deal is through.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

[Image credit: WSJ]

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More