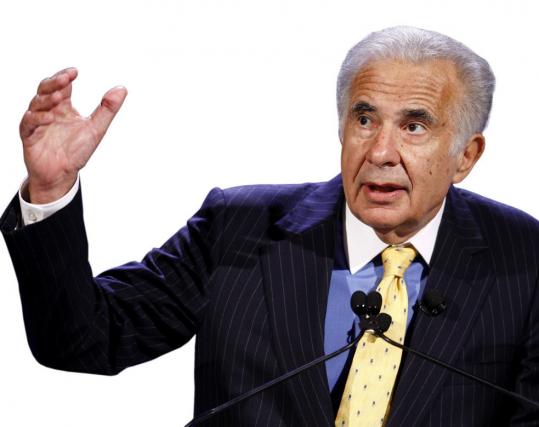

Carl Icahn made by far his largest single trade on Apple this week, tweeting that his investment has grown to $3 billion.

The outspoken billionaire has repeatedly referred to Apple as a “no brainer.” His stake represents less than one percent of Apple’s stock, and Icahn is not one of the company’s largest shareholders. However, this is a huge position for the investor; according to Forbes, it represents his largest trade.

Having purchased $500 million more $AAPL shares in the last two weeks, our investment has crossed the $3 billion mark yesterday.

— Carl Icahn (@Carl_C_Icahn) January 22, 2014

Since tweeting about our large position in $AAPL on Aug 13, when the stock was 468 per share, we’ve kept buying shares of this ‘no brainer.’

— Carl Icahn (@Carl_C_Icahn) January 22, 2014

Shares rose one percent after Icahn published his tweets.

Icahn believes that Apple should use some of its cash hoard to buy back shares to boost the stock price. He has shared this opinion with Apple chief executive Tim Cook and the broader public. So far, his request has fallen on deaf ears, with Apple formulating its own plan.

We feel $APPL board is doing great disservice to shareholders by not having markedly increased its buyback. In-depth letter to follow soon.

— Carl Icahn (@Carl_C_Icahn) January 22, 2014

Icahn has been pushing Apple to buy back an additional $150 billion of its own stock since August. He has upped his stake three times after referring to the stock as “extremely cheap.” At the same time, Icahn has been openly critical of Apple and has accused the board of what he called a lack of finance experience.

Apple is in the midst of returning $100 billion to shareholders in the form of higher dividends and an accelerated stock repurchase plan.

“What bothers me a hell of a lot is that the decision to use a cash horde of $150 billion just sitting there doing nothing, and not use it to do a huge buyback is sort of disgraceful… doing a disservice to its shareholders, especially its smallest shareholders,” he told CNBC in an interview today. “No one on board that has real finance experience, [they] rely on investment bankers for advice — if you’re seasoned in playing tennis, doesn’t mean you should give advice on brain surgery.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=3605d351-7e32-4a73-b040-52be0f53552d)