In a December 11 Bloomberg interview with Emily Chang, legendary venture capitalist Bill Gurley reiterated his belief that “e-commerce is a dangerous game.” He first made the case in a 2012 article, “The Dangerous Seduction of the LTV Formula,” where he argued that customers don’t exist in a vacuum and that many companies poorly estimate the actual economics of the formula.

The public markets might agree; 2014’s most lauded e-commerce IPO, Wayfair, is down nearly 50 percent from its open price, and flash-sales leader Zulily was down 40 percent in 2014 and over 65 percent from its March 2014 high. At the same time, brick and mortar retailers such as Williams-Sonoma and Nordstrom, with their strong online performance, have surged to all-time highs. And in the middle, the next generation of e-commerce startups from Rent the Runway to Instacart to Stitchfix have raised financing at high valuations, while Trunk Club was acquired for $350 million at barely four years old.

So what’s the truth? And what’s going on? It’s my belief that customer acquisition for commerce companies has never been more competitive and is causing considerable drag on traditional players. At the same time, connection focused e-commerce platforms are leveraging network effects for reduced acquisition cost and sustained engagement. Their success is rooted in an authentic voice and restoration of consumer trust — a trust that was broken by an exceeding amount of email and retargeted marketing spam. But e-commerce is cyclical, and early indications suggest that storytelling and content could be the major drivers in the next generation of e-commerce.

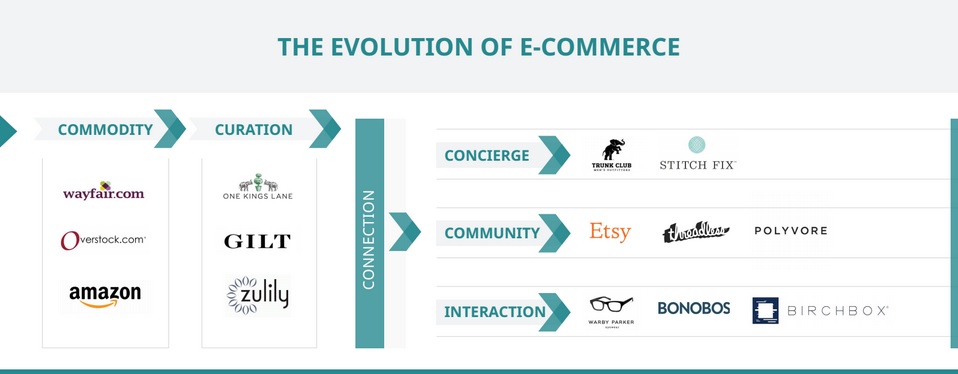

To understand the current state of online commerce, it’s important to take a quick look at its history.

Commodity: Early players such as Amazon and Overstock built their businesses carrying a catalog of SKUs wider than traditional brick and mortar retailers while undercutting aggressively on price, leveraging their lower overhead costs. They had early access to now dominant affiliate platforms, allowing them to quickly acquire customers at scale.

Curation: But that same catalog of infinite SKUs caused real pain for all but the most specific of product searches. This pain led to the birth of discovery- and push-curation focused platforms — from Gilt to Zulily to Wanelo — whose focus was to highlight and promote intriguing products, often specially selected by an editorial team.

This curation focused model succeeded in generating dozens of businesses with hundreds of millions in revenue, but it also suffered from the same macro-factors as e-commerce 1.0. Why?

- Traditional retailers such as Nordstrom and Williams-Sonoma drastically improved their digital marketing teams and presence, making the costs of customer acquisition more expensive. [The systemic problem of paid acquisition is illustriously outlined by Josh Hannah of Matrix Partners.]

- Although curation models benefited from limited-time sales and the power of refreshed experiences, the majority of revenue still came from email remarketing — a continual competition with every traditional retailer under the sun for inbox attention.

Connection: Which brings us to the present — the era I’ve labeled “connection.” On a macro level, the move towards connection makes a lot of sense. Consumers are overwhelmed by email, social, and retargeted marketing, while at the same time flocking to platforms such as Uber and HotelTonight, whose focus is on constraining choice and cognitive noise. It is the overwhelming noise that I believe created a loss of trust amongst consumers — a trust that can only be rebuilt either via a personal concierge, a welcoming community, or in-person interaction in the next generation of retail stores (Warby Parker, Bonobos, BaubleBar, etc).

The Cycle

In the web curation stage of e-commerce, email continues to drive the majority of revenues by leveraging existing customers. But as email became noisier, mobile focused curation apps such as Poshmark, Tophatter, and Spring emerged to leverage push notifications, attempting to bypass the existing clutter. Push is now undeniably cluttered as well. The same cycle will repeat itself with home-screen notifications.

And this, in my opinion, explains the proliferation of human connected businesses — platforms that are able to cut through digital noise and connect in a real, interpersonal way. As our lives incrementally become more automated and digital, we increasingly crave real relationships in life areas that matter deeply to us — our hobbies, our families, what we eat, how we look, etc.

But this cycle will ultimately have its limits too. Consumers will only have bandwidth for a certain number of personal concierges (many of whom are financially incentivized to sell). Individuals will only have time to engage with so many interest-specific digital communities. As these models inevitably become more competitive and margin-compressed, the increased pressure to sell will break that same consumer trust that was so recently restored. Though human relationships are more secure and long lasting than brand affinities, I predict that in the next downturn, these commercial relationships will be upended in favor of those focused on family, physical health, emotional health, or even nutrition.

The Future: Content, Media, and Stories

In September 2013, eBay acquired an under-the-radar e-commerce startup, Bureau of Trade, whose sole thesis was to build powerful stories, content, and context around items that were otherwise available on Amazon or eBay and see what happened. Would consumers become highly engaged with those stories and shop on the site? Would they alternately search around for the same items at cheaper prices? What effect would rich content have?

A lot happened. CEO Michael Phillips Moskowitz, commenting at the time of acquisition, noted: “The average good on eBay will sell at X purchase price. That same piece of merchandise when covered by the Bureau — when written about by us — created in many instances a 50 to 100 percent price increase. That’s profoundly valuable.” These results speak clearly to the power of storytelling above and beyond the personal relationships of a concierge, physical store, or community.

Moskowitz and the Bureau of Trade aren’t alone. In 2011, Natalie Massenet, founder of Net-a-Porter and former fashion editor for W magazine noted that “Media companies are going to become retailers and retailers are going to become media companies.” Matt Rutledge, who sold Woot.com to Amazon in 2010 and recently launched Meh.com, told Business Insider, “The underlying premise [of Meh] is that we’re building a store that you don’t need to buy anything from to have fun” — effectively, content-enabled commerce.

This January, in a chat I had with Moskowitz, now Chief Curator and Editorial Director at eBay, he stressed the challenge facing e-commerce companies: “One thing I can say about the American consumer is that they’re constantly under an artillery barrage. What do you do when everyone is demanding of your attention? You default to the one thing which provides solace, be it drink, TV, movie, or friends. You lose the thrill of finding out about the new thing because every thing is a new thing.”

The answer? One theory: If platforms can manage to keep you entertained, informed, educated, or otherwise engaged, you’re more likely to transact. The intriguing aspect of the content/story focused model is that it provides many of the practical benefits of the connected models — instruction and assistance, for example — while reverting closer to the pull functionality of e-commerce 1.0, in that consumers are more likely to be exploring on their own, unguided. [Chris Dixon has a great recent post on pull versus push.]

Effectively, these stories and content provide the credibility and legitimacy of connected experts and the entertainment of an active community, but without the overwhelming push pressure and noise.

Having held a variety of marketing roles since 2003, my experience suggests there’s no right or wrong model — rather, e-commerce is a dynamic ecosystem that adapts to the psychological and sociological realities of consumers as preferences evolve; it is a fluid reality. As the era of connected commerce continues to blossom and we move into content commerce, entrepreneurs and investors should be paying close attention to which approaches are becoming cognitively overwhelming and track the historical cycle of commerce.

Ezra Galston is a venture capitalist with Chicago Ventures and the former Director of Marketing for CardRunners Gaming. Follow him on Twitter @EzraMoGee and his blog BreakingVC.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More