This year was a big one for mobile commerce. More people than ever are turning to their smartphones to discover products and make purchases. Sales on mobile devices are expected to top $100 billion this year, with mobile commerce comprising nearly a third of all ecommerce transactions.

In particular, two innovations stand out as having pushed the digital-shopping experience forward in 2015: the buy button and one-touch payments.

Buy buttons

This year, retailers began making goods available outside the shopping cart and the implementing the “buy button” on mobile apps.

At the end of 2014, everyone from Twitter to Tumblr teased a buy button — a single tap feature that lets you buy merchandise from a non-retailer site. The buy button replaces the practice of linking to a brand’s site with a shopping experience that occurs inside the app you’re browsing. Think shopping directly on Pinterest rather than on Net-a-porter.com. This year we saw the buy button come alive and drive sales in new places.

This year Facebook, which released buy buttons for ads in 2014, started testing a full shopping experience in which a click on an ad sent users to a screen with a broader product offering. A sort of mini-retailer site located within Facebook.

Facebook also took cues from another social-media channel when it started testing its own shopping channel. Earlier this year, Pinterest launched “buyable pins,” a custom buy-button feature that encourages purchases inside the Pinterest app. In addition to surfacing these pins inside its search results, Pinterest created a shopping channel that lets users exclusively browse buyable pins.

During Facebook’s F8 Conference in March, the company also said it would turn Messenger, its break-out chat app with 700 million users, into a platform for buying everything from stickers to apparel. Initially, Messenger opened a way for merchants to communicate with customers, the most recent manifestation being a partnership between Uber and Facebook that allows Messenger users order a car directly within the app — a move that is more illustrative of how Facebook intends to serve consumers.

Other companies created more shopping opportunities on their platforms. Right ahead of the fall shopping season, Google announced Purchases on Google, a new feature that appends buy buttons to search ads. It also launched shoppable ads on YouTube via its TruView technology, effectively making its ads more valuable.

Meanwhile Twitter, which added buy buttons to tweets in 2014, started extending its buy button to more retailers this year. Payments processor Stripe also rolled out Relay — a way for merchants to make their own tweets shoppable.

Even publishers like Huffington Post and Bustle experimented with ways to bring commerce to their sites.

One-touch payments

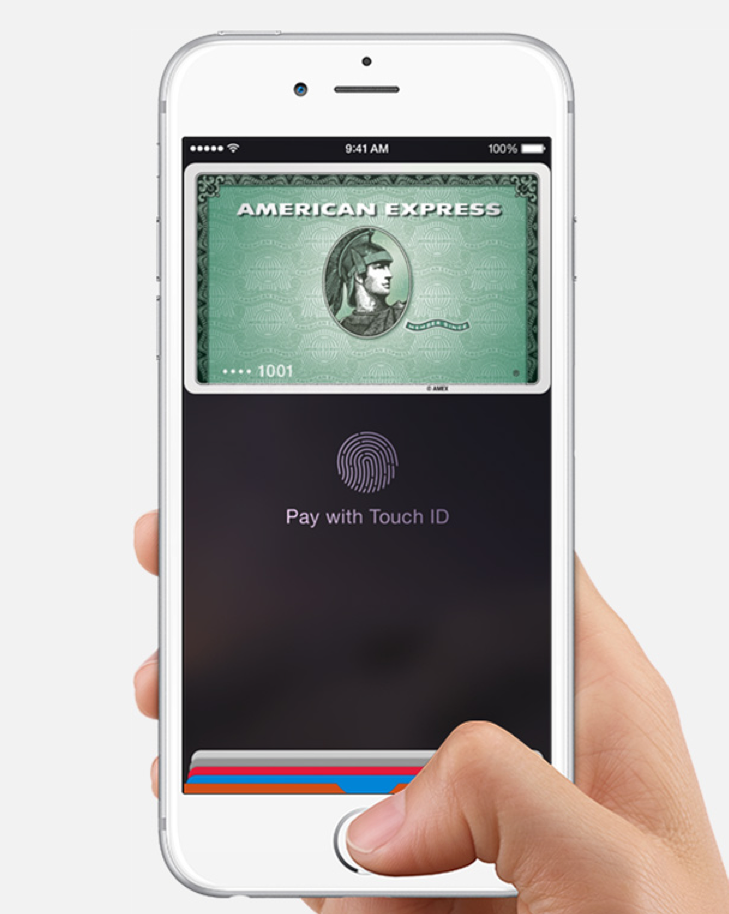

While social platforms and search engines are enabling shopping experiences in more places, one-touch payment features like Apple Pay, Android Pay, and PayPal are making people buy stuff there. Though PayPal One Touch has been around since 2014, Apple Pay and Android Pay are entirely new.

Apple launched Apple Pay in October 2014 with Android Pay following nearly a year later. These apps allow users to store credit and loyalty card data into their phone to use at physical retailers and in-app purchases. Apple Pay has largely failed to catch on with users as an alternative to credit cards at brick and mortar stores.

Inside apps, these tap-to-pay features solve a problem that’s plagued ecommerce for roughly a decade. Though Apple Pay and Android Pay haven’t released any data regarding use, PayPal says more than 10 million people have opted into One Touch, its instant-checkout technology. PayPal is processing “millions” of One Touch transactions each month. Its rising popularity shouldn’t come as a surprise. In many ways, this is the shopping invention consumers have long awaited.

Online shoppers often abandon their carts when it comes time to enter their payment credentials. Filling out a form with your credit card, shipping and billing address is so cumbersome that people would rather not buy at all. That issue has hampered the growth of online sales.

Still, ecommerce has grown 15 percent year over year, with mobile commerce jumping 30 percent, according to Statisita. Part of that may be due to a maturing population of digital natives who are in a better position to spend. But it stands to reason that some of the growth is coming from the wide array of easy payment options becoming available.

Tap-to-pay features are at their earliest stages. For instance, this coming year PayPal plans to open up Venmo as a payment option for many of its online retail partners. There’s also an opportunity for mobile-phone makers Samsung and LG to open up their own tap-to-pay features to include in-app purchases.

For more on what’s to come in ecommerce, check out my predictions for 2016.