As 2016 begins, mobile commerce in India is undergoing an exciting transition. The country has seen an impressive rise in everyday commerce conducted via mobile devices. A market report released last year by consulting firm Zinnov estimated that India’s market for mobile commerce was worth $2 billion in 2014 and is estimated to grow up to $19 billion by 2019. In fact, India is now one of the top five regions for the Google Play store, as more of its 1.2+ billion people look to search, interact, and shop on the go via their smartphones and other mobile devices.

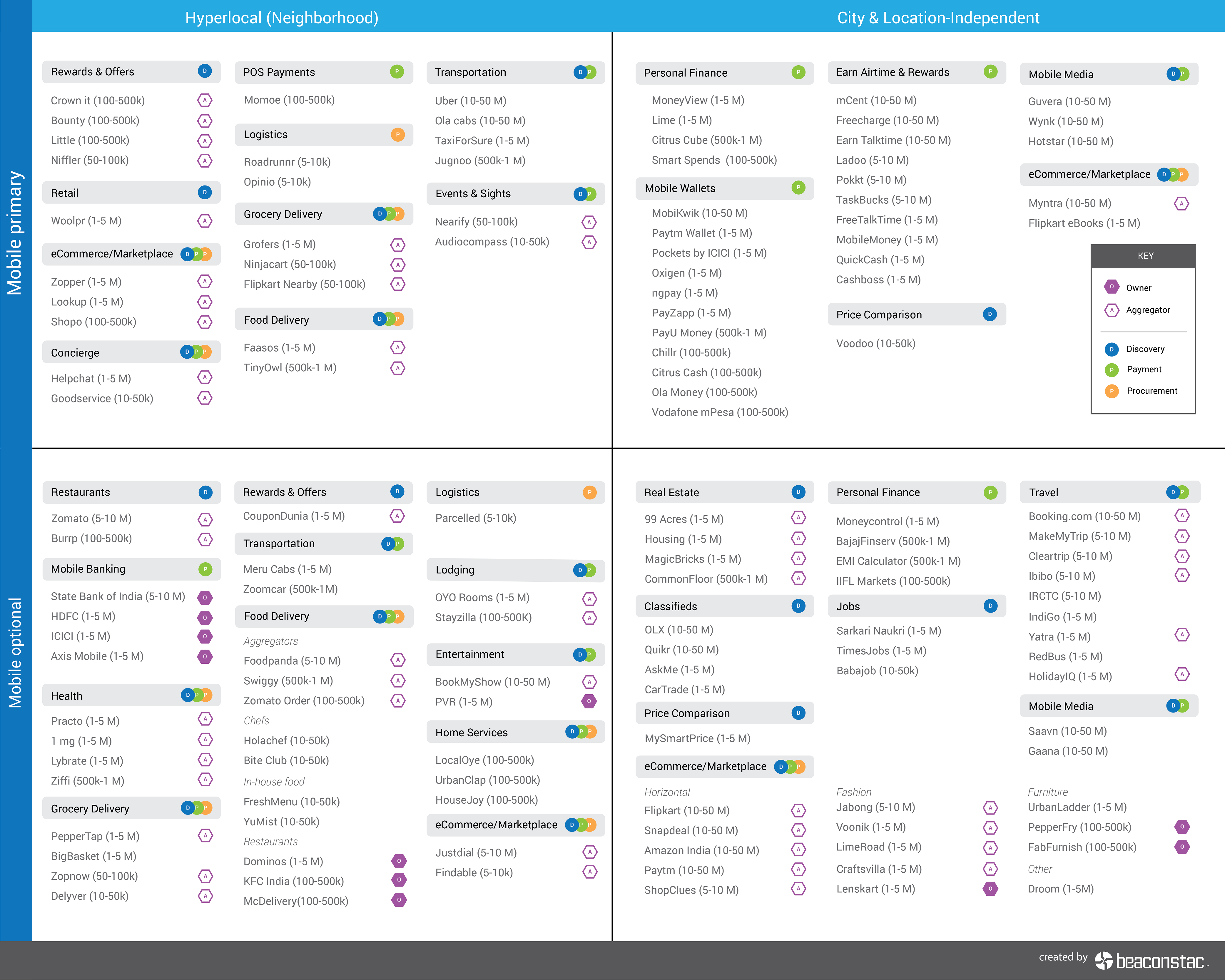

To track which mobile services seem to be winning with India’s newly plugged-in population, we built a map of the Indian mobile commerce landscape (see below). The map includes any business that uses mobile devices to directly or indirectly enable the exchange of money for goods and services. It includes any company that touches at least one stage of the mobile customer journey — from discovery to payment to procurement of goods and services — though many companies touch more than one, or even all three.

Though the Indian mobile commerce market is incredibly vast and quick-moving, our map highlights a few important takeaways.

1. Financial technology (fintech) startups have the potential to enable much more than just payments.

Fintech companies are building the foundation for the Indian mobile commerce ecosystem by enabling cashless, on-the-go financial transactions. From cab rides to movie tickets to utility bills, almost anything can be paid via simple mobile apps. However, mobile wallets in particular can add extra value by bridging payment with discovery and procurement to offer more seamless mobile shopping experiences — either through integration with existing ecommerce apps or the creation of their own in-app features.

Paytm has done the former by partnering with music streaming app Saavn — as well as with Uber, MakeMyTrip, and many others — to enable in-app payments. However, it has also begun to pursue its own ecommerce offering and is splitting its mobile wallet and ecommerce arm into two different apps. This allows the leading mobile wallet provider to experiment with several new features such as in-app loyalty rewards and social gifting, also serving as an entirely new marketing channel for participating brands.

2. Aggregator apps are greatly outpacing apps for individual businesses.

In recent years, there has been a rise of “aggregator” apps that compile anything from offline retail brands to restaurants to health service providers in one convenient app. With the exception of a few restaurants (e.g. Dominos, KFC), airlines (e.g. Indigo) and entertainment providers (e.g. PVR), most large companies and big-box retailers have become reliant on these aggregators for their mobile app presence. Some of these companies have tried to develop an app strategy, but have not achieved the desired results. Shoppers Stop, for instance, attempted to build its own loyalty app but appears to have not succeeded in gaining traction despite being one of the country’s largest retailers. For many of these businesses, it is a tough call whether to develop and market their own apps or rely on the well-established brands and strong user bases of existing services like Zomato, MakeMyTrip, and BookMyShow. [Disclosure: BookMyShow is a customer of ours.]

However, there have been a few successful “full-stack” startups that present an alternative to this aggregator model. These companies own the entire business end-to-end—from product design to supply chain management—and interestingly, the majority of them fall into the hyperlocal column of our chart. By definition, businesses like PVR or Dominos that sell their own product through their own channels from their own neighborhood branches are full-stack. Others, like Ola in transportation, Bigbasket in grocery delivery and FreshMenu in food delivery, deal in hyperlocal services.

These “full-stack” players are far from the norm right now, but they still deserve our attention. Bigbasket, for instance, has successfully distinguished itself in the wildly competitive grocery delivery space by hiring its own delivery boys and building its own warehouses of inventory. If pulled off correctly, this “full-stack” model can ensure businesses deliver more reliable and unified user experiences — especially in a country known for unexpected variables in online-to-offline commerce.

3. The ecosystem is moving towards “hyperlocal mobile” commerce.

Over time, we expect the ecosystem to slowly shift to the upper left section of our map as companies look to go “hyperlocal mobile”. This is driven by two main factors right now: 1) India has become a mobile-first country, and 2) a sizeable amount of commerce is still happening offline, especially outside of Tier I cities.

If companies want to tap into the country’s massive market opportunity, they will need to develop strategies that enhance the offline world with the use of mobile, and vice versa. In some cases, such as Lenskart or Pepperfry, this means opening up actual physical “experience centers” that give customers the touch-and-feel experience and personal service of brick-and-mortar stores to supplement their online and mobile shopping. Harnessing mobile devices in these offline environments can open up a world of possibilities: tailored in-store recommendations based off online preferences, frictionless checkout and payment, social sharing, among much more.

In many other cases, though, this will come in the form of aggregating offline vendors, offers and products that are available nearby. This has already given rise to location-based deal aggregators, social discovery platforms and the food tech craze that we see filling the majority of our map’s hyperlocal column. This phenomenon of “aggregating offline” allows a business to layer mobile technology on top of an existing framework of offline commerce—and hopefully profit in the long run from it.

In an ecosystem with new acquisitions, investments and partnerships seemingly every week, it is clear that there will be a rapid reorganization of Indian mobile commerce in coming years. Will there be a consolidation of players, a fragmentation or something in between? Will established ecommerce titans make the successful transition to hyperlocal before a new generation of mobile-first companies does, or will the two coexist? Can hyperlocal turn hyper-profitable? The answer to all of this and more, it seems, is in the palm of our hands.

Sharat Potharaju is cofounder and CEO, and Perry Nunes is Marketing Associate at Beaconstac, a beacon-based customer-engagement platform based in Karnataka, India.

![]()

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More