Intel reported fourth-quarter earnings that beat Wall Street’s expectations.

Intel is a bellwether for the PC market, and its fourth-quarter results are a good benchmark for what will happen in the computer market in 2015.

The world’s biggest chip maker reported net income of $3.7 billion, or 74 cents a share, on revenues of $14.7 billion for the fourth quarter. Analysts expected Intel to report earnings-per-share of 66 cents on sales of $14.71 billion. A year ago, Intel reported earnings of $2.6 billion, or 51 cents a share, on $13.83 billion.

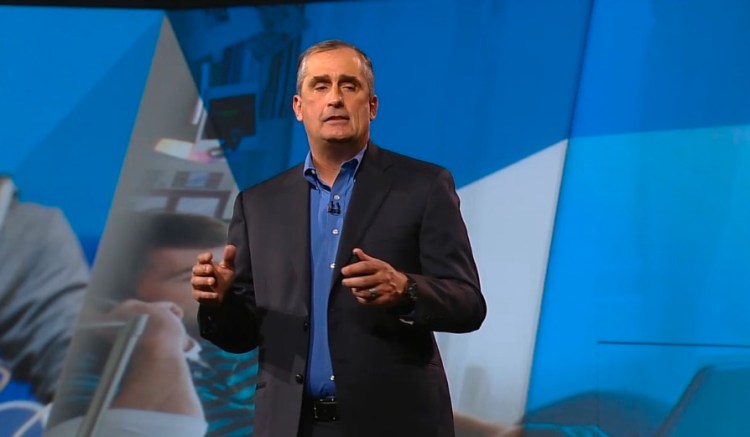

“The fourth quarter was a strong finish to a record year,” said Intel CEO Brian Krzanich, in a statement. “We met or exceeded several important goals: reinvigorated the PC business, grew the Data Center business, established a footprint in tablets, and drove growth and innovation in new areas. There is more to do in 2015. We’ll improve our profitability in mobile, and keep Intel focused on the next wave of computing.”

For the first quarter, Intel projected revenue of $13.7 billion and gross profit margins of 60 percent. Since Intel wasn’t optimistic about the upcoming first quarter, Intel’s stock is falling in after-hours trading. The stock is currently at $35.49 a share, down 1.83 percent.

For the full year, Intel reported record net income of $11.7 billion, or $2.31 a share, on revenue of $55.9 billion, compared with net income of $9.6 billion, or $1.89 a share, on revenue of $52.7 billion a year earlier.

Intel’s stock rose 40 percent last year, the best since 2003. That was because the PC market didn’t fall apart. On top of that, Intel had a resurgence in chips for mobile devices, and it also launched a new line of chips for the Internet of Things. While Intel sells roughly 90 percent of the chips used as processors in data centers, the company has been losing a lot of money in mobile chips.

At the recent 2015 International CES, Krzanich gave a keynote speech. He highlighted applications such as self-piloting drones, 3D printing, wearables, and a new chip dubbed Curie for the Internet of Things. Krzanich also announced that Intel would invest $300 million in diversity programs over the next five years. Intel also showed off tech that uses its new RealSense 3D depth cameras.

Market researcher IDC reported that global PC shipments fell 2.4 percent from a year ago in the fourth quarter. The overall decline in 2014 was 2.1 percent.

Intel said its PC Client group generated revenue of $8.9 billion, down 3 percent from the prior quarter and up 3 percent from a year ago. Data center group revenue was $4.1 billion, up 11 percent from the prior quarter and up 25 percent from a year earlier. Internet of Things revenue was $591 million, up 12 percent from the prior quarter and up 10 percent from a year ago.

Mobile and communications group revenue was negative $6 million. Software and services revenue was $557 million, flat from the prior quarter and down 6 percent from a year ago.

In the third quarter 2013, Intel reported that its PC Client Group generated $9.2 billion in revenue, while the Data Center Group generated $3.7 billion in revenue. The Internet of Things contributed $530 million and the Mobile and Communications Group generated $1 million in revenue. The mobile group had operating losses of $1.04 billion in the third quarter.

For 2014, Intel said it shipped more than 46 million units of chips for PCs, servers, tablets, phones, and the Internet of Things. It also completed a $5 billion stock repurchase in the fourth quarter and increased its cash dividend to 96 cents a share per year.

For 2015, Intel plans on $10 billion on capital spending.

“Intel had a solid fourth quarter with record revenue which was really a repeat of many of their quarters over the past year,” said Patrick Moorhead, analyst at Moor Insights & Strategy. “That is, datacenter saw big growth, PCs saw commercial growth driven by established regions, and mobile losses continue but at a lower pace. It will be important to keep an eye on the PC market as Intel did see a sequential revenue shrink driven by original equipment manufacturer (OEM) inventory bleed. Networking was a key revenue growth area and it’s share shift versus a market growth story as it is in servers driven by the cloud. While mobile losses are high, it’s not a surprise, and it will be important for Intel to hit their commitments to reduce the losses by $800 million for 2015.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More