The Intel connection is important because Intel spends billions of dollars on its chip manufacturing and rarely shares the competitive advantage it gains from those factories with other companies. It isn’t clear why Intel has decided to make chips for Tabula, but it will give the small company an advantage as it competes with large rivals such as Xilinx and Altera. Tabula and Intel have not announced the manufacturing deal, but a source independently confirmed the relationship to VentureBeat.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":252941,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"A"}']Tabula has been around for eight years trying to perfect a way to get a lot of processing done without requiring a huge chip to do it. The company has focused its technology on field programmable gate arrays, or FPGAs, a $5 billion market for chips that can be programmed to do something unique at the very last minute before being built into a device such as computer networking gear or communications equipment.

“We can see that this will be transformative, but it’s taking a lot of time and patience to get there,” said Greg Papadopoulos, a partner at one of Tabula’s investors, New Enterprise Associates, and former chief technology officer at Sun Microsystems, in a recent interview.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

To date, Tabula has raised more than $214 million from backers such as NEA as well as Benchmark Capital, Crosslink Capital, Balderton Capital, Greylock Partners, Integral Capital Partners, and DAG Ventures. Investors have stayed away from chip companies lately because they take so much funding in order to bring a new chip to the market and because huge chip makers have covered a lot of the product landscape. But Papadopoulos said the deal showed there is still funding for those who can make dramatic gains in new technology.

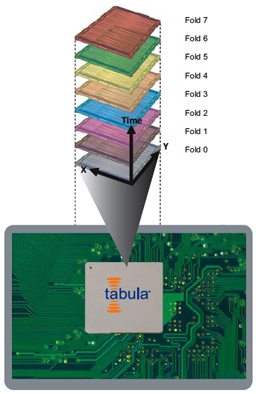

Lots of rivals such as Tier Logic have tried to crack the grip of Xilinx and Altera, but have largely failed over the years. Tabula has figured out how to use time sharing to make a better FPGA. It does so by programming an FPGA to do a certain function. Once that function is performed, Tabula then reprograms the FPGA to do something else on the fly.

Normally, someone programs an FPGA and never reprograms it again. But reconfiguring quickly to do other tasks, you don’t have to have use hard-coded silicon to do those other tasks.

A chip can therefore be built to do a bunch of tasks, without all of the usual accompany silicon, said Tom Halfhill, an analyst at the Linley Group. “It’s a clever idea,” Halfhill said. “They say that the faster the chip runs, the more time slices they can squeeze in. It’s like having more space, like in a three-dimensional building where you use an elevator to get more space. But in this chip, the third dimension is a temporal one, not a spatial dimension.”

Halfhill says the success of the idea depends on how quickly Tabula can move from one manufacturing technology to another.

That may be where Intel comes in, as Intel has promised that it will accelerate its shift from one generation of manufacturing to another. Semi-Accurate reports that Intel may be interested in the deal with Tabula so that it can easily make chips that are used in conjunction with its existing Atom microprocessors and other future microprocessors. Tabula believes it can make FPGA chips that cost $100 to $200, around a fifth of the usual cost for similarly capable chips.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":252941,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"A"}']

The tough task is that Tabula will have to keep up with Altera and Xilinx — which dominate the multibillion dollar FPGA market — in manufacturing. Those companies can invest their huge profits into manufacturing alliances that get them the latest technology as quickly as possible. Tabula would ordinarily have to wait in line to get access to the same manufacturing. Right now, Tabula’s chips are made with 40-nanometer manufacturing technology. (A nanometer is a billionth of a meter). Tabula began making those chips last year.

But Intel is already manufacturing at the more advanced 32-nanometer node and will likely move to 28 nanometers before the rest of the industry does. Halfhill said Tabula needs to move as quickly as it can to 32-nanometer and 28-nanometer production in order to succeed.

Tabula was founded in 2003 by Steve Teig, former chief technology officer at Cadence Design Systems. Dennis Segers is chief executive of Tabula. Segers has said that the latest round of funding will take the company to profitability. Last year, Tabula generated its first revenues.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More