Okay, to be more specific, there are actually several apps for that: There’s Credit Card Terminal from developer InnerFence. Twitter co-founder Jack Dorsey is working on something similar. Now financial software maker Intuit is introducing its own offering, called Intuit GoPayment.

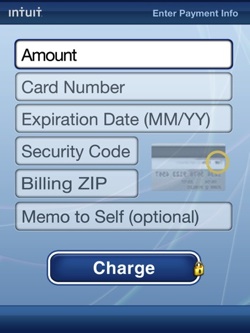

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":107614,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"D"}']GoPayment can be used on any phone with with a mobile web browser — customers just enter their credit card info, the payment is processed, and you can send them a receipt. It’s available as a standalone application for some phones (including the BlackBerry curve, but not the iPhone), and even if you don’t have the right phone you can always access the site via a mobile browser, and you can also purchase a card scanner (so you don’t have to type the number in) or a combination card scanner/receipt printer.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

So what makes Intuit better than what’s already out there? Well, there’s the fact that it integrates with Intuit’s QuickBooks software for small businesses. Also, the card-reading side is just a small part of it — Intuit is also handling the back-end of processing payments, reducing the headache for businesses. It’s affordable, too, at $19.95 per month plus a one-time $59.95 set-up fee. The company also takes a cut of between 1.64 and 3.54 percent on each transaction, which it says is standard for credit card fees.

Are you an entrepreneur or executive active in mobile? Join us at MobileBeat 2009, our mobile conference for industry leaders. Sign up by May 23, and save $145.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More