Hedge fund manager Jeffrey W. Ubben disclosed yesterday that his fund, ValueAct Capital, has taken a $2 billion position in Microsoft stock, causing an almost immediate 4 percent jump in the stock.

Hedge fund manager Jeffrey W. Ubben disclosed yesterday that his fund, ValueAct Capital, has taken a $2 billion position in Microsoft stock, causing an almost immediate 4 percent jump in the stock.

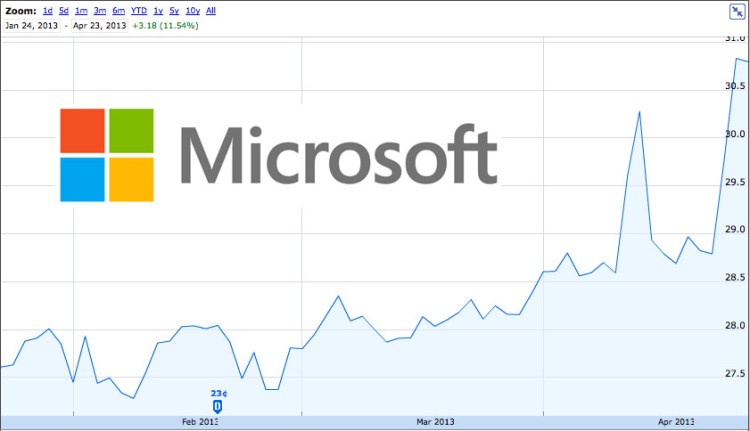

Microsoft stock, which is down a penny today, jumped from under $30 to over $31 almost immediately overnight, and has climbed almost 11 percent over the last month. That’s part of a fairly steady rise over the last quarter which has added over $30 billion in value to the company.

According to the Wall Street Journal, Ubben said that Microsoft “is a dominant software company … and in the long term it will win out,” and that in five years, Microsoft’s investments in web and cloud could transform the company into the largest cloud company in the world. Just five days ago, Microsoft announced general availability of its Windows Azure Infrastructure Cloud — a cheaper cloud than Amazon and Rackspace.

The company has had challenges with Windows 8 adoption which some have blamed for historically slow PC sales in the last quarter, although it is investing more in Windows 8 for tablets and smaller touch devices.

In any case, Microsoft appears to be doing something right. At least, if you can trust Wall Street.