Securing an app downloaded from a user is no longer the end game.

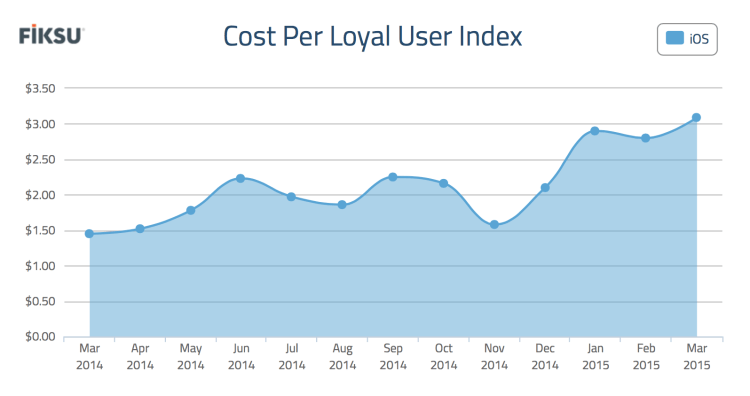

The cost of acquiring users for games and apps is up a notable 10 percent from last month and a scary 113 percent from last year, putting the number at $3.09. These figures from mobile marketing technology company Fiksu’s Cost Per Loyal User Index data, which measures the cost of gaining a user that opens an app three times, points to mobile marketing’s steadily rising importance — and costs.

Other than a bit of a dip in November, the CPLU index has steadily climbed since March of last year, where it started at less than half of where it stands now.

It’s all expensive: Fiksu’s Cost Per Install Index, which figures the cost per app install directly tied to ads, climbed to $1.53 on iOS this month, up 46 percent since last year. A similar index, Cost Per Launch, was up for both iOS and Android, at $0.31 and $0.24 respectively — up 62 percent and a whopping 135 percent year-over-year. It’s increasingly difficult to find new users as gaming grows, but spending to do is necessary to stay afloat in the $30 billion mobile games market.

From VB research:

Mobile User Acquisition: how the most successful developers get better users for less money

With the millions of available games on the App Store and Google Play, it’s easy to get crowded out as a free-to-play mobile title. These need a constant influx of new users to stay relevant — and to pay for the rising costs to continue the cycle.

“One of the big issues here is that, according to John Koetsier’s recent Mobile User Acquisition study, mobile app and game developers prefer cost per install (CPI) user acquisition techniques more than any other,” Stewart Rogers, analyst at VB Insight, said. “CPI may enable cost management against lifetime value (LTV) but it also attracts low-spending, and low quality, users. That in itself is driving the CPLU index up, since that group is the least likely to stick with the vendor’s app.”

The demand for apps also continues to climb. The Fiksu App Store Competitive Index tracks the average daily download volume of the top 200 free iOS apps. For March, it shows a 16 percent decrease since last month, but a 15 percent increase since last year. At 8.1 million downloads in March, mobile users are still hungry for apps.

“As we enter another record-breaking month, brands must face the inevitable rising tide: mobile marketing is maturing and becoming more expensive. To stay ahead of this evolving market, marketers must continually adjust and take advantage of programmatic media buying methods to spend marketing budgets as wisely as possible,” said Micah Adler, CEO of Fiksu in a statement. “Sustainable success will be found by brands that use more precise forms of targeting to reach the right mobile users: those who will engage with an app and become loyal over the long term.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More