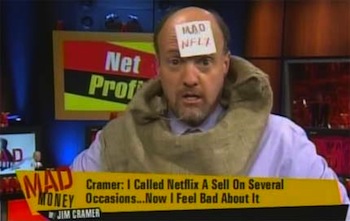

“This is the most outrageously overvalued, ridiculous thing that I’ve seen since CBS Marketwatch or TheGlobe,” he said.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":260369,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,entrepreneur,","session":"A"}']Cramer also compared the IPO to TheStreet.com, the site that he cofounded. Like LinkedIn, Cramer said, TheStreet was a “sliver” IPO, where only a small number of shares became available on the public market, driving investors into a frenzy. But, the interviewer asked, if LinkedIn’s stock price eventually comes back down to Earth, won’t that lead to more reasonable pricing of other Web companies expected to go public, like Facebook, Twitter, and Groupon? Cramer responded that LinkedIn will probably remain overvalued as long as there’s only a limited amount of stock available.

“We’re going to do another one of these things where we destroy everybody,” Cramer said. He later added, “This is exactly the playbook from 1999.”

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

So is Cramer right to be worried? Well, I was still in high school during the first dot-com era, but VentureBeat’s Matt Marshall tells me that this doesn’t begin to compare to the hype last time around. Matt also sounds more optimistic about LinkedIn’s long-term potential, as you can see in his post about the IPO.

http://plus.cnbc.com/rssvideosearch/action/player/id/3000022964/code/cnbcplayershare

[via Business Insider]

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More