The JOBS Act, a piece of legislation designed to make crowdfunding a viable option for startups, has passed the U.S. House of Representatives and now awaits President Obama’s vote.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":408774,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"C"}']The JOBS (Jumpstart Our Business Startups) Act first came up for a House vote earlier this month. The bill proposed that startups raising $1 million or less be able to let anyone buy up to $10,000 (or 10 percent of the annual income, whichever is less) in equity.

The bill removed the 500-shareholder rule, which states that any company with 500 shareholders or more must publicly report financial data to the SEC. The new legislation lifts that limit to 1,000 individual investors. The JOBS Act would also give non-accredited investors an easy path to becoming early shareholders in startup companies.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

After a brief sojourn in the U.S. Senate last week, the Act was modified to include protections for these less sophisticated or experienced investors. Individuals who want to buy equity in new, privately held companies will have to do so through approved channels. Also the amount each individual can invest was capped on an income-based sliding scale, with limits ranging from $2,000 to $10,000 dollars.

The bipartisan legislation is already strongly backed by the White House and has support from both major political parties. The JOBS Act passed in the Senate with a 73-26 vote, and the revised bill passed in the House with a 380-41 landslide.

“Bipartisan action on important innovation issues like the JOBS Act shows the American people that Congress and the President can find ways to work together for the better good of the country, even in an election year,” said Timothy Tardibono, Washington D.C. office director for tech and science network Connect.org, in a statement issued this morning.

“Emerging growth companies represent America’s best opportunity for long term economic growth and it is critical that they have access to capital at all phases of their lifecycle,” said Paul Maeder, general partner at Highland Capital Partners and chair of the National Venture Capital Association in a statement today. “The JOBS Act will help revitalize an IPO market that has suffered in recent years under the weight of market volatility and one-size-fits-all regulation. The passage of this legislation sends a strong and welcome signal to our most promising companies that the U.S. capital markets system is open for business.”

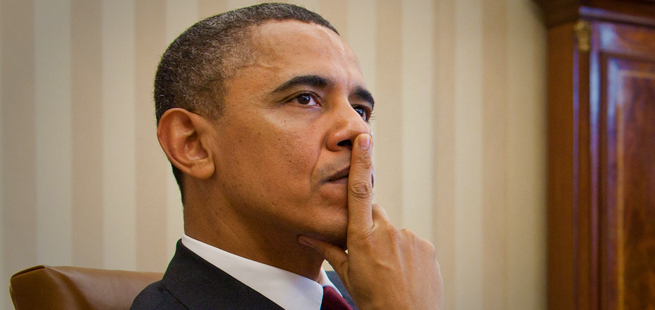

Image courtesy of The White House, Flickr

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More