GamesBeat: You’ve brought up enough differences that my question would be, why don’t you just do a totally different game for China?

Wakeford: As we’ve talked about before, as you think about system design, for some of our great games it’s really good. A good example of success in China would be Plants Vs. Zombies 2. You look at that game and you compare, side by side, the game here and the game in China, the UI is completely different. The characters are different. The environments are different. They integrated payment through SMS, which is different. The amounts you pay are different. But fundamentally it’s the same game. And you get that brand halo, even if on some levels it’s a radically different game.

In EA’s case they bet on a great game design, culturalized it in the right way for China, and it’s one of those key games — by the way, there aren’t that many of these. Western games only account for 16 percent of the market in China. There aren’t that many breakout successes. But EA’s Plants Vs. Zombies 2 is a good one, and there are some other examples. The games I’m focused on really getting right are the ones that have that kind of outsized return.

GamesBeat: So you can have a game that’s a global hit, that works well in China and works well here?

Wakeford: I believe you can. Clash is a good example. It’s a big success. They haven’t quite made it all the way up the charts in China, but they’ve had good success, and in Japan as well. You see it happening the other way, with some of the Asian games having a lot of success – Rage of Bahamut and some of the other card battle games. I do think there’s a global cross-pollination happening, with more Asian games rising up the charts in the U.S. We’ll start to see the emergence of truly global games, but those games will have a level of culturalization for different markets.

Question: You mentioned LTV. How quickly and accurately can you predict LTV for your games after launch? Can you share any best practices?

Wakeford: Predicting LTV is both art and science. We can look at it as early as a seven-day ARPPU. We’ve created a predictive model to project out a LTV. Now, there’s a wide variance. At 30 days, 60 days, 90 days you can have a much better predictive model about the decay of the long-term ARPPU (LTARPPU) curve.

But where the big shift comes in is, what do you do after the game launches? You can have a lot of predictive data at day 60, 90, or 120, but if you invest in system design that changes the LTARPPU curve, your LTV could now be 20 or 30 percent higher. Conversely, if you really screw up the game — if you throw in a bug or launch something that upsets consumers, your LTV could swing the other way. You can get to a predictive model and have things that are directionally correct, but ultimately the live operation of the game is going to have the biggest impact on the ultimate outcome.

Question: The gentleman from Atari talked about a big black hole in games as far serving women 35 and older. I’m wondering about your thoughts as far the genre that could serve that demographic.

Wakeford: If you look at demographics, casino skews older and skews more toward women. A lot of social games as well. Zynga did very well skewing more toward women and 35+. There’s a very big genre that goes after that demographic. Now, has it been optimized for that demographic? Are there areas people could invest more? I’m sure there are. But that sector has proven to be highly engaged and that’s willing to be very social. That’s led to a lot of success for Zynga and others.

Question: For a company like Kabam that’s done so well with first-party productions, why do you have a third-party publishing program, and how do you manage to reconcile tying effort and resources to third-party publishing with first-party products? How does that weigh out for you?

Wakeford: Let me start with the second question — how do we manage time and resources? The way we organize the company to deal with that is, we have two completely separate P&Ls, P&L ownership, capital, and budget that go into each one. First-party and third-party teams are both responsible for delivering results and they have capital to use. They’re not tapping into each other’s marketing budgets or teams or anything else. They’re run independently with their own goals to achieve.

To the first question, as we looked at the company and what we’d invested in, a lot of what we’d invested in were structural items that go across. For a marketing infrastructure, we have the ability to intake hundreds of distribution channels and understand how to optimize across them. We have a BI system that allows us to understand everything that happens within a game. We have cross-promotion tools that sit across all our games. We have reward programs that sit across all our games. We have localization teams across the world, customer support in all different languages. We have live operations teams that run events in local languages in six countries.

As we looked at that infrastructure, we had the capacity to put a lot more product than just our own into these pipes that we’d created. That’s why we’ve had some great success. It’s been beneficial to our partners, being able to leverage an investment we made at scale for companies that couldn’t otherwise make that same investment.

GamesBeat: You have a fair amount of West-to-Asia and Asia-to-West happening there at this point.

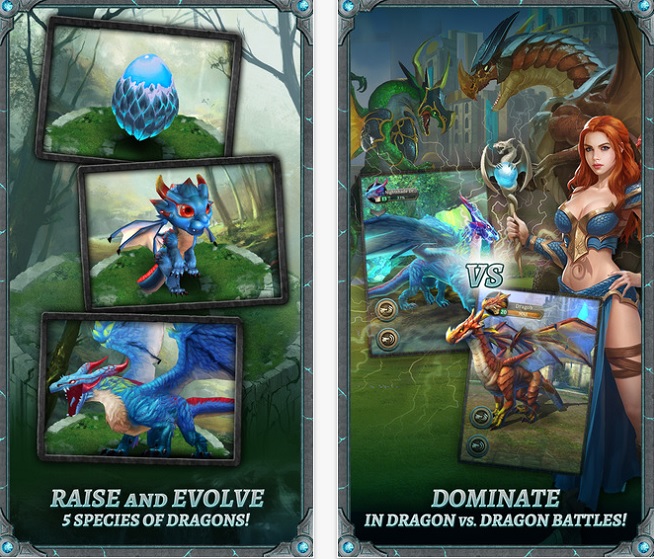

Wakeford: That was another area that we looked at strategically. As a publishing group, where do we want to focus? A lot of great games are coming out of Asia. Let’s focus and put a lot of emphasis on Asia – partly so we could understand the market, but also because of amazing free-to-play game developers. The quality of a lot of their games, especially RPGs, is sensational. Bringing those games west has been very interesting.

Question: You talked about genres, but you didn’t talk as much about demographics. Is there a reason for that?

Wakeford: I was keeping it high at a genre level, as opposed to going to the next level, which is demographics. For us as a company, we make core games for gamers. Our demographic tends to skew more male, tends to be more in the 18-35 traditional gamer demographic. Most of the genres we look at are in that demographic range.

Now, there are games that clearly hit other demographics. We mentioned that black hole. Women love simulation games, slots, casino, the puzzle genre. It’s a completely different demographic and player base with different monetization characteristics. The organic users you can bring into those games are much higher than in the more core genres, though.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More