So why is there so much pent-up demand? It is not just, as Jim Cramer claims, the limited number of shares. Hot, second wave Internet companies are taking a long time to go public and the stock is only available a select few. Only accredited investors could invest in hot Silicon Valley companies through late-stage investors like DST to buy out existing stockholders

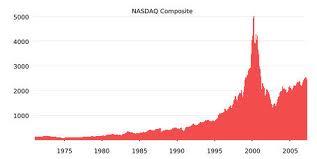

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":260410,"post_type":"guest","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,social,","session":"D"}']I have lived through two bubbles, the .com bubble and the housing bubble, and have concluded that bubbles are essentially giant href=” http://en.wikipedia.org/wiki/Pyramid_scheme”≥pyramid schemes. And Grandma is at the bottom of the pyramid. It is a bad sign when unsophisticated Grandma starts investing her money in 1999 dot-com startups that she doesn’t understand and in 2008 investment property in Phoenix although she knows nothing about investment real estate. Yes, everyone else has made so much money and it is going up and up, and her financial advisors are telling her to take advantage of the opportunity. But after the unsophisticated investors like Grandma jump in, there is no one left for her to sell her stock to.

Grandma is the last stop of the gravy train.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

We have felt the early signs of the bubble here in Silicon Valley, but the price of companies has been self-contained to the Bay Area. My company Webtrends decided to move to out of San Francisco’s uberhip South Park neighborhood because rents got too high. And engineers are demanding skyhigh salaries.

The key metric to watch is multiple on revenue. LinkedIn is valued at 36 times its 2010 revenues, which is a very high multiple. Contrast that to San Francisco-based RPX Corporation, which acquires patents on behalf of large companies to fend off patent trolls. RPX went public 10 days ago and had a slight pop, and is now valued at $1.3 billion, ten times its 2010 revenues. Ten times revenue is generally considered a fantastic multiple, and well deserved for a company that is profitable and growing fast in a novel space such as patent protection.

Peter Yared is the vice president of apps at Webtrends, which acquired Transpond, a social-apps developer he founded. You can follow him on Twitter.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More