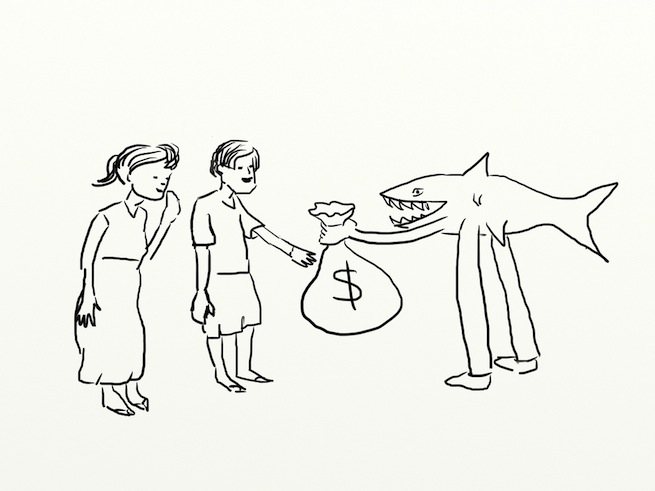

When loan sharks bite, they bite hard and often leave a nasty scar. But when you need cash and the bank is shutting you out, there’s often no other option.

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":543185,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"B"}']Aidil Zulkifli, a lawyer in Singapore, and Izati Ngaliman, who heads up the marketing side, founded Singapore-based LoanGarage in 2012 to solve this problem. The two founders are building the business with the goal of making loan sharks more transparent.

“More consumers are turning to private lenders for personal loans simply because they are underserved by traditional banks and financial institutions for a variety of reasons,” said Ngaliman in an email to VentureBeat. “But the private lending industry is currently a nontransparent market where legal lenders and illegal loan sharks are almost indistinguishable.”

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

The company lists lenders — banks and private loans alike — on its website where borrowers can peruse their options. The lenders have LoanGarage’s stamp of approval, which means they’ve been vetted and are trustworthy. The borrowers then fill out an application and can quickly apply to a number of loans and “shop around” for the best deal.

LoanGarage is currently only available in Singapore, but if the company receives its first round of funding in time, it will expand internationally in the first quarter of 2013.

But it’s not just the beleaguered folks in countries like the U.S. and the U.K. that LoanGarage wants to help. Indeed, Ngaliman says the company is well equipped to serve emerging markets, as well.

“LoanGarage is here to serve not only those with bank accounts, but also those without,” he said. “For example, 58 percent of Indonesians are still unbanked, but they have access to Internet via mobile. … It is crucial for consumers in the emerging markets to have access to financial products. Eighty-four percent of the world’s population lives in emerging markets. We don’t see why financial products and technology should only be developed or created for the minority 16 percent in the developed markets, where the population is well served, or over-served.”

Catering to this, LoanGarage plans to release a home-grown way of assessing credit scores. It will take into account traditional forms of credit scoring but also include some unconventional ones, which will undoubtedly serve those who do not have a bank account. The hope is that borrowers who are turned down for poor credit will have a different avenue to prove that they are worthy of the loan. This technology should be available by November 2012.

On the DEMO stage, Founders’ Den managing partner Jason Johnson said the service reminded him of AngelList, which connects early-stage startups with part-time investors and went so far as to say he could see the service doing well outside the developing world, too.

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":543185,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,","session":"B"}']

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More