I usually take an “If-Then” approach when it comes to parking. If I’m in the American suburbs, then I expect parking to be plentiful, easy, and usually almost free. If I’m in a densely populated city, then I detest parking enough to try to seek out alternatives to driving my car. As I do a deeper dive into parking data and technologies, I’m compelled to rethink the real cost of free on-street parking and how parking planning is ready to be disrupted by data and the Internet of Things.

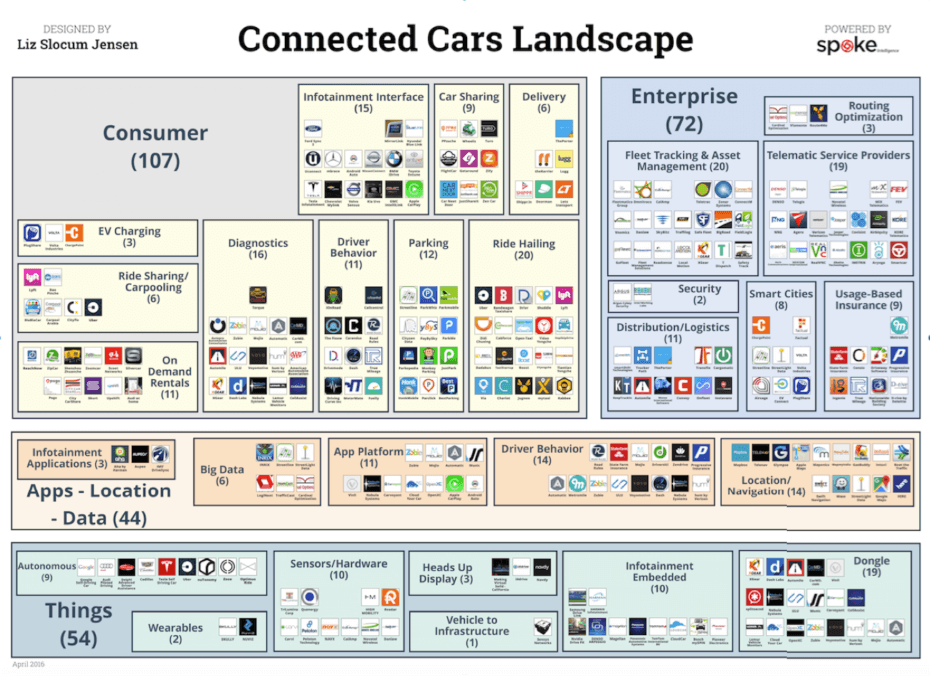

Above: Above: VB Profiles Connected Cars Landscape. (Disclosure: VB Profiles is a cooperative effort between VentureBeat and Spoke Intelligence.)

This article is part of the Connected Car Landscape. You can download a high-resolution version of the landscape here.

The parking industry is beginning to use data and sensors to ease the stress for both parking operators, municipalities and consumers. It’s a big, growing market. In Europe and North America, smart parking is a $7 billion market, which is estimated to grow up to $43 billion in 2025, according to Frost & Sullivan. Curiously, this indicates that either they don’t foresee fully autonomous driving as a service impinging on parking growth or that autonomous is a catalyst for the explosive growth. Donald Shoup, distinguished research professor in the Department of Urban Planning at UCLA, estimates that searching for parking spaces causes, on average, 30 percent of traffic congestion in cities, creates about 366,000 excess vehicle miles traveled, and produces 325 tons of CO2 per year. McKinsey asserts that as we look to the future of mobility, people will take advantage of the new services in mobility — autonomous, shared, and multi-modal — that passenger miles traveled could increase 25% by 2030. This means that if parking remain status quo, it will just be less efficient and costly for everyone involved. Parking innovations can help reduce pollution, traffic, and wasted time. At the same time it can increase customer turnover and sales in business districts because drivers can easily find parking, buy something, and quickly vacate the spot for the next customer.

Consumer apps compete to find a niche

ParkWhiz, Parkopedia, and Parking Panda are the more popular consumer smartphone apps. They help drivers locate, compare pricing and amenities, and reserve a spot. Parkopedia has been around since 2007 so they’ve aggregated a lot of public and private data over the years. The app offers service in 75 countries and over 6,000 cities. However, their current cancellation policy is 24 hours prior to the booking in order to get a full refund. The more recent apps appeal to my more spontaneous attitude about parking and allow me to cancel up until my reservation time and are currently available. Parking Panda is distinguishing itself by partnering with special events and venues such as museums, theaters, and sporting events like Super Bowl 50.

If parking your own car is too much of a hassle, there’s Luxe for a more high touch valet-on-demand experience. Luxe can have your oil changed while it’s “parked” and even drive your car home for you. In 2016, Hertz has invested $50 million to expand the service. Soon, Luxe valets will deliver a Hertz rental car directly to wherever you are.

IoT for parking

I first heard about the Internet of Things in 2011 and parking sensors were one of the first examples. From 2011-2013, the San Francisco Municipal Transportation Agency (SFMTA) conducted a pilot project in which they installed sensors that used a magnetometer into 8,200 on-street parking spots. These sensors enabled demand responsive pricing were used to direct drivers towards available parking by sending real-time availability to mobile apps and to the website. Overall, despite hardware challenges, SFMTA found the technology and data useful. They acknowledged that there was improved technology on the near horizon that could help with their battery life and electromagnetic interference issues. Fast forward two and a half years and we see companies such as Streetline, Inrix, and Parknav use embedded sensors, cameras, and GPS to help to transform the parking landscape with real-time and more accurate information about availability and turnover.

Streetline (acquired by Kapsch TrafficCom AG in July 2016) has been working with embedded in-pavement sensors and cameras with image detecting software to monitor parking spaces in real time. Parknav uses mobile sensors by leveraging GPS from the user’s phone. To expand on its sensor data pool, Parknav partnered with Inrix for infrastructure data, BMW for embedded connectivity, and Vinli for after-market connectivity. Both Streetline and Parknav use machine learning and data analytics to figure out traffic patterns. For data analytics, Smarking offers a data analytics dashboard in the form of demand patterns for off-street (garages and lots) parking operators.

In-car payment platforms

In the US, payments in the car have been mostly limited to tape-mounted toll tags, which is actually a secure method to store payment credentials in a car. Parking has become a popular channel for experimenting with car payment platforms. In early 2016, ParkWhiz partnered with Honda to provide the app via their infotainment system. This is great if you have a supported Honda and you find your infotainment experience indispensable. For now, I’m happy with my smartphone user experience and my $10 after-market dashboard mount, which is unapologetically ugly.

PaybySky is a clever way to use an after-market device that plugs into the OBD-II diagnostics port to identify a registered car and its location in order to create an in-car payment systems. Parknav and Vinli have a partnership that offers a similar service. As I’ve written before, the consumer market for dongles has limited consumer applications. Looking at the enterprise fleet sector is a common play for dongle makers and that is what PaybySky is doing. I can see this as a starting point for paying for other things in the car including gas, car washes, food, tolls. My main concern for both dongles and in-car infotainment systems is the demonstrated lack of security coupled with the fact that it creates a financial motive to hack a car.

The future of transportation will not necessarily be about how to ease congestion or load on the infrastructure but rather how to efficiently price and manage the increased load that we expect to see. Even with data about congestion and increased travel, perceptions does not match reality. Parking is oversupplied by 65 percent on average and by 45 percent in areas where the explicit purpose of the study was to ease a parking shortage. Currently, drivers perceive scarcity because of a lack of information. Parking design and administration, such as off-street parking requirements and free on-street parking, needs to be re-examined by municipalities. Businesses and municipalities now have the opportunity to break from the under-informed parking models of the last few decades to take a more optimized, data-focused approach to urban design.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More