AppCard, a mobile-first loyalty marketing program for small and medium-sized retailers, is announcing a $20 million Series B round, led by Alexander Rittweger and PLDT capital. PLDT Capital is the investment arm of Philippine Long Distance Telephone Company (PLDT, NYSE: PHI, PSE: TEL). Existing investors Founders Fund (Peter Thiel), Innovation Endeavors (Eric Schmidt), and Jerry Yang also participated in the round.

AppCard essentially connects users with their favorite retail stores, sending personalized offers to their phones and killing coupon-clipping. The more you shop at your favorite stores, the better the offers you get, along with targeted promotions from other stores that should interest you. You can even get a plastic discount card to swipe at select stores.

Data-driven loyalty

I caught up with AppCard cofounder and CEO Yair Goldfinger to see how it all fit together, and why a loyalty startup targeted at small and mid-sized businesses was set for rapid expansion. In an email, Goldfinger explained the way AppCard works: “Our capture technology is a small hardware device installed at retail stores. It ‘copies’ the receipt data and sends it to our servers for analysis. With the hardware we place at the retail store, we are able to identify a customer by swiping a loyalty card, keying a phone number or tapping a phone. Coupling the receipt information and the user identity we have to build a unique profile at retail stores.”

The combination of expressed customer data and a unique ID allows the company’s AI engine to run its course, collect data, improve user profiles, and trigger a personalized marketing campaign with the goal of bringing customers back to the store — effectively improving loyalty and lifetime value (LTV).

According to Goldfinger, “The AppCard platform is easy and intuitive and the setup requires no integration with the merchant’s POS.” He added that “after several months of ‘learning,’ our engine may start to work autonomously, or suggest campaigns to merchants they can then approve and send out.” This could certainly benefit retailers lacking the manpower to run a traditional loyalty program themselves.

As we learned in VentureBeat’s Marketing.FWD summit, the value of customer loyalty programs cannot be overstated. They simply work. They’re also usually a huge tech infrastructure challenge and have traditionally been limited to larger brands. AppCard’s sweet spot lies with the smaller retail chain that has fewer resources to launch and manage such a program (SMBs and medium-sized businesses with $100 million to $2 billion revenue, according to AppCard). The promise of a loyalty program like AppCard is increased RFM — recency, frequency, monetary — which equates to loyal, happy customers.

Mobile is driving retail to evolve faster than we realize

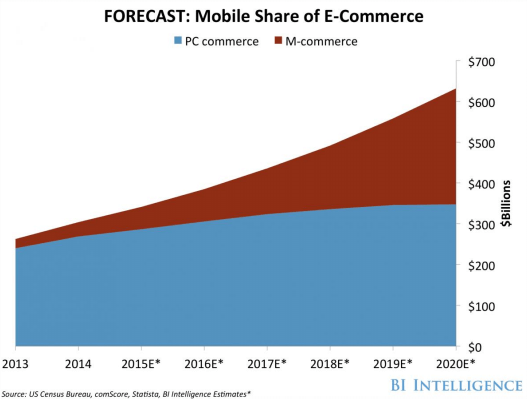

Based on how rapidly shopping habits are evolving, U.S. retailers are going to have to race to stay relevant. Some of the trends are relatively predictable — like the rise of ecommerce or the ubiquity of mobile phones. A recent Business Intelligence report boldly predicts that by 2020, mobile commerce will make up around 45 percent of total ecommerce sales (or $284 billion).

This year’s VentureBeat Mobile Summit will feature several working sessions around mobile growth, including how best to harness data for mobile engagement. It takes place April 4-5 at the scenic Cavallo Point Resort in Sausalito, CA.

Space is extremely limited — we’ve only got seats for a total of 180 executives — but it’s not too late to apply for one of the remaining seats.

In addition, PricewaterhouseCoopers’ recently released annual online shopper survey, Total Retail: The Race for Relevance, makes it clear that in terms of mobile retail, the U.S. has barely scratched the surface.

PwC’s survey, which was based on a global panel of 23,000 online shoppers, found that a mere 22 percent of American shoppers plan to make a purchase on their mobile device each month, compared to 35 percent in emerging markets. China and other Asian markets saw nearly double the U.S. numbers. Sixty-six percent of Chinese consumers shop online with their mobile device at least once a month, and 59 percent of Chinese shoppers think their mobile phone will become their main purchasing device, versus 26 percent in the U.S.

Above: Q: Please indicate how strongly you agree or disagree with the following statement? “My mobile phone will become my main purchasing tool”

Source: PwC, 2016 Total Retail Survey, February 2016

The PwC survey points to brand trust as among the top reasons people shop with their favorite retailers. Customer loyalty is a symptom of that trust — and a frictionless experience across channels and devices, particularly for younger consumers, has rapidly become a must-have. AppCard’s platform may just be sitting neatly at the nexus of this convergence of trust, loyalty, and the explosive growth of the mobile device.

AppCard will use the new funds to expand its technology offering, business, and sales organizations. The company has “thousands” of retailers and “millions” of customers on the platform and is expected to grow 5x this year.