The digital health investment fund Rock Health polled a room full of health tech investors at a recent event, and got a surprising response to a simple question:

“Are private digital health companies over-valued right now?”

Most of the investors in the room thought that indeed they are. Sixty-two percent of them, to be exact. Only 29 percent said no.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

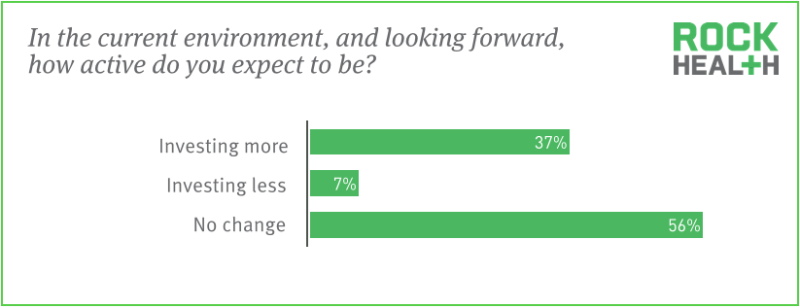

Could this mean that the investment community is cooling off on the space? Probably not. Investments in the space grew rapidly last year. On the top line, digital health funding in 2014 exceeded $4.1 billion, Rock Health said, a total greater than that of the previous three years combined.

And while signs show that growth is slowing in 2015, the investment numbers are still climbing.

Digital health investments, however, are still small in the grand scheme of technology venture capital investment. VC firms invested more than $48 billion in tech companies during 2014.

It may be that a sort of honeymoon period in digital health investing has ended, and health investors are becoming more circumspect about the real money-making potential of startups in the space.

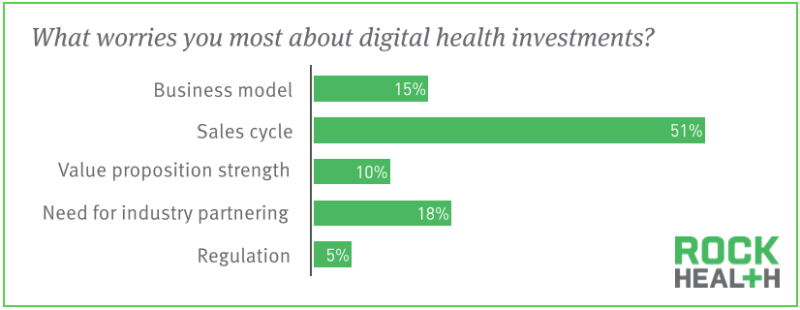

Wellness engagement platforms, for example, have lost their appeal due to the difficulty in tracking the ROI, and the length of time it takes to see real positive health effects in whole populations of people.

“Time to ROI” is a sensitive issue in digital health investing. Sales cycles in the health space are notoriously long, so a startup must have a product or service that can immediately begin healing a pain point in the delivery system for the investment thesis to make sense.

There may be no killer apps in digital health. There may be no Uber for health care. The good investments in the space are startups that are willing to go neck-deep in the complexities of the business, the regulations, the clinical aspects, the old school workflows, and other minutia of the health care business. They fill a niche, erase a friction point, and then hang in for the long haul.

Jack Young, a partner at dRx Capital, nails it with this quote: “It’s not about disruption, it’s about implementation.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More