Investors continue to fuel the marketing tech fire, with 25 acquisitions and 63 investments totaling $6.8 billion in April and May alone. This doesn’t include undisclosed acquisitions, angel investors, or friends-and-family fundraising. The true totals are likely much, much higher.

We’re tracking a growing list of over 2,100 companies, 2,400 executives and investors, and 3,200 funding events, including $45.2 billion raised last year, on VB Profiles. It’s the most complete detailed data available on VC funding, period.

We previously plotted and analyzed 120 investments and acquisitions from Q1 of 2015, available at VB Insight.

I caught up with Ravi Belani, managing partner at Alchemist Accelerator, for an investor’s take on our full Q1 2015 martech funding report in April. Alchemist is a top venture-backed accelerator focused on seed-stage B2B companies, investing in around 40 companies a year.

Back then we saw almost $700 million to analytics platforms alone, which follows the trend of the rise of customer data in the enterprise. Belani said, “The presence of analytics at the top of the VC investment leaderboard is not surprising. What’s driving this whole category is a proliferation of data, caused by a massive and long-term shift in both consumer and business buying patterns. No function is impacted more than marketing, as they need to filter out the signal from all this noise.”

If you work in marketing with a role in data analysis, take our survey and we’ll share the results with you.

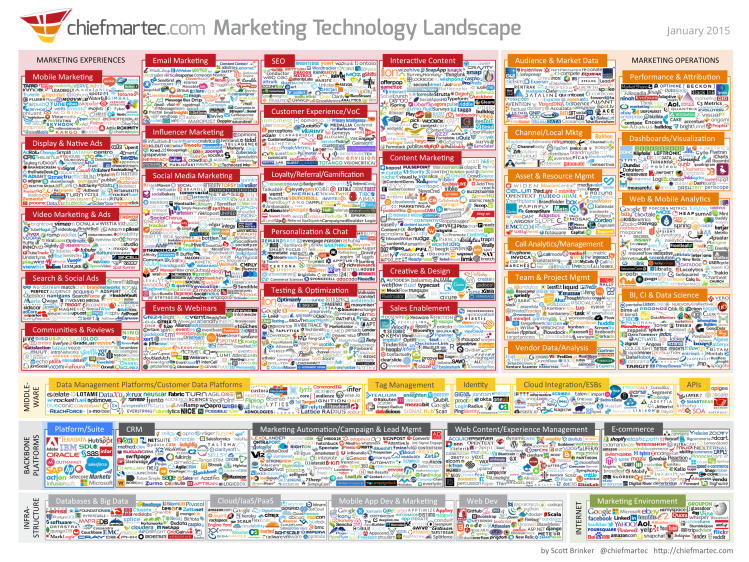

According to Belani, analyzing the data is just the first step. Inserting it back into the enterprise in an action-oriented way is a big pain point for brands. Once the data is effectively parsed, it’s back to marketing to make something happen. This might be tweaking a campaign or offer, or taking a deep analysis of customer data and fundamentally changing a product. Belani said, “The next big category to emerge, where you will see large acquisitions or venture rounds, will be marketing operations. The problem of attribution and performance measurement is one we see over and over from our corporate partners.”

Q2, to this point, has been just as prolific as Q1, with some emerging categories of which to take note. Here is how the data from April and May looks thus far. Belani is spot on.

Missing from this graph is Verizon’s $4.4 billion acquisition of AOL. E-commerce’s spot on the leaderboard is powered by IPOs from Etsy and Shopify. Data integration is a new category with strong momentum, as we predicted in the Q1 report. Same goes for database technology, which will face the task of effectively housing the universe of data being collected, analyzed, and integrated.

The full list of companies and funding analysis will be available in early July in our Q2 2015 marketing tech funding report.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More