It’s not a pretty topic, but bankers have to learn to be good about collecting money from delinquent borrowers. And the better at it they become, the more they’ll be able to lend money to (hopefully good) borrowers in the future.

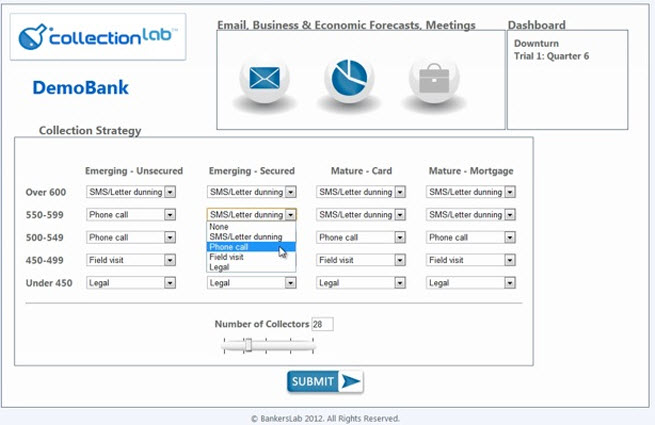

[aditude-amp id="flyingcarpet" targeting='{"env":"staging","page_type":"article","post_id":557576,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,enterprise,games,","session":"D"}']So BankersLab has created a “gamified” training simulation — a game, really — to train bank employees how to do collections right. It’s not about who will pay a bank the money they owe it or the best way to get results as a Repo Man. Rather, the CollectionLab simulation helps bankers correctly forecast the impact of debt collection decisions over the lifetime of a bank. The game is part of the Serious Games movement or gamification, where game mechanics are used to improve engagement in nongame applications.

With the simulation, bankers can create competing teams that operate virtual portfolios over a 30-year period. They can test debt-collection strategies in real-world conditions.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

San Diego, Calif.-based BankersLab tapped the expertise of Neil Seitz, a professor of finance at Saint Louis University and a pioneer in simulation games for the banking industry. He had created simulations based on spreadsheets, but BankersLab brought the decade-old games into the modern era. Seitz served as an adviser to BankersLab. Game designer Robert Zepeda, the founder and chief executive officer of PlayBasis, helped create the modern gamified simulation program, which is web-based.

As the number of delinquencies and write-offs remain stubbornly high, collections managers are faced with big challenges. Delinquencies on residential home loans rose to 10.61 percent in the second quarter, according to the Federal Reserve. The idea is to improve collection skills by turning the learner into a player, said Michelle Katics, the CEO of BankersLab, in an interview with GamesBeat.

“You can think of them as flight simulators for bankers,” said Katics. “They make decisions and see the impacts play out over years.”

To win, players have to operate the most profitable virtual bank with the most satisfied customers. Katics said bankers have to use their resources wisely. If they make a lot of risky loans, they’ll need to hire more collectors. But hiring collectors drives up costs.

If they can only make so many phone calls to delinquent customers, the bankers have to choose which people to call. Some need coaching or reminders to make their payments. The work requires expertise in staffing, collection management, resource allocation, economic analysis, and product growth. Each module in the game is linked to gamified course materials, online learning, and iOS mobile apps.

Is it fun?

[aditude-amp id="medium1" targeting='{"env":"staging","page_type":"article","post_id":557576,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,enterprise,games,","session":"D"}']

“If you’re in this business and this is what you do, then it is fun,” said Katics.

She added, “The secret to successful delinquent collections is finding the right balance between cost and benefit while still maintaining customer satisfaction. We wanted to create a product that taught professionals how to confidently walk this tightrope.”

Other bank-related simulations address new kinds of products, asset liability, operational banking, agricultural banking, or local territories.

BankersLab was founded in January, and it has 20 employees. It is self-funded and has four founders: Katics, Kurt Gingher, Gail Galuppo, and M. J. Kim. A bank in India has already signed up to use the simulation.

[aditude-amp id="medium2" targeting='{"env":"staging","page_type":"article","post_id":557576,"post_type":"story","post_chan":"none","tags":null,"ai":false,"category":"none","all_categories":"business,enterprise,games,","session":"D"}']

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More