Microsoft today reported earnings for its second fiscal quarter of 2016, including revenue of $25.69 billion and earnings per share of $0.78. In Q2 2015, Microsoft saw $26.47 billion in revenue and earnings of $0.71 per share.

Analysts had expected Microsoft to earn $25.26 billion in revenue and earnings per share of $0.71. The company’s stock was up 1.63 percent in regular trading, and up another 3 percent in after-hours trading. Microsoft said it returned $6.5 billion to shareholders in the form of share repurchases and dividends during the quarter. But it’s likely the company’s cloud business that has investors excited.

[graphiq id=”9LtVBPzmWP3″ title=”Microsoft Corporation (MSFT) Quarterly Revenue & Growth Rate” width=”650″ height=”557″ url=”https://w.graphiq.com/w/9LtVBPzmWP3″ link=”http://listings.findthecompany.com/l/9638071/Microsoft-Corporation-in-Redmond-WA”]

Last quarter, Microsoft started reporting earnings by breaking down its results into three operating groups, plus a “Corporate and Other” section. We’ll look at each more closely to see how the company fared.

Productivity and Business Processes

This segment, which includes results from Office and Office 365 (commercial and consumer customers), declined 2 percent to $6.7 billion.

Office 365 had a decent quarter, adding 2.4 million subscribers to hit 20.6 million. Office commercial products and cloud services revenue grew 5 percent with Office 365 revenue up nearly 70 percent.

At this point, steady Office 365 growth is not much of a surprise. The company is slowly but surely converting its traditionally most-lucrative software business into a subscription revenue stream.

Intelligent Cloud

This segment, which includes results from server products and services (including Windows Server and Azure), grew 5 percent to $6.3 billion.

Server products and cloud services revenue grew 10 percent. But the big highlight was Azure revenue, which grew 140 percent, including revenue from Azure premium services growing nearly 3x year-over-year.

“Businesses everywhere are using the Microsoft Cloud as their digital platform to drive their ambitious transformation agendas,” Microsoft CEO Satya Nadella said in a statement. “Businesses are also piloting Windows 10, which will drive deployments beyond 200 million active devices.”

Microsoft this quarter also shared that its commercial cloud business was on a $9.4 billion annual run rate. The company previously projected that it expects this number to hit $20 billion by 2018.

More Personal Computing

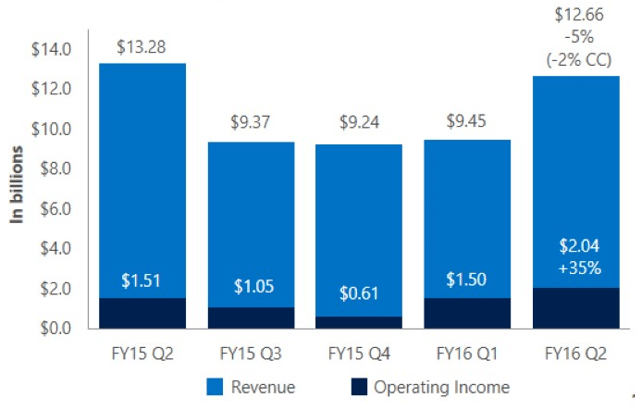

This segment, which includes results for Windows licensing and devices (Surface, phones, and Xbox), decreased 5 percent to $12.7 billion.

Windows OEM revenue declined 5 percent. Microsoft tried to highlight the silver lining by saying this decline was okay because it counts as “outperforming the PC market.”

Microsoft saw Surface revenue jump from $1.10 billion in Q2 2015 to $1.35 billion in Q2 2016. The Surface Pro 4 and the Surface Book seem to be selling well. And yet, we still don’t know how many Microsoft is pushing out, as the number includes accessories and older Surface devices.

Phone revenue declined 49 percent “reflecting our strategy change announced in July 2015,” Microsoft said. That is in reference to the employee cuts and Nadella’s plan to focus on fewer devices.

But the numbers are even worse on a per-unit basis: In Q2 2015, Microsoft sold a record 10.5 million Lumia smartphones. In Q2 2016? Just 4.5 million.

Search is oddly also included in this category. Advertising revenue from this group, excluding traffic acquisition costs, grew 21 percent. Microsoft attributed this to Windows 10, which includes tighter Bing integration.

Xbox Live monthly active users grew 30 percent year-over-year. The service now has 48 million players, up from 37 million a year ago.

Once again, the More Personal Computing group performed the worst of the three. This is not a big surprise and won’t be changing quickly, largely thanks to a shrinking PC business and the aforementioned change in phone strategy.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More